Break-even analysis is a crucial tool for business owners, whether planning a business idea, launching a new product, or writing a business plan. It will help you estimate when your idea could start generating profits so you know where you are headed before investing your time and money.

In this guide, we will cover break-even analysis, when to do it, its components, how to calculate the break-even point and the benefits of doing it.

What is Break-Even Analysis?

A break-even analysis is a calculation to determine your break-even point (BEP). The break-even point happens when you have sold enough units to cover all your costs. At this point, you would have neither lost money nor made any profits.

Break-Even Calculator (Goods/Services)

Why Should Every Business Do Break-Even Analysis?

Break-even analysis helps entrepreneurs –

- Minimize risks by understanding the viability of products even before launch

- Outline all potential expenses

- Appropriately price their products or services

- Determine what level of funding is required and prepare for it

- Calculate the no profit-no loss point

Components of Break-Even Analysis

In break-even analysis, we understand how production, costs, revenue, and profit relate to each other. Here’s what it means:

- Volume of products or services vs. costs:

It examines how changes in the number of products you produce or services you provide affect the costs involved (e.g., fixed costs like rent and variable costs like raw materials).

- Sales revenue vs. profit:

It indicates how the money earned from selling products or services (sales revenue) is used to cover costs and estimates when you can start making a profit.

Let us understand different cost components –

- Fixed Cost — Fixed costs remain the same no matter how many products or services are sold. They are also called overhead costs. Examples of fixed costs include interest on capital, mortgages, insurance premiums, salaries, electricity, rent, taxes, and so on.

- Variable costs – Variable costs fluctuate according to the changes in the units produced/services offered. It is calculated per-unit basis, so if you produce or sell more units, you incur more variable costs.

How do I Calculate the Break-Even Point (BEP)?

Accounting software with managerial accounting features typically calculates the BEP for you. But let us understand what goes into that formula. There are three ways to calculate the break-even point. They are –

- Mathematical Equation Method or Break-even point in units,

- Contribution Margin Method or Break-even point in rupees, and

- Graphic Method

Let us understand this with an example. Imagine that you are in the business of producing mobile phones. Your fixed cost is ₹1,00,000, your variable cost per unit is ₹3 500, and your selling price per unit is ₹4,500.

- Mathematical Equation Method or Break-even point in units:

Calculating the break-even point in units will tell you how many units you need to produce before the business breaks even (reaches a point of no profit/loss).

Break-even point (in units) = Fixed costs ÷ (Selling Price per unit – Variable cost per unit)

In our case, it would be 1,00,000 ÷ (4,500 – 3,500) = 100

Based on the above calculation, 100 mobile phones must be sold to break-even.

