As discussed in “The Changing Landscape of the Accounting industry in 2023 part 1”, accountants face many challenges today, and the need for “financial automation” is evident. This article looks deeper at how Fintechs drive this digital transformation in accounting.

Gone are the days when “financial automation” was only a “good to have” for businesses. In today’s competitive landscape, it empowers accountants to become strategic business partners rather than only taking care of the accounting work, that too manually. Automation in financial services allows accountants to focus on more critical tasks, such as analyzing data and making strategic decisions.

Finance automation: what’s it all about?

Automation in finance means automating repetitive, time-consuming manual tasks with little or no human interaction. By automating these aspects, finance departments can focus on creating value and driving strategy instead.

Finance automation is being made possible by technologies such as artificial intelligence (AI), blockchain, optical character recognition (OCR), and robotic process automation (RPA).

Advantages of Financial Automation

Many articles declare automation as “the death of an accountant.” However, automation is more of an evolution than an extinction.

A new opportunity awaits accounting professionals, and they can get more from their work than ever before.

“Accounting Professionals spend about 30% of their time collecting data and fielding inquiries related to invoices and payments”– Goldman Sachs

This following section will provide an overview of the key focus areas of financial process automation.

Ensuring accuracy

Human errors are forgivable, but mistakes in accounting can have serious repercussions. Even an additional zero or typo can cost a business large sums of money.

Accounting automation eliminates this risk. Accountants can do away with manual data entry and balancing accounts as automation software does everything from scanning invoices to reconciliation automatically.

Assuring financial transparency

Provides complete visibility into finance pipelines, including contracts, invoices, and vendor information, without switching tools or manually sorting through data.

Conducting a thorough analysis

A finance automation tool gives businesses a comprehensive picture of their financial ecosystem. It automatically generates powerful business reports such as P&L statements, cash flow statements, income statements, payment performance reports, and other reports that carry critical business information.

These business reports help study their current profitability index, the break-even point of sale, earnings per share (EPS), and interest expense to make changes that can enhance their financial position.

Optimizing efficiency

Typically, accountants spend a lot of time on data entry, processing invoices, and reimbursements, reconciling accounts payable & receivables, and managing various regulatory compliances. Automating such tedious tasks helps save time & improve efficiency across the teams.

With an understanding of how financial automation is crucial for any business, it’s time to explore how accounting firms and accountants can implement such automation in their day-to-day activities.

Want to learn more about Business Finance Automation & how are CFOs evolving?

Visit – https://register.open.money/business-financial-automation-ebook/

How can practice management solutions help CAs, Tax practitioners & Accountants

Like all businesses, accounting firms and tax practitioners seek opportunities to make their work simpler. In light of this, key fintech players are focusing heavily on developing technologies that simplify invoicing, billing, and bookkeeping paving the way for practice management solutions.

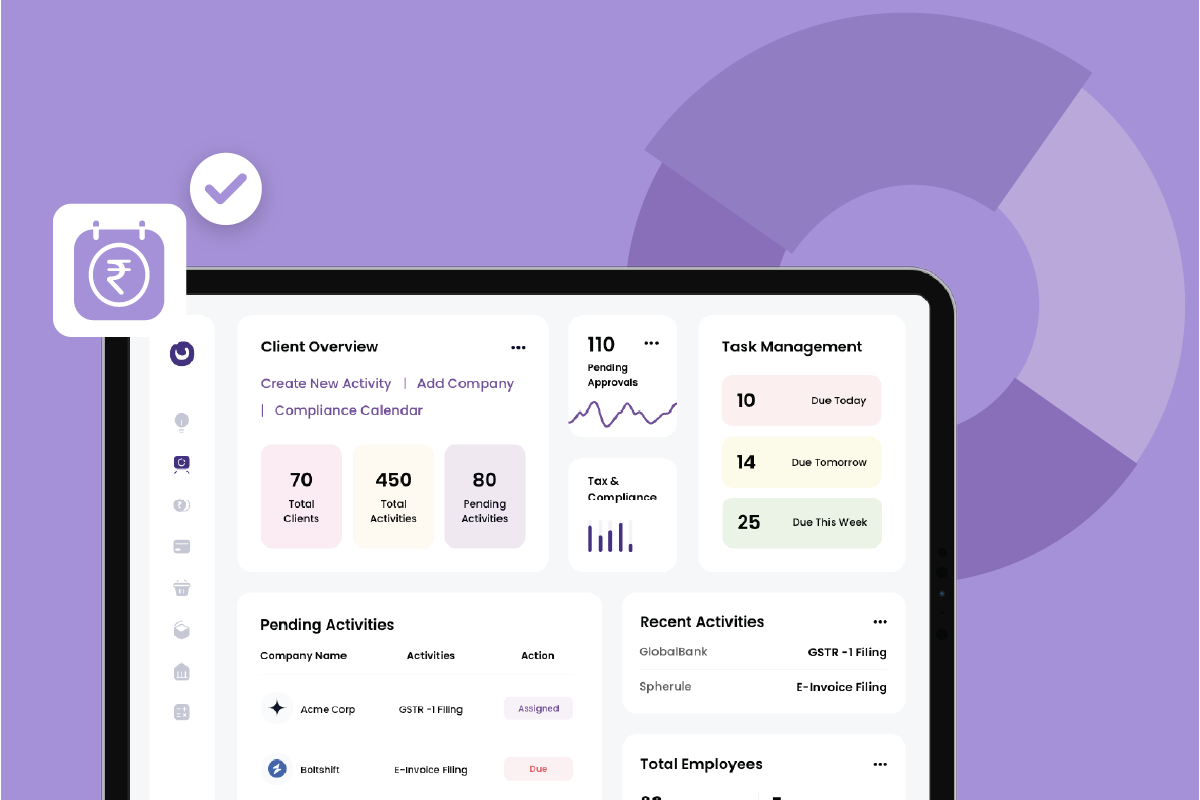

Think of practice management software as your administrative hub where you can:

