If you’re a small or medium business owner trying to simplify and manage your business expenses, corporate cards can make your life easier. There are various players in the industry providing seamless card experiences to small business owners without the hassle of going through tedious paperwork. The card programs allow you to pay for things on the go and enable you to reimburse for expenses without a hassle. Besides simplifying the business expense management, these cards also offer cashback, benefits, and rewards.

But, if you’re starting as a small business, you think so little about the long-term impact of choosing the right corporate business card program. In the beginning, getting a card program approved by a financial institution might seem like a tremendous bargain. Hence, the long-term impact might be the least of your concerns initially.

Nowadays, after seeing a digital ad, you might click on the link, enter the landing page of a corporate card program, fill out an application, get approved, and finally, the corporate card arrives. You will start using the cards and distribute them among a few employees. But, the trouble begins when your company scales and more employees enter the card program. If your card doesn’t support a cost-efficient, transparent and seamless scaling strategy, the impact of your poor card decision will start to show up both in micro and macro-financial aspects of your business. At this point, changing the provider and setting up a whole different expense management process will become a necessity. But remember, it will be challenging, time-consuming and costly.

Hence it is imperative to consider the following when you choose your corporate card program:

1. Choose the right type of corporate business cards

As a startup founder, it must be hard for you to receive a valid corporate credit card issued from a traditional bank. But, now there are neobanks and other financial institutions providing card programs, and you might be baffled by the many cards available to you.

As for the type of corporate card, there are four different types:

- Charge cards: A charge card doesn’t have a preset spending limit. However, they do not offer unlimited spending either. With this card, you will receive a monthly bill, and you will have to do the full settlement of the bill amount every month.

- Business credit cards: These cards have a preset spending limit, but you can carry a month-to-month balance and interest with 0% APR (Annual Percentage Rates) periods. This facility is not possible for charge cards.

- Business debit cards: These cards allow you to use the balance available on the cards, but there will be no option to set and control spending limits.

- Prepaid expense cards: Prepaid expense cards revolutionized the expense management process in organizations. You can give out these cards to your employees, set spend limits, avoid reimbursement processes, and track and manage the team spending.

2. Manage your credit score

As a startup founder or a small business owner, financial institutions need many documents to evaluate your creditworthiness when you apply for cards. If you own an established business, your business account books or transaction histories can vouch for the credit. But, if your business is new, you might not have enough business transaction statements initially to prove your creditworthiness. Hence your personal credit score might have more relevance. Here, your personal credit score will be detrimental in assessing your creditworthiness, granting credit limits, and checking the eligibility to approve different types of cards available.

If your business has been functional for a while, another factor to consider is the company’s credit score. If you and the company have a high credit score, you’re likely to be approved for a corporate card quickly. However, if the company has a lower credit score and your personal credit score is higher, then it’s unlikely that you’ll be approved.

3. Be aware of personal liability

As you are the business owner, regardless of the card program you choose, you’re personally responsible for the charges made on your business card account. Hence, it is crucial to have a comprehensive understanding of money flow over the cards. The same has to be traced and monitored well. Besides, it is essential not to miss payments and not break the payment cycle as it could cause a sudden increase in APR.

4. Assess the cost of the program

It is inevitable to assess the cost of the card program. It’s not a good idea to apply for a card that is too expensive or one that will put you in debt. On the other hand, if you plan to use your card often and spend a lot, it might be worth paying more upfront.

Some cards offer sign-up bonuses or discounts at certain stores, which can help offset the cost of the card if you’ll be using it often. Different companies charge different prices for the same cards – and some even offer more generous interest rates than others! When deciding what type of card is best suited for you and your company, take this into account.

5. Check the application process for the cards

As a startup founder, it might not be easy to join a corporate card program via a traditional bank as it involves multiple steps to analyze your creditworthiness. It requires you to fill long forms, do tedious paperwork, and submit a never-ending list of documents.