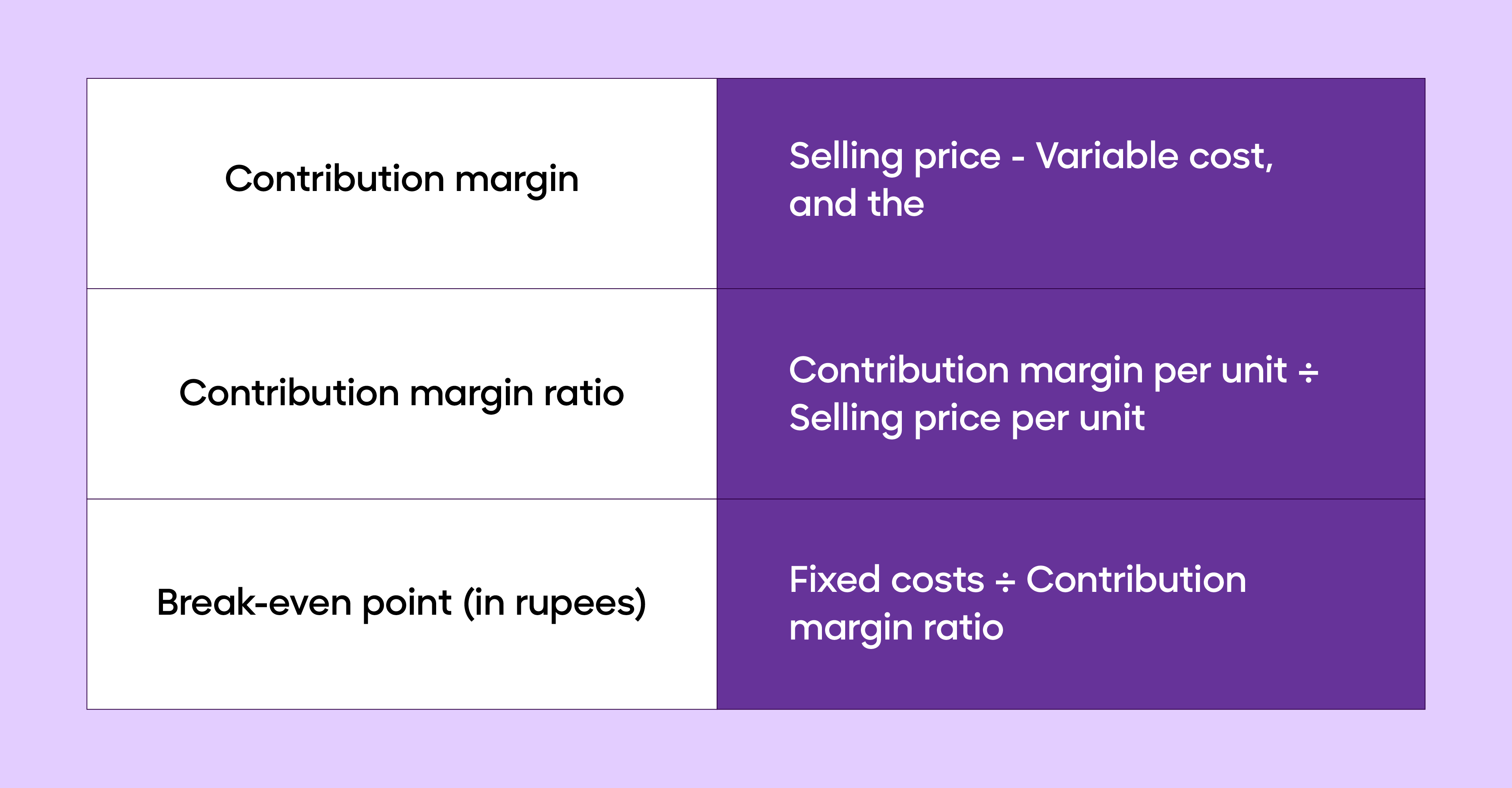

- Contribution Margin Method or Break-even point in rupees:

If you prefer calculating the break-even point in rupees, it will tell you how much revenue you need to generate before your business breaks even. Here, you need to know a critical concept called Contribution margin. The Contribution margin is the amount you contribute to recovering your fixed cost. The two critical formulas here are –

In the previous example, say if you sell 20 mobile phones, then the break-even point would be 1,00,000 ÷ ((4,500- 3,500)/4,500) = ₹ 4,50,000.

