Business finance automation is vital for modern enterprises to enhance their financial processes and stay competitive in today’s evolving business landscape. Businesses can save time, reduce errors, and improve overall efficiency by automating invoicing, expense tracking, and financial reporting tasks. Additionally, finance automation allows for greater accuracy in financial data analysis, enabling informed decision-making and strategic planning.

With 73% of finance leaders acknowledging that finance automation boosts efficiency and frees up time for valuable tasks, embracing automation is a necessity for growth and success in today’s digital age.

Despite its benefits, business finance automation is often hindered by myths and misconceptions, causing hesitation and the belief that it’s only for large corporations. Debunking these myths with accurate information allows businesses to make informed decisions, optimize financial processes, and drive growth.

Through this blog, we’re addressing some of the common myths about business finance automation. Let’s dive right in!

Here are some of the common myths regarding Business Finance Automation:

1. Finance Automation is Only for Large Corporations:

Business finance automation isn’t just for large corporations; it benefits businesses of all sizes. Through automation, small and medium-sized enterprises (SMEs) can significantly enhance their financial processes, reduce manual errors, and save time. This allows them to operate more efficiently, compete with larger companies, and allocate resources for growth and innovation. With many affordable and flexible automation tools available, even the smallest businesses can utilize automation to improve their financial operations.

2. Business Finance Automation is Expensive:

Contrary to popular belief, automation of business finance is often cost-effective. While initial costs may be associated with implementing automation tools, the long-term savings are significant. Automation reduces the need for manual labor, minimizes errors, and increases efficiency, leading to significant cost reductions over time. Many businesses discover that the initial investment is swiftly compensated by the reduction in operational costs, making automation a financially wise decision in the long term.

3. Business Finance Automation Causes Job Losses:

Despite the misconception, business finance automation does not necessarily lead to job losses. Instead, it improves job roles by automating repetitive and time-consuming tasks, allowing employees to focus on more strategic and value-added activities. Automation streamlines processes improves productivity, and empowers employees to contribute meaningfully to the business’s success. Rather than replacing jobs, automation creates opportunities for professional development and innovation within the workforce.

4. Business Finance Automation is Not Secure:

Automated finance systems prioritize security with robust measures in place. These include data encryption, which protects sensitive information from unauthorized access and ensures that financial data remains confidential. Access controls restrict access to authorized personnel only, preventing unauthorized individuals from interfering with and accessing financial data.

Compliance standards, such as GDPR or PCI DSS, further enhance security by ensuring that automated finance systems meet regulatory requirements. These security measures work together to safeguard the integrity and confidentiality of financial data within automated finance systems.

5. Business Finance Automation is Complicated to Implement:

Implementing business finance automation is not as complex as often believed. Many user-friendly automation tools and software are available in the market. These tools are designed to simplify the implementation process, with intuitive interfaces and step-by-step guides. Also, several automation providers offer training and support to assist businesses in adopting and integrating automation into their existing workflows. With the right tools and support, businesses can successfully implement automation and utilize its benefits without encountering significant complications.

Finance and accounting have emerged as the most automated business functions, accounting for an average of 26% of an organization’s total automation efforts.

Business Finance Automation offers numerous benefits and opportunities for organizations of all sizes:

- Saving Time: Automating repetitive tasks frees up time for employees to focus on important activities.

- Reducing errors: Minimizing manual data entry reduces the likelihood of errors and increases data accuracy.

- Improving Efficiency: Streamlined processes enhance overall operational efficiency.

- Optimization of Resources: Saving time and reducing errors leads to more effective use of resources.

- Enhanced Decision-Making: Accurate and timely financial data supports informed decision-making and strategic planning.

- Scalability: Automation solutions can easily scale with the growth of the business, accommodating increased transaction volumes and complexity.

Choosing finance automation enables businesses to stay competitive in the current digital landscape, driving innovation and success. Organizations must recognize the transformative power of automation and use it to unlock new possibilities for their financial operations.

For Example, a mid-sized company processing about 500 invoices monthly faced slow, error-prone, and costly manual data entry, verification, and approval processes. After implementing automation with OCR technology, the company now automatically extracts invoice data, verifies it against purchase orders, and routes it electronically for approval, with payments scheduled and processed automatically. This automation reduces data entry errors, speeds up processing time from days to hours, cuts administrative costs, and ensures on-time payments, enabling the company to profit from early payment discounts and enhancing overall accuracy, productivity, and cost efficiency.