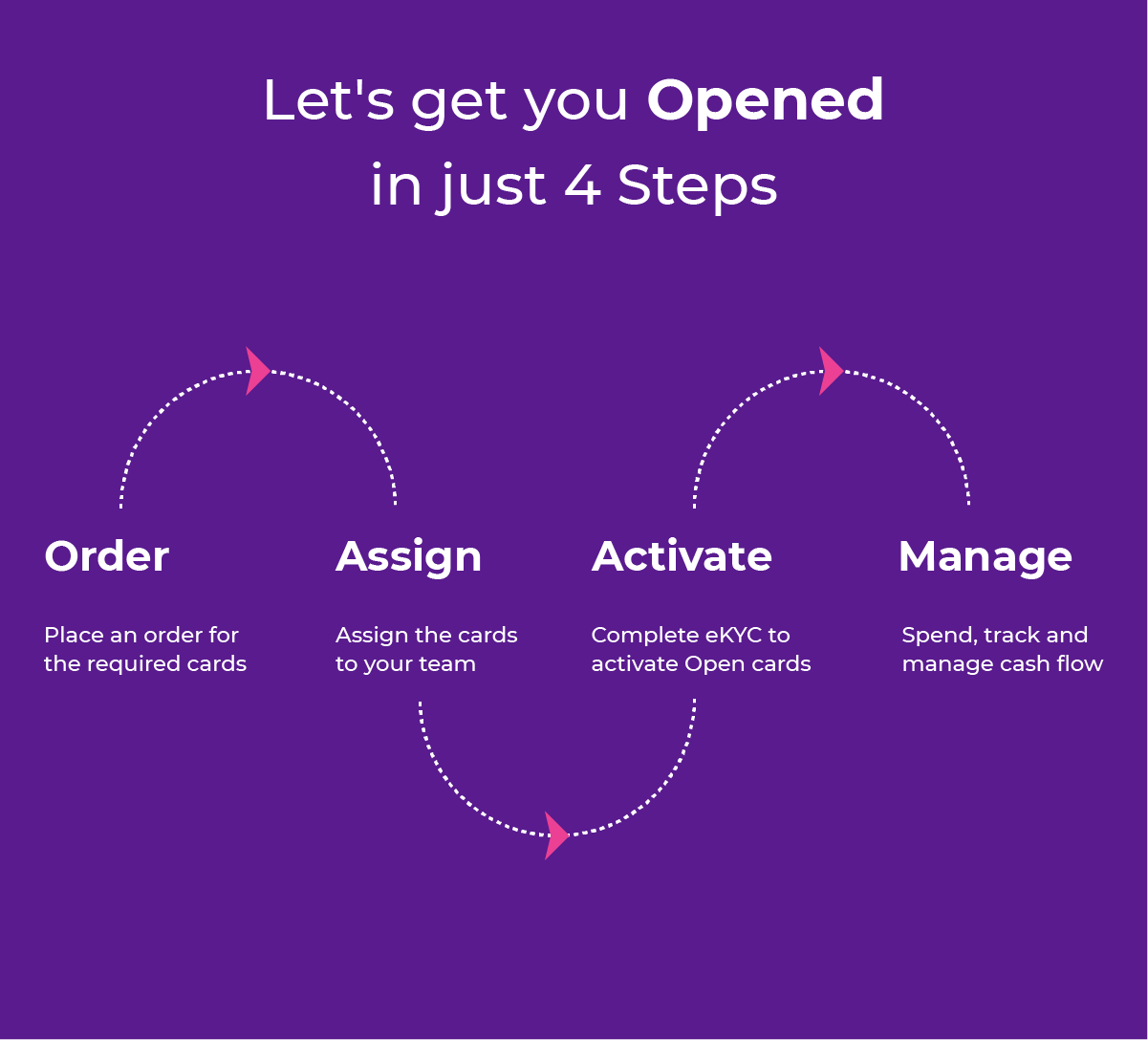

However, with Open Cards, the corporate card program is as simple as it could ever get!

To apply for the Open Business Cards, the process is relatively straightforward.

Here is how we get you Opened in just 4 Steps:

- Order: Place an order for the required cards

- Assign: Once you receive the cards, assign them to your team members

- Activate: Ensure that you complete eKYC to activate Open cards

- Manage: Now spend, track and manage cash flow

6. Reap the benefits of reward programs

