Have you ever wondered how banks ensure your money reaches the correct account without any errors when making a transaction? The answer lies in a unique identifier called the IFSC, issued by the Reserve Bank of India (RBI). This alphanumeric code is the backbone of secure and efficient banking transactions in India, especially when moving money electronically. But what is IFSC code, and why is it so important? Let’s break it down.

What is an IFSC Code?

The Indian Financial System Code (IFSC) is an 11-character alphanumeric code identifying specific bank branches in India. Each IFSC is unique to a branch, ensuring that money transfers are error-free and accurate.

This unique code is assigned to each bank branch involved in the country’s electronic payment system. Its purpose is to streamline digital transactions such as NEFT, RTGS, and IMPS, making them faster, safer, and more efficient.

Here’s how the IFSC is used in different electronic transfer systems:

How IFSC Codes Work in NEFT, RTGS, and IMPS

The IFSC code plays a major role in ensuring smooth and secure transfer of funds between accounts, especially in digital banking systems like NEFT, RTGS, and IMPS. Here’s how they function in each:

- National Electric Funds Transfer (NEFT): NEFT processes fund transfers in batches, making it suitable for regular banking transactions. When starting a NEFT transaction, you need to provide the recipient’s account details, such as their account number, name, and the IFSC of their bank branch. The IFSC is important as it identifies the specific branch where the funds need to go, ensuring the transaction is routed accurately. Without this code, the system cannot process the transfer correctly, likely causing errors or delays.

- Real-Time Gross Settlement (RTGS): Real-Time Gross Settlement (RTGS) is for transferring large sums of money that need quick settlement. This system processes transactions individually and in real-time, ensuring there’s no waiting period for fund transfers. The IFSC plays a crucial role in RTGS by identifying the exact branch where the funds should be credited. This precision is important for large payments, where even small errors can lead to complications.

- Immediate Payment Service (IMPS): IMPS offers 24/7 fund transfer capabilities, including weekends and holidays, making it ideal for instant payments. Like NEFT and RTGS, IMPS also relies on the IFSC code to identify the recipient’s bank branch during a transaction. When the IFSC is used, it ensures that even instant transactions are accurate and secure.

By embedding the IFSC in these systems, banks can eliminate errors, ensure timely delivery of funds, and enhance the overall efficiency of digital payments. Whether transferring small amounts or significant sums, IFSC remains a key element in India’s digital banking framework.

Where to Find an IFSC Code?

Finding the IFSC for your account is quite simple:

- Chequebooks: The IFSC is printed on the top of every chequebook.

- Bank statement: Most banks include the IFSC in their bank statements.

- Online banking portal: Branch-specific IFSC codes can be found on their official websites.

- Reserve Bank of India website: The RBI keeps a list of IFSC for all registered banks and branches to facilitate secure and reliable electronic transactions.

Importance of IFSC Code

The IFSC code is essential to modern banking, guaranteeing safe and precise transactions. It distinguishes a branch uniquely, making sure no one gets confused while sending funds, thus preventing fraud. IFSC help in making electronic payments faster and easier, thus reducing time for both banks and customers.

