Prior to the introduction of GST (Goods and Service Tax), goods were consigned based on an invoice or a delivery challan. These goods were verified on the incoming and outgoing checkposts of the respective regions. This resulted in heavy investment in time and effort, eventually causing delayed transits. The introduction of the e-Way bill under GST has made inter-state and intra-state goods movement a lot easier and more streamlined.

What is a GST e-Way bill?

An e-Way bill, a.k.a Electronic Way bill is a document mandated by the government to track and monitor goods during intra-state or inter-state transit.

On April 1st, 2018, CBIC (Central Board of Indirect Taxes and Customs) introduced the implication of the e-Way bill under GST that follows some standard set of rules nationwide. This led to harmonised regulations for the transport of goods inter-state. [1]

Later, different states introduced the e-Way bill for the intra-state movement of goods at different times. However, all states have introduced the e-Way bill latest since 16th June 2018. An e-Way bill comprises two segments.

- Part A: Determines the details of GSTIN (Goods and Services Tax Identification Number) of the recipient, place of delivery (PIN Code), invoice or challan number and date, the value of goods, HSN (Harmonized System of Nomenclature) code, transport document number (Goods Receipt Number or Railway Receipt Number or Airway bill Number) and reasons for transportation.

- Part B: Comprises transporter details (Vehicle number).

Businesses that are applicable for e-Way bill creation

Any registered business, that undertakes movements of goods with a consignment value worth ₹50,000 or more, must submit an e-Way bill. In case of the goods movement taking place via road, rails or air, either the sender or the receiver generates an e-Way bill. In case of the transporter is in charge of the goods movement, the transporter must generate the e-Way bill.

Benefits of e-Way bill for your businesses

e-Way bill regulations aid in managing business compliance in many ways:

- Seamless and hassle-free inter-state and intra-state goods transit

- Eliminated checkposts resulting in a quicker turn-around time

- Finer logistics network – avoiding confusion and faster transition across the country

- Online bill generation – amplifying convenience

- Better compliance with all the data recorded on a cloud-based system

What is the validity of an e-Way bill?

An e-Way bill is valid for 1 day for a distance less than 100 km. Depending on the distance defined, the validity extends by 1 day with the addition of every 100 km.

How to generate an e-Way Bill with OPEN?

With OPEN users generate an e-Way bill in one click. It allows users to generate, view, cancel, and download e-Way bills within minutes ensuring 100% GST compliance.

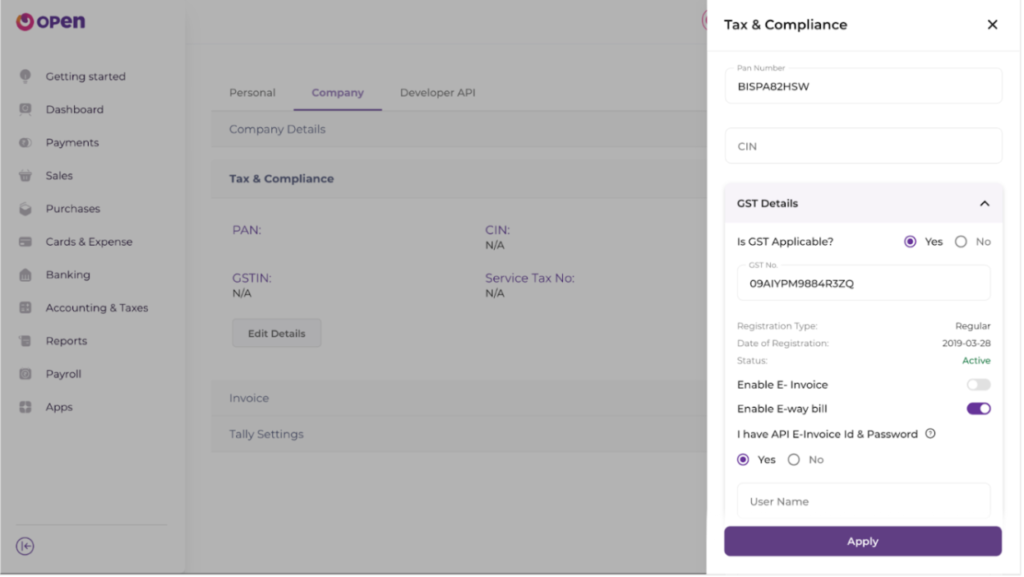

Enable e-Way bill creation

The GST section in OPEN’s Taxes module offers an option to enable/disable an e-Way bill. Here, the user needs to choose the ‘Enable e-Way bill’ toggle based on their business requirement and also check if they own the API credentials.

