Mr. Sharma is running a successful supermarket store in Delhi for the last 7 years. As any new business owner, he also faced challenges with his payments as his business grew. Fortunately, Yes Bank Connected Banking made his business payment troubles vanish. How? Let’s see through this article.

When Mr. Sharma’s business was at a very early stage, he was managing his payments using a single current account. But as his business started expanding, he experienced a spike in his customer base, vendor base, and the number of transactions. By that time, he also started dealing with more current accounts. All of these posed him with various payment challenges such as:

- Tedious, slow, and error-prone manual reconciling process

- Logging into different banking portals to check balances for different current accounts

- Chasing customers to ensure receivables are completed and finding UTRs for specific customers among long spreadsheets was a nightmare

- Missing paying vendors due to increasing vendor base, lack of proper record-keeping, and experiencing strained business owner and vendor relationship

Then there was a solution to all this which came with Yes Bank’s Connected Banking offering and Mr. Sharma was able to solve all of his payment problems. Moreover, he made his business payments process even better.

OPEN, a business payment platform has partnered with Yes Bank to ensure that such payment problems are solved easily through connected banking services. These services are provided to all Yes Bank current account holders via the OPEN platform. Mr. Sharma reaped all the benefits that this current account linking with OPEN offered.

What Does Yes Bank-Connected Banking Mean?

Simply, Yes Bank Connected Banking enables you to connect Yes Bank’s current account to OPEN’s business payment platform. Additionally, it can also connect your current account to your accounting software such as Tally, Zoho Books, Microsoft Dynamics, etc.

How Yes Bank Connected Banking With OPEN Benefitted Mr. Sharma’s Business?

With the features and benefits that OPEN and Yes Bank Connected Banking bestowed on Mr. Sharma, he not only streamlined his disturbed payment cycles but got added advantages as well. Let’s know-how:

1) Pay and get paid on time

For Mr. Sharma, linking his Yes Bank current account with OPEN provided him with the ease to pay directly to his vendors through his desired current account. He was able to create invoices and bills in just a few clicks and could even pull them from his connected accounting software and share them with his customers and vendors with payment links attached.

Benefit: Mr.Sharma always collected his payments and paid his vendors on time. This kept his relationship positive with his vendors and getting paid on time maintained a healthy cash flow of his business which is important for businesses’ financial health. He was able to create quick digital invoices and bills and send them easily. This saved him from the hectic task of dealing with physical invoices and saved him a lot of time that was earlier used to get exhausted in creating and safe-keeping of physical invoices and bills. Moreover, OPEN allowed him to send constant payment reminders to his customers which increased his chances to get paid on time.