- Manage data and storage for your clients

- Take control of your workflow

- Organize your documents and those of your customers

- Monitor your sales

- Facilitate accounting, reporting, regulatory training, and competence tracking

- Keep track of upcoming and previous tasks

And a myriad other tasks…

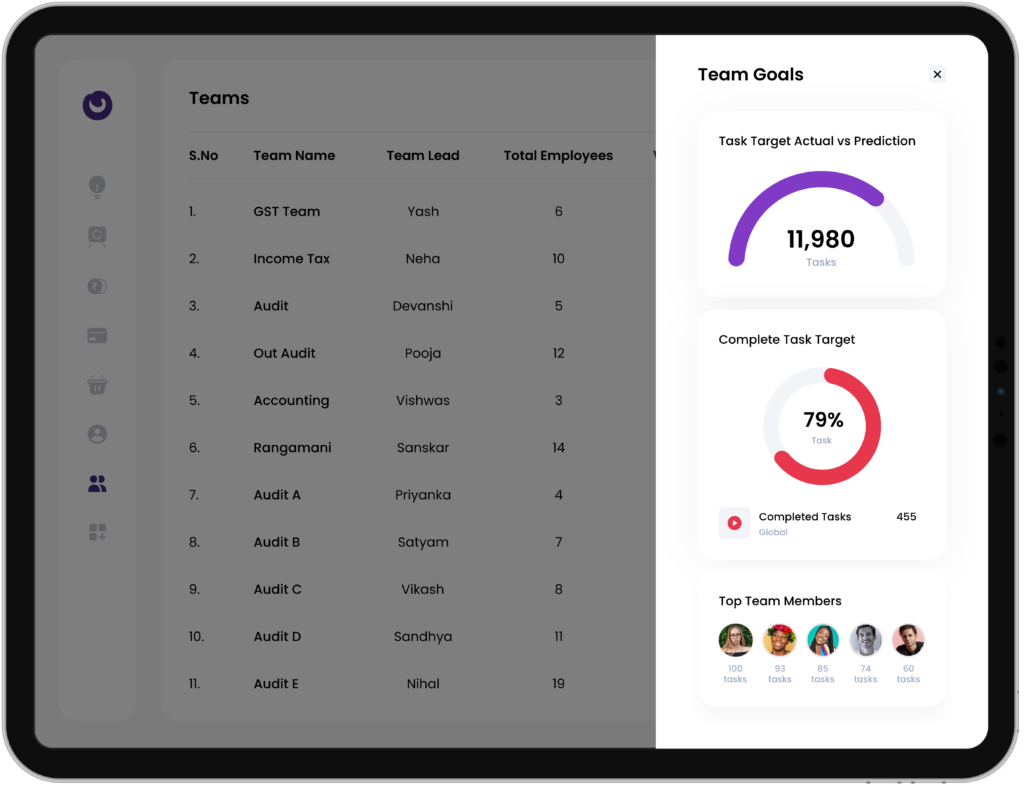

In essence, best practice management solutions manage the entire “back office” of your accountancy practice. It can become an integrated and highly effective one-stop resource where you can decide who needs to do what and when.

Imagine never having a task slip your mind or never missing another client deadline.

The best practice management software should organize everything in one place so that tasks can be delegated, managed, and accomplished!

OPEN accountant has got it all!

OPEN’s practice management takes a different approach from the rest of the pack.

OPEN accountant allows you to bring your teams, clients, & their business finances together in one place.

Now, let’s get down to business & see how open.accountant solves challenges that are unique to an accounting firm

-

Save 10x time/week

The best part about OPEN accountant is that it eliminates several office tasks such as manual billing and reconciliation, therefore increasing efficiencies and improving processes essential to running a firm.

-

Access to real-time data

With OPEN accountant, you get real-time access to clients’ financial data by easily integrating with Tally, Zoho & Quickbooks, depending on your client’s use.

It also allows you to allocate team members to deliver consistent client services.

-

End-to-end tax management

Importing the existing invoices from the billing software on OPEN or creating a new invoice on OPEN leads to a smooth business tax management journey. OPEN auto-segregates all the invoices into relevant GTSR-1 categories. The GSTR-1 filing is, therefore, sorted!

-

Facilitate growth capital for clients

It is now possible to lend up to ₹30,00,000 to your clients without requiring any collateral from them.

Yes! Zero Collateral loans only for your clients

That’s not all; Connect all your existing bank accounts, make payments & payroll, too, in one place with OPEN accountant.

Automation for the win

There is no doubt that the accounting industry is undergoing a huge transformation. With the advancement of technology, cloud computing, the global economy, compliance automation, the influx of a new generation, and the changing demands of clients, accounting has been reinvented, radically altering how accountants practice their profession.

Leap and choose a practice management solution that acts as a financial OS and integrates everything you need in one place.