Structure of an IFSC Code

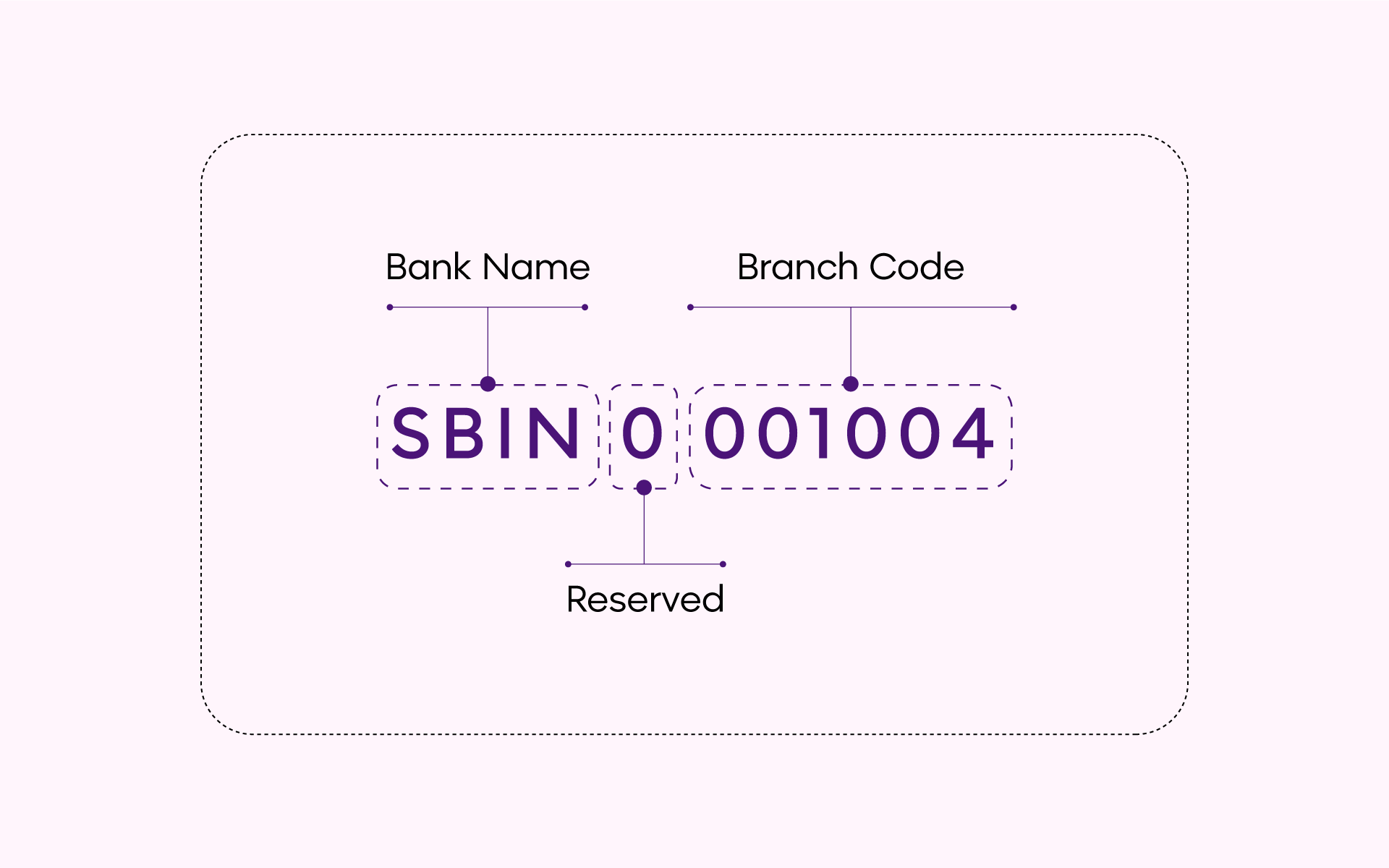

An IFSC code is carefully structured and not a randomly generated code—each segment carries specific information about the bank and branch.

- First four characters: The first four characters of an IFSC code represent the bank’s name. For example, SBIN denotes SBI bank.

- Fifth character (zero): The fifth character is always zero and is reserved for future use.

- Last six characters: The last six characters of an IFSC represent the particular branch of the bank.

Did You Know?

As of November 15, 2024, over 1,70,000 bank branches in India are enabled with Indian Financial System Codes (IFSC) to ensure precise and secure electronic fund transfers!

Conclusion

The IFSC code is an essential part of India’s banking system, ensuring online transactions are secure and accurate. Whether you are sending money, paying bills, or receiving money, it’s important to ensure that your funds reach the right destination. Understanding its structure and importance makes digital banking easier and helps you manage your finances effectively.

FAQs

1. What is the full form of IFSC?

IFSC stands for Indian Financial System Code.

2. How many digits/alphabets are there in the IFSC code?

An IFSC code is an 11-character alphanumeric code that is unique to each bank branch in India.

3. How can I find my IFSC code?

You can find your IFSC in your chequebook, online banking portals or even from the RBI official website.

4. Is the IFSC code required for online transactions?

Yes, the IFSC code is required for certain types of online transactions like NEFT, IMPS and RTGS.

5. What is the difference between an IFSC code and an MICR code?

An IFSC is a 11 character alphanumeric code used for fund transactions whereas an MICR code is a 9 digit code used for cheque clearance.

Visit open.money for more insightful content on banking and finance!