If Yes, the user can record the existing username and password.

If No, the user can create an API username and password from the e-Invoice portal.

View more details on how to create a new API username and password on the GST portal by clicking on ℹ️ this.

Once the user inserts the respective username and password, click on ‘Apply’ to save the credentials.

Note – In case the user has not recorded the username and password under the Taxes module, he can also record the same while creating an invoice by enabling the e-Way bill toggle.

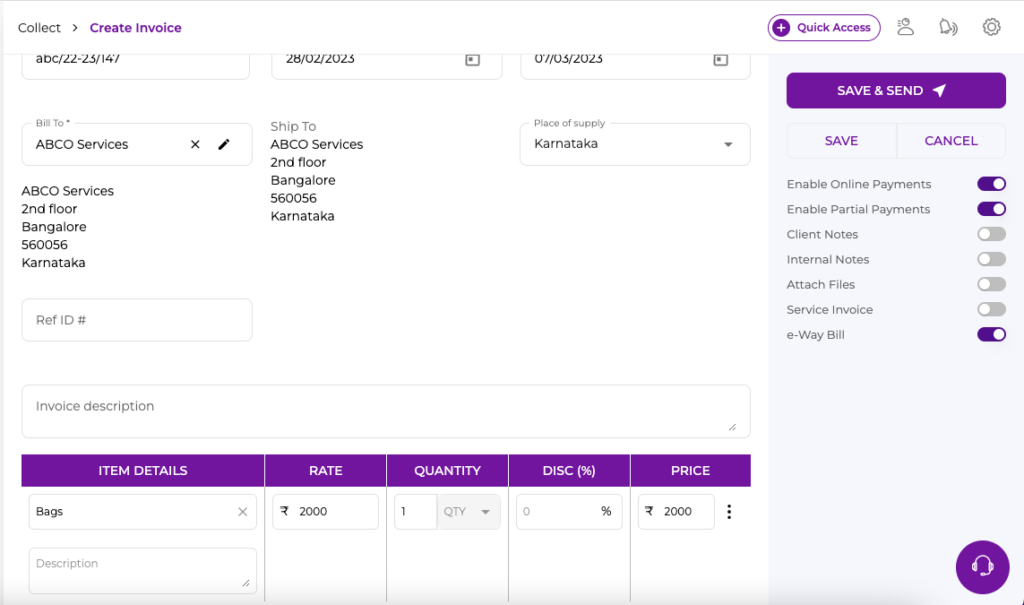

Creating an Invoice with OPEN

The user can now proceed with invoice creation (if not yet done). Once all the details have been filled in the invoice, click on ‘Save’.

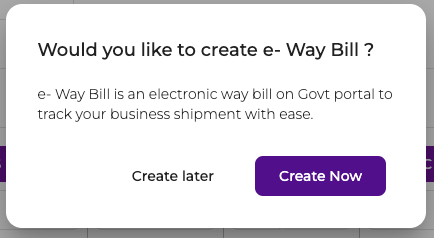

A pop-up will appear asking if the user wishes to create the e-Way bill – Later OR Now.

