About 66% of businesses report that invoice processing consumes more than five days per month. Given the volume of invoices, the majority of businesses dedicate at least five days each month to this task. Becoming proficient in invoice automation is essential for optimizing Accounts Payable (AP) operations. This technology-driven approach simplifies invoice handling by automating data entry, approval routing, and payment processing tasks.

By embracing invoice automation solutions, businesses can save time, minimize errors, and enhance the efficiency of their AP processes. Join us as we explore the benefits of invoice automation and discover how it can revolutionize your AP operations.

Invoice automation speeds up the invoicing process using technology to handle tasks like invoice generation, approval workflows, and payment processing. Automating manual tasks and utilizing technologies such as OCR and AI allows businesses to simplify operations, minimize errors, and enhance efficiency within their accounts payable processes. This digitization saves time and resources, improves accuracy, and leads to better financial management.

Manual Invoice Processing and Approval Workflows pose several challenges for Businesses:

Imagine an entrepreneur named ‘X’ with a thriving manufacturing business. Despite his success, X encountered significant challenges due to manual invoicing processes, which proved to be time-consuming and costly.

Here are several obstacles he encountered with manual invoicing processes:

> Time-Consuming:

Processing invoices manually takes a lot of time. Employees must input data, route invoices for approval, and track payment status manually. This inefficiency can lead to delays in invoice processing and payment, impacting vendor relationships and leading to possible late charges.

> Error-Prone:

Manual data entry is prone to errors, such as typos, duplicate entries, and incorrect expense categorization. These errors can lead to discrepancies in financial records, resulting in inaccurate financial reporting and potentially costly reconciliation efforts.

> Lack of Visibility:

Manual workflows often lack transparency and visibility into the invoice approval process. Without a centralized system for tracking invoices, it can be challenging for businesses to monitor invoice status, identify bottlenecks, and ensure compliance with approval policies.

> Limited Scalability:

As businesses grow, manual invoice processing workflows become increasingly burdensome to manage. Handling a higher volume of invoices manually can strain resources and increase the risk of errors and delays.

> High Costs:

Manual invoice processing requires significant labor hours, which can result in higher operational costs for businesses. Additionally, the chance for errors and delays can lead to additional costs in terms of late fees, vendor disputes, and time spent rectifying discrepancies.

Manual invoice processing and approval workflows present numerous challenges for businesses; overcoming these challenges requires implementing automated invoice processing solutions that streamline workflows, reduce errors, and improve visibility and control over the AP process.

Invoice automation is crucial for businesses to work smarter and more accurately. Automating tasks like entering data, matching invoices, and sending for approval saves a lot of time compared to doing things manually. Additionally, it significantly decreases mistakes, ensuring that financial records are accurate and reducing the need for expensive corrections.

Want to know how CFOs can ace in AP automation? Read our latest e-book “Decoding the AP automation process for CFOs.

Visit-https://register.open.money/automate-accounts-payable-ebook/

With automation, businesses can keep a close eye on invoices as they move through the system, making it easier to spot any problems and make better decisions. This helps with managing cash flow and following rules and regulations. Automation can easily handle more invoices as businesses grow without losing speed or accuracy. And by making things more efficient and reducing errors, automation saves businesses money in the long run. So, using invoice automation is key for businesses to make their payment processes smoother, more efficient, and less prone to mistakes.

Key Features of Invoice Automation Solutions that can enhance your existing Process:

- Automated Data Capture and Entry: These solutions automatically capture and input data from invoices, eliminating the need for manual data entry. It can speed up the processing time and reduce errors associated with manual input.

- Configurable Approval Workflows: Invoice automation solutions offer customizable approval workflows based on predefined rules. This ensures that invoices are routed to the appropriate approvers according to set criteria, simplifying the approval process and maintaining compliance.