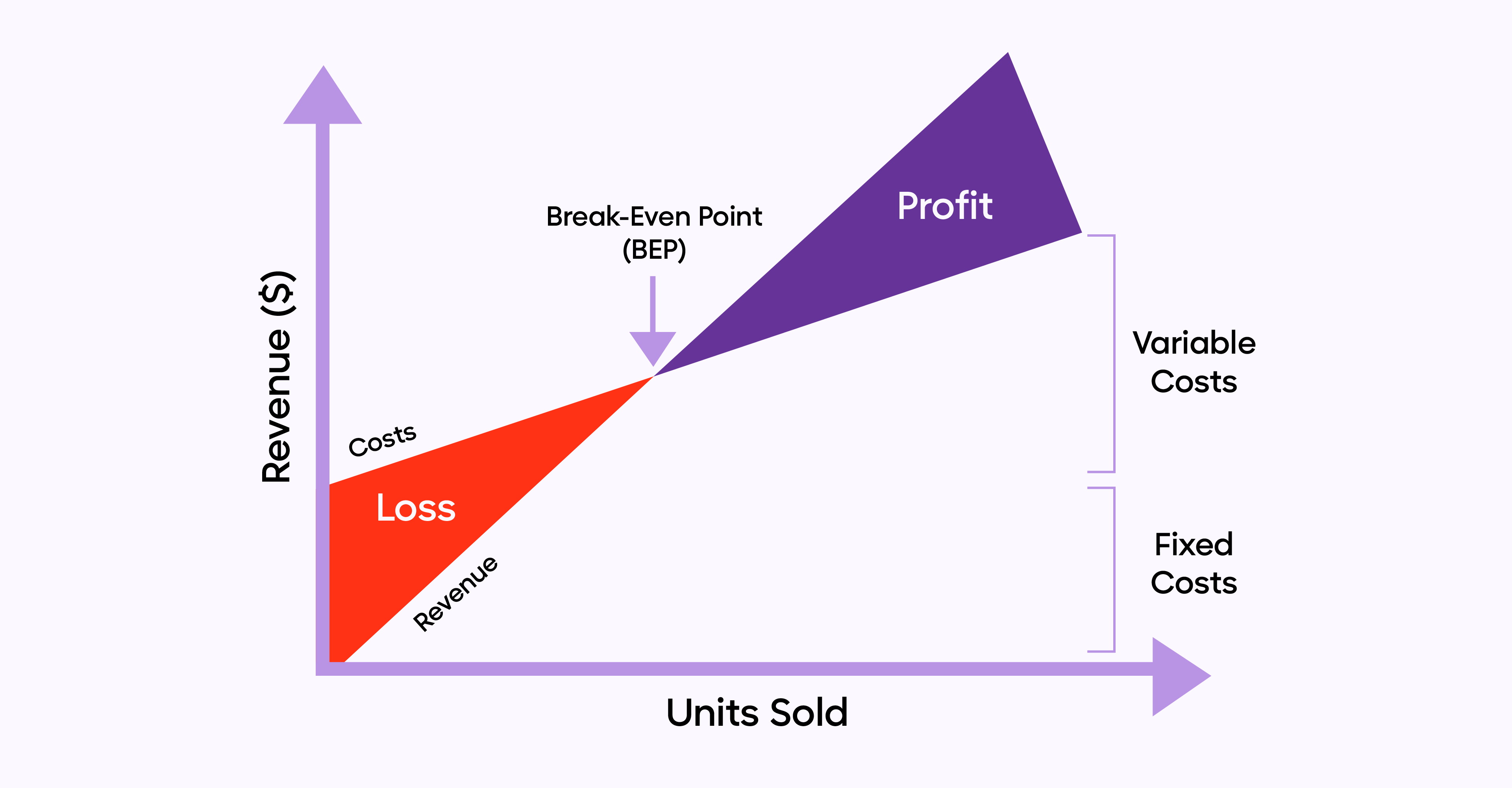

- Graphic Method:

In the Graphic method, you plot the total revenue and cost lines. The point where the total revenue line and the total cost line intersect is the Break-Even Point (BEP). The total revenue line starts from the origin because when no units are sold, the total revenue is zero. However, the total cost line doesn’t start from the origin because fixed costs are incurred even when no units are sold.

When to do a Break-Even Analysis?

Businesses should do a break-even analysis before they decide to –

- Expand the business

The break-even point helps entrepreneurs/CFOs understand the time a business takes to generate profit.

- Give discounts

Sometimes, businesses need to offer discounts to outperform their competitors. So, they need to determine how many additional units they need to sell to offset or compensate for the discounts.

- Narrow down the options

Entrepreneurs are constantly making decisions. The break-even point reduces decision-making to a series of yes or no questions.

- Securing Funding

Break-even analysis is often a key tool in securing funding, allowing you to present a well-thought-out business plan to investors and lenders.

- Pricing Strategically

By conducting a break-even analysis, you can determine the optimal pricing for your products, ensuring they align with your business’s profitability goals.

- Avoiding Emotion-Driven Decisions

Making decisions based on emotions can be risky in business. A break-even analysis provides you with concrete data, enabling you to make informed, objective decisions.

Standard Break-Even Time Period & How To Reduce It

The time it takes to sell enough units to break even is called the break-even period. The break-even period completely depends on the nature of your business, making it harder to predict.

Typically, businesses consider a window between 6 and 18 months an acceptable break-even period because a window greater than 18 months is considered risky. However, this isn’t a globally accepted range.

There are two ways to reduce your break-even period –

- Increase prices and

- Decrease costs.

You could outsource your fixed costs and reduce variable costs by finding cheaper alternatives.

Limitations of Break-Even Analysis

Even though the break-even analysis can pave the way to profitability, it isn’t the best analytical tool. Here are some of its limitations –

- It assumes constant prices — It assumes the prices of products or services remain constant, which may not reflect actual market conditions where prices may fluctuate.

- Fixed costs might change — Fixed costs may not always be fixed. They may change due to salary hikes, tariff changes, changes in rental rates, or other factors.

- Costs and sales might not have a linear relationship — Break-even analysis assumes a linear relationship between costs and sales, which may not be the case, especially in industries with economies of scale or diminishing returns, such as automobile manufacturing or agriculture.

- Ignores external factors — Break-even analysis doesn’t account for changes in market demand, competition, regulations, or other economic factors.

- Limited to a single product or service——This analysis is typically applied to single-product businesses, making it less useful for diversified businesses.

Conducting a break-even analysis is crucial for making informed business decisions. Whether you’re planning to start a new venture or implement changes to your existing business, a break-even analysis will help you be better prepared.