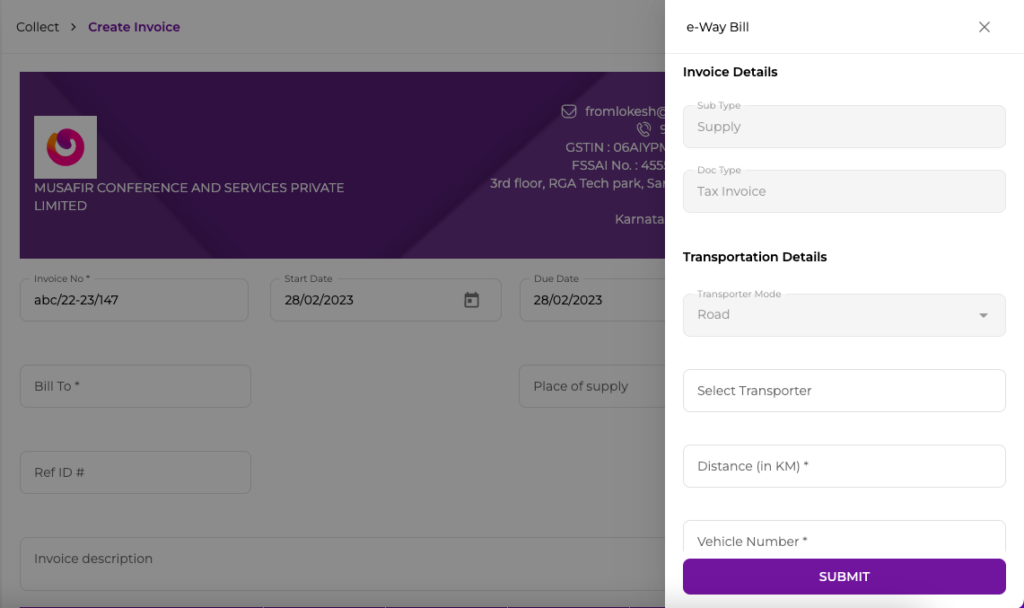

When the user chooses the ‘Create Now’ option, it is followed by submitting the basic transportation details as mentioned below. In the case of choosing ‘Create Later’, the pending e-Way bill can be monitored in the e-Way bill report.

By clicking on –

Create Now – The user can view the e-Way bill in the e-Way bill report listed as ‘Created’.

Create Later –The user can view the applicable Invoice in the e-Way bill report, listed as ‘Pending’.