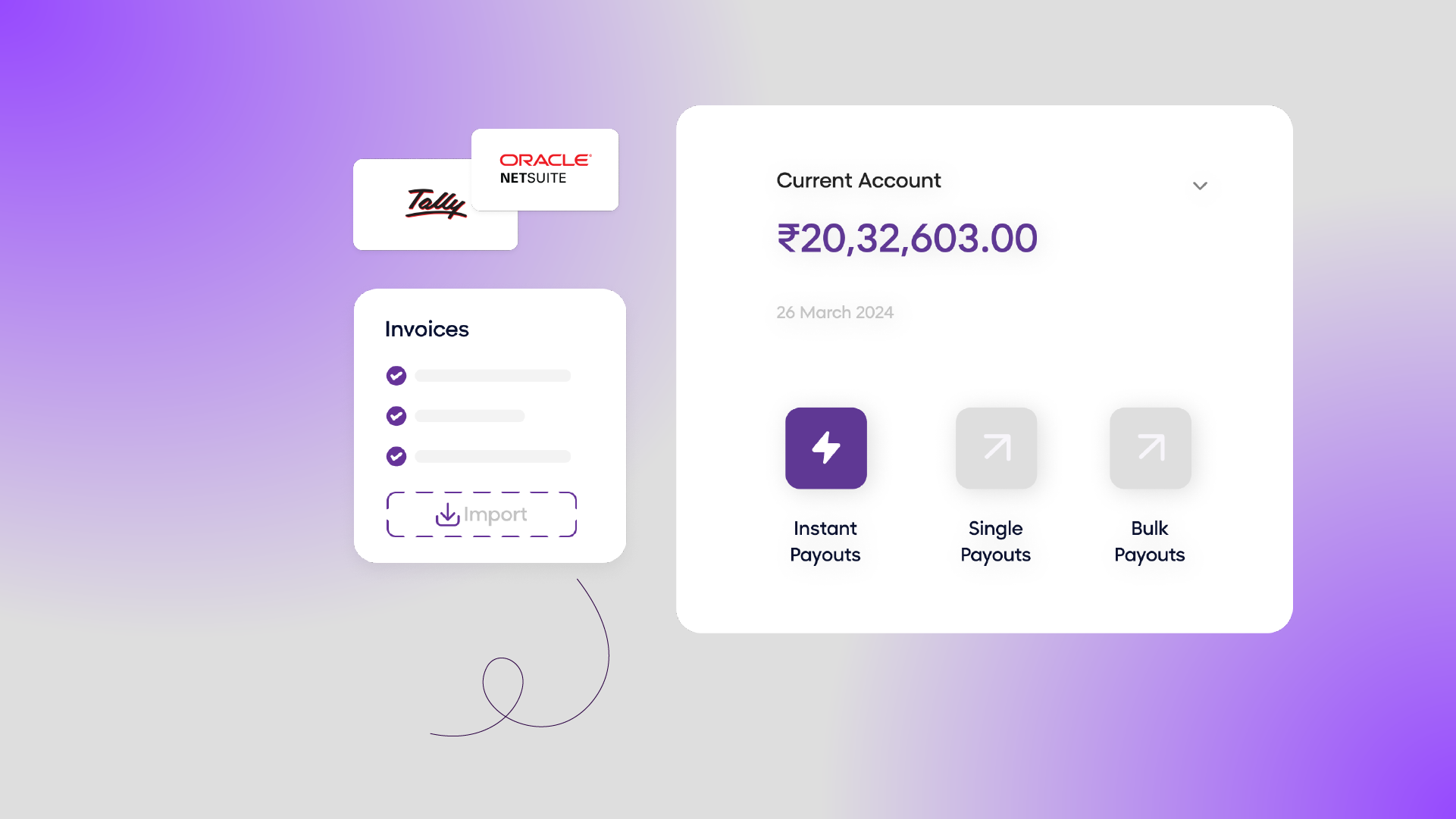

- Integration with Accounting Systems and ERP Platforms: These solutions easily integrate with accounting systems and Enterprise Resource Planning (ERP) platforms. This integration facilitates smooth data transfer between systems, improving accuracy and efficiency in financial processes.