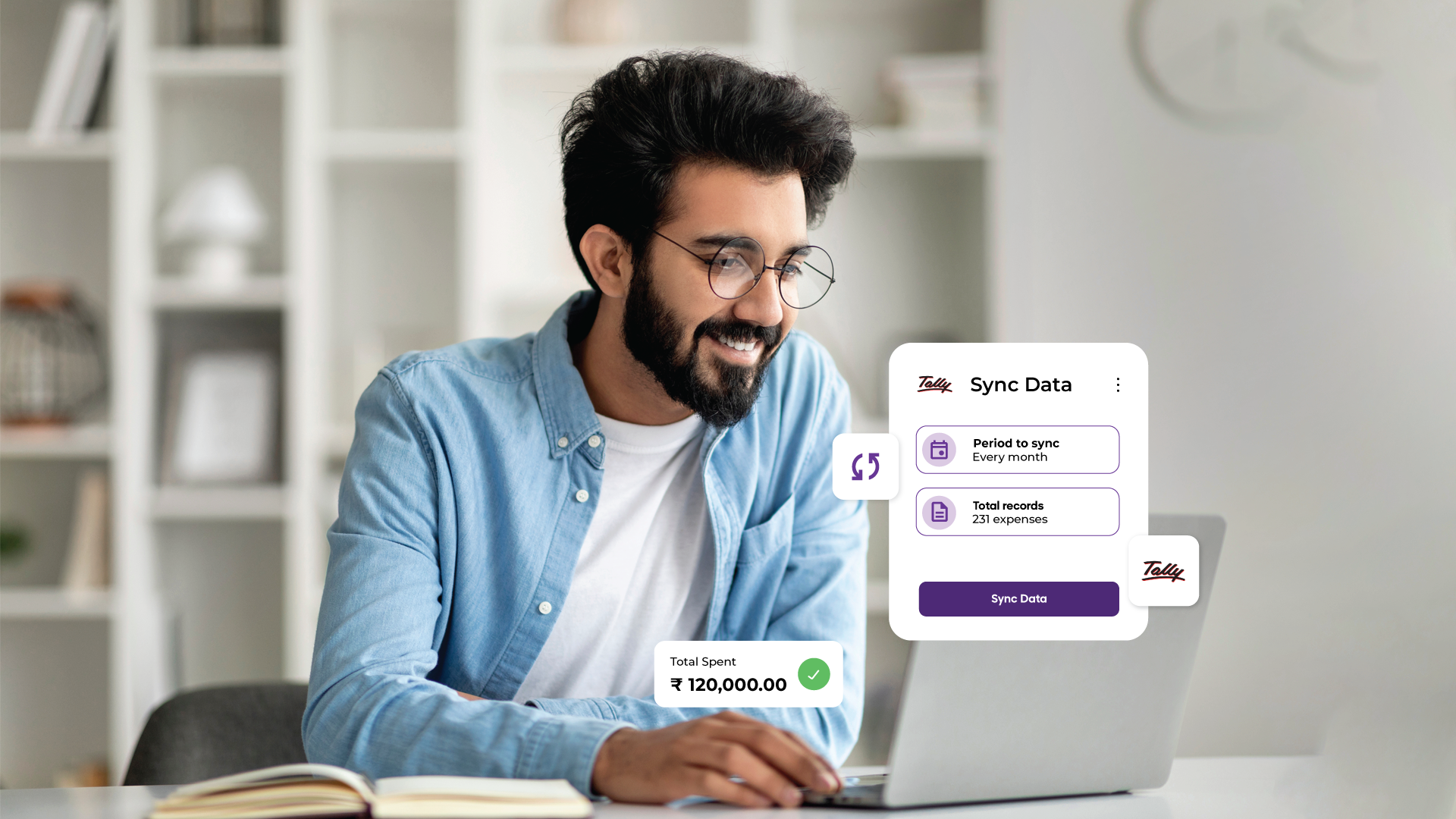

2) Hassle-free Auto Reconciliation

OPEN with Yes Bank connected banking provides a major advantage of linking your accounting software with the platform. This helped Mr. Sharma in leaps and bounds. Every payment and collection made via OPEN auto-reconciled with the e-statement entries of each current account. Also, payment and collection entries on OPEN were pushed into his accounting tool instantly.

Benefit: There was no need for Mr. Sharma to sync bills and invoices manually with accounting software and then match them. This saved him from long and tedious hours of manually synching and reconciling.

3) Keen Eye On cash flow

With Yes Bank Current Account linked to OPEN, every business payout and collection was visible to Mr. Sharma. Bank balances and e-statements were available on the dashboard. Through this, he had thorough visibility of his cash

flow.

Benefit: Mr. Sharma never forgot to pay his vendors on time. This kept his relationship strong with his vendors. Additionally, with clear visibility of cash flow, he had a projection of his business’s profits.

Therefore, he was able to allocate funds for business sudden requirements like buying new equipment, covering unfortunate losses for a particular month, buying inventory, etc. OPEN also allows to send payment reminders to its customers automatically at set intervals which increased Mr. Sharma’s chances of getting his receivables on time.

4) Single Dashboard To Manage All

With Yes Bank Connect and OPEN, Mr. Sharma linked all his current accounts and was able to see them from a single dashboard.

Benefit: Linking three of his Yes Bank Current Accounts to OPEN allowed him to view balances from each account without the need to remember and enter different passwords. He was also able to make direct payments through his linked bank accounts.

OPEN platform also allowed Mr. Sharma to pay all his vendors in bulk without the requirement of paying them separately and without the need to prepare a long and complicated Excel sheet to record the details of each beneficiary. He was able to pay a number of vendors at the same time. Moreover, it made him free from the hassle of entering OTPs for each payout.

Greater Gains With OPEN

OPEN also offers some advantageous business-specific tools which allow them to do:

- Spend Management – Keep track of employees and business expenses by automated receipt collection and approvals.

- GST filing – Forget the hassles of calculating GST as OPEN does it for both inward and outward supplies with GSTR-1 ready for filing. Download GSTR-2A for verifying your transactions and file GSTR-3B. Do it all directly from the OPEN platform.

- E-invoicing – With the simple method, create invoices from OPEN platform and generate e-invoices with the option available.

- Payroll – Manage employee reimbursements, leaves, and pay from the OPEN platform.

If you want to streamline and elevate your business payments with Yes Bank Connected Banking just like Mr. Sharma, connect your Yes Bank Current Account with OPEN today.