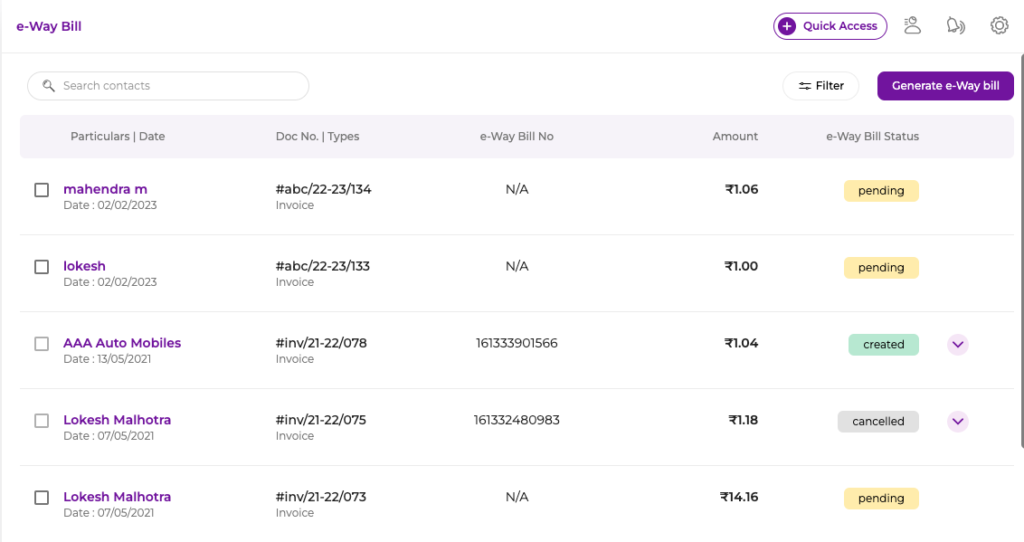

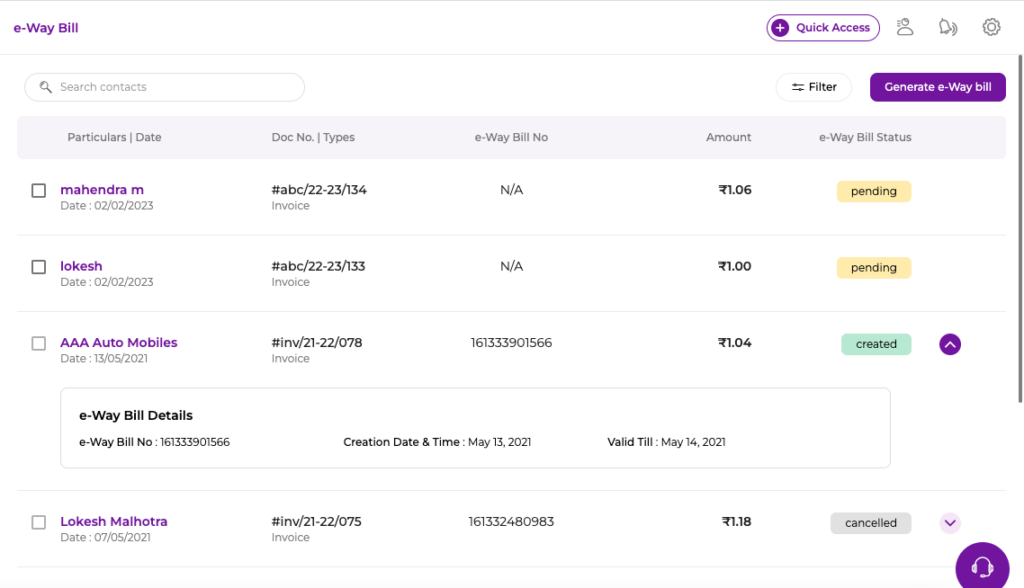

What is an e-Way bill report?

An e-Way bill report consists of the invoices applicable for e-Way bill creation listed with their real-time status. The status for an e-Way bill can be either ‘Created’ or ‘Pending’. e-Way bills that are cancelled after creation are recorded as ‘Canceled’ in the e-Way bill report.

Moreover, the user can select single/multiple invoices tagged as ‘Pending’ from the list and click on the ‘Generate e-Way bill’. One can also view the summarized data of any ‘Created’ e-Way bill by clicking on the purple down arrow visible towards the right end of the row.

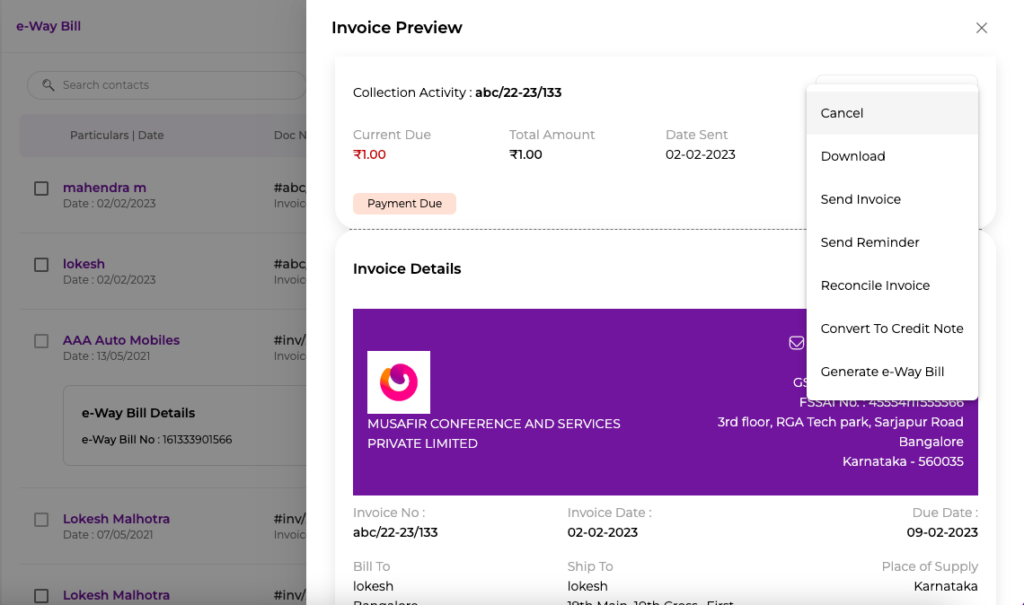

The OPEN dashboard also allows the user to convert an invoice into an e-Way bill right away from the invoice preview by clicking on ‘Generate e-Way bill’.