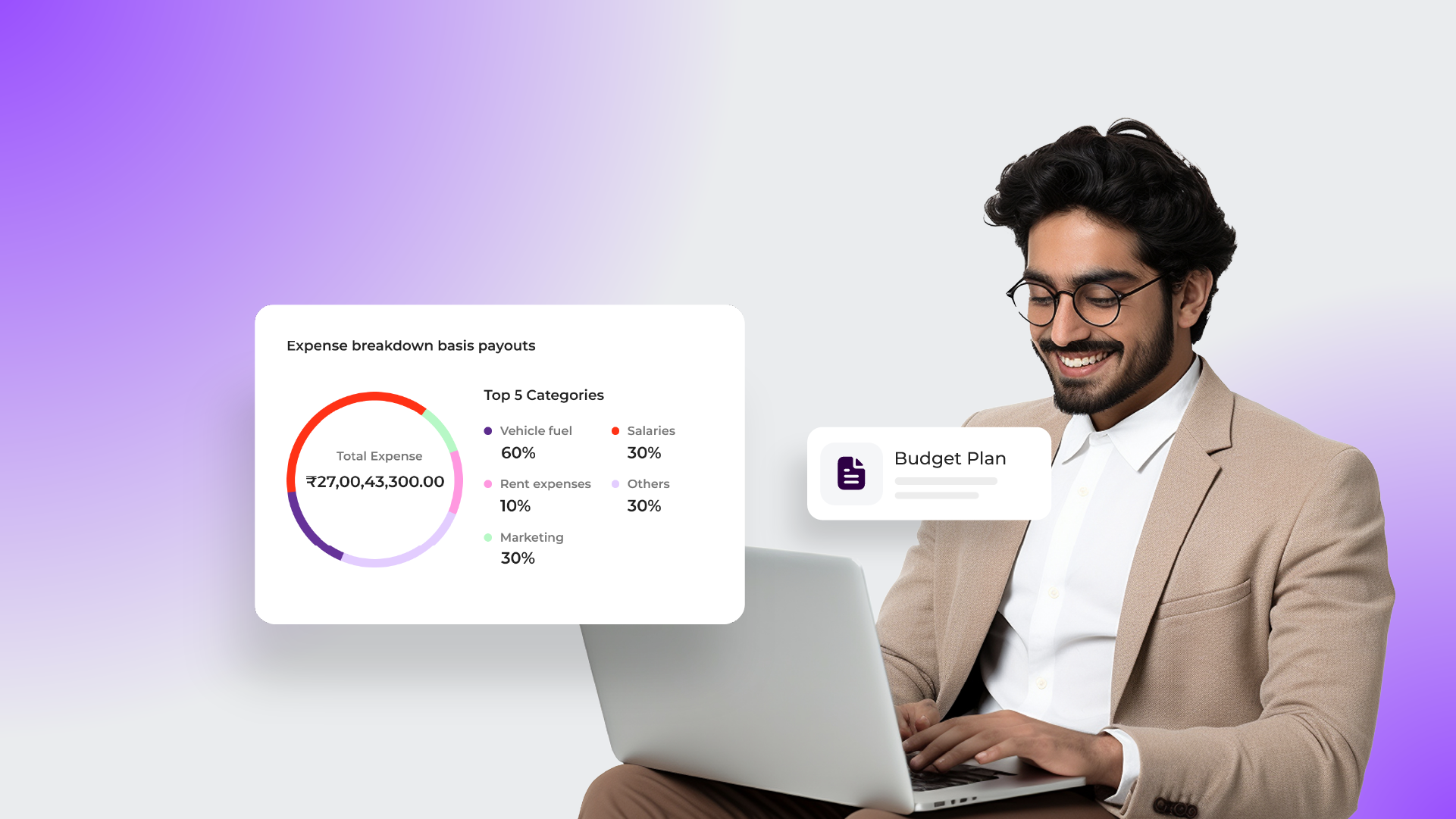

- Real-time Visibility: Invoice automation solutions provide real-time visibility into the status of invoices and reports. Businesses can track invoice progress throughout the entire process, from receipt to payment, enabling better decision-making and timely action.

Benefits of Invoice Automation:

- Reduced Processing Times and Increased Productivity: Invoice automation significantly reduces the time required to process invoices compared to manual methods. Businesses can optimize their invoice processing workflows and increase overall productivity by automating tasks such as data entry, approval routing, and payment processing.

- Improved Accuracy and Compliance: Automation minimizes the risk of errors associated with manual data entry and processing. With automated validation checks and predefined rules, invoice automation solutions ensure accuracy and compliance with internal policies and regulatory requirements, reducing the chances of costly mistakes and compliance issues.

- Enhanced Vendor Relationships and On-time Payments: Invoice automation solutions enable businesses to pay vendors promptly by accelerating invoice processing and approval cycles. Timely payments strengthen vendor relationships, improve trust and reliability, and may even lead to better terms and discounts, cultivating positive supplier partnerships.

- Better Cash Flow Management and Forecasting: Invoice automation provides real-time visibility into invoice status and payment schedules, empowering businesses to manage cash flow more effectively. With access to accurate and up-to-date financial data, organizations can make informed decisions, optimize cash flow management strategies, and forecast future cash flow needs with greater precision.

Getting Started with Invoice Automation:

- Evaluate Current Workflows: Assess current invoice processing methods, including manual data entry, approval processes, and filing systems. For example, your company manually receives invoices via email, prints them, enters data into spreadsheets, and forwards them for approval. This process is prone to errors and delays.

- Identify Areas for Improvement: Look for time-consuming, error-prone, or redundant tasks that can be automated. For example, your company’s finance department is often seen struggling with errors and duplication caused by manual data entry. Identify all the possible gaps in your manual process before narrowing it down to the final steps of invoice automation.

- Change Management: Convey the benefits of invoice automation to stakeholders, addressing concerns and ensuring their commitment to the initiative. You can conduct meetings to explain how automation will streamline processes, reduce errors, and improve efficiency while also providing training sessions to familiarize employees with the new software.

- User Adoption Strategies: Offer comprehensive training and support to users, emphasizing the benefits of automation. Consider hosting interactive workshops where employees can engage in hands-on training with the new software. Emphasize key features like automated data extraction and approval workflows to showcase how they streamline their tasks.

By following these steps and incorporating examples, businesses can effectively transition to invoice automation, improving efficiency and accuracy in their finance processes.

Take the next step towards streamlining your invoicing processes with OPEN. Schedule a demo or consultation to learn more about how automation can benefit your business. With OPEN’s connected banking solution, businesses can access a unified interface that simplifies payouts, facilitates collections, reconciles accounts, and generates compliant payment-linked embedded invoices—all from a single platform. Don’t miss out on the opportunity to optimize your invoicing workflows and enhance efficiency with invoice automation. Schedule a demo now!

Visit Open.money for more details!