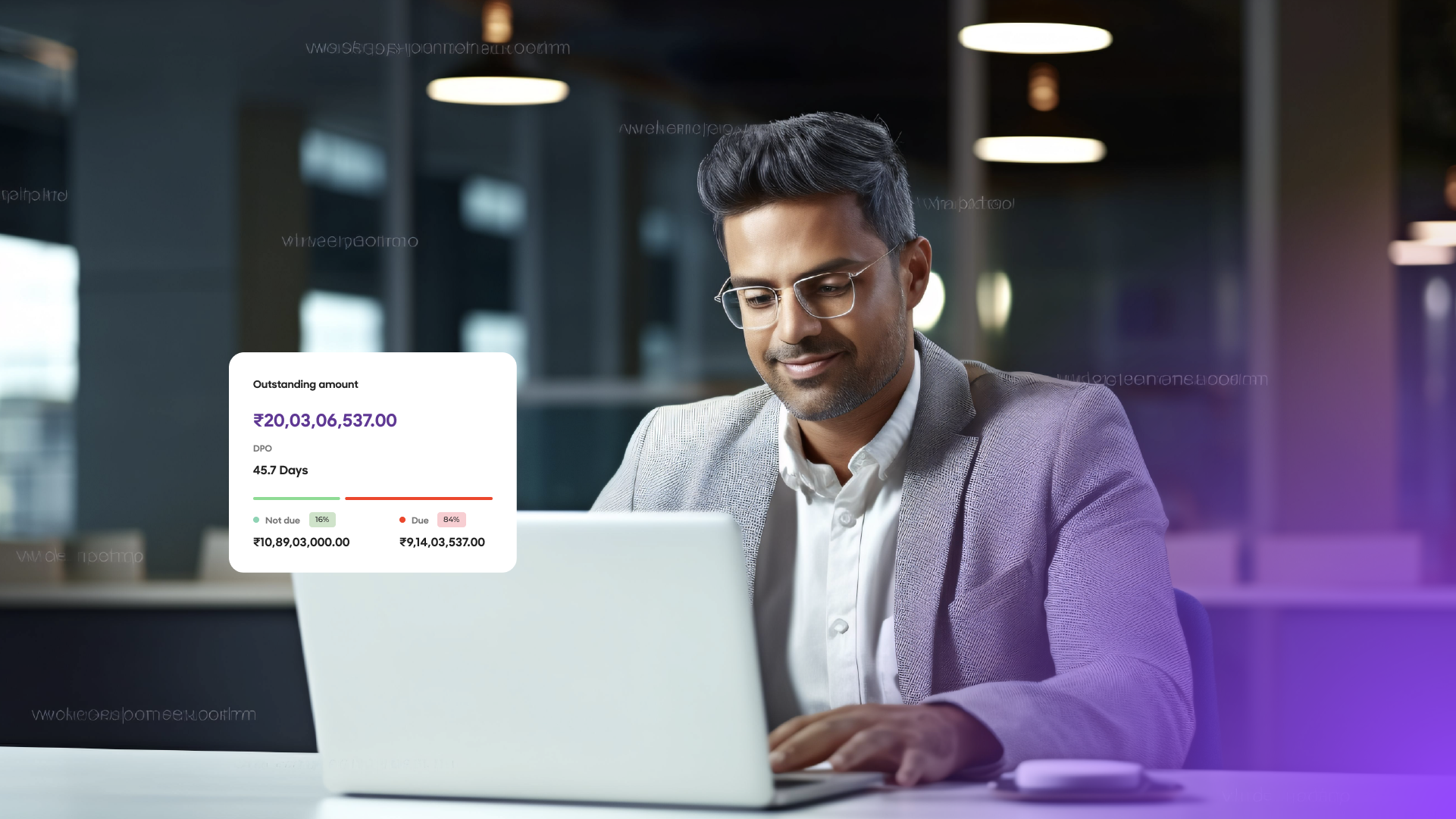

OPEN empowers finance teams by automating and integrating multiple finance processes across departments, effectively connecting internal inventory management and procurement software. With OPEN’s connected banking solution, SMEs and MSMEs benefit from a unified interface to easily make payouts, collect payments, reconcile accounts, and generate compliant payment-linked embedded invoices, all in one place.

Visit Open.money for more information!