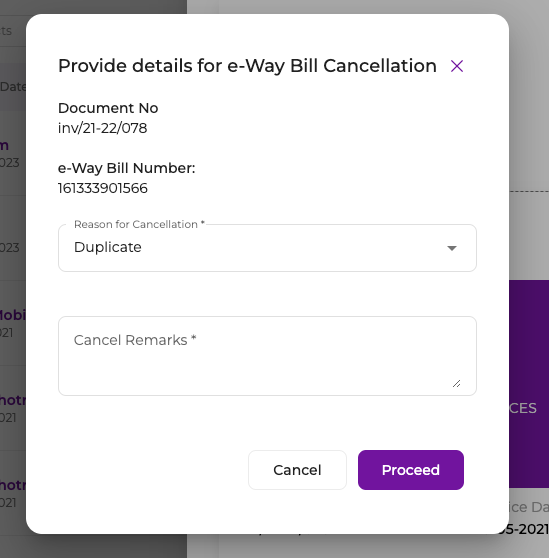

Further, to cancel a generated e-Way bill, the user can click on the e-Way bill and drill down to the respective invoice. The invoice preview has a dropdown on the top-right corner, which comprise the option ‘Cancel e-Way bill’.

A pop-up will appear to choose the ‘Reason for Cancelation’ to proceed with it.

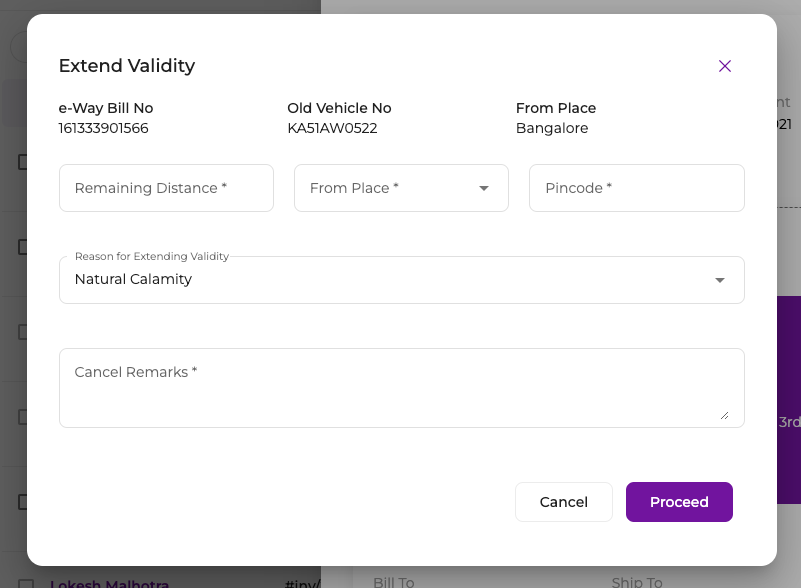

A user can also extend the validity of an e-Way bill, in case of shipping or logistics disputes. Here, the user must select the reason for the extension of the validity along with mentioning the required details such as ‘Remaining Distance’, ‘Pincode’, etc.

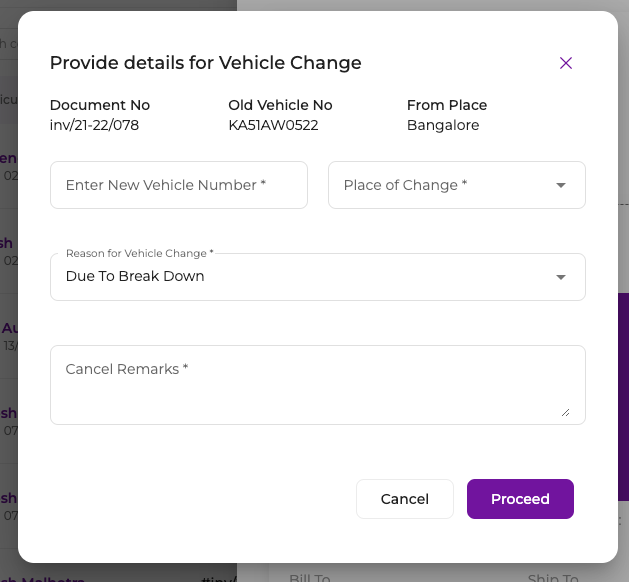

Perhaps, if there is a change in the vehicle, due to a vehicle breakdown or any such reason, the vehicle details can also be changed after mentioning the cause of the change.

OPEN enables any business dealing in goods transition to create e-Way Bills with 100% tax compliance anytime, anywhere! And creating and recording an e-Way bill with OPEN is as simple as it could be. It’s time to create e-Way bills with OPEN and switch to the best tax and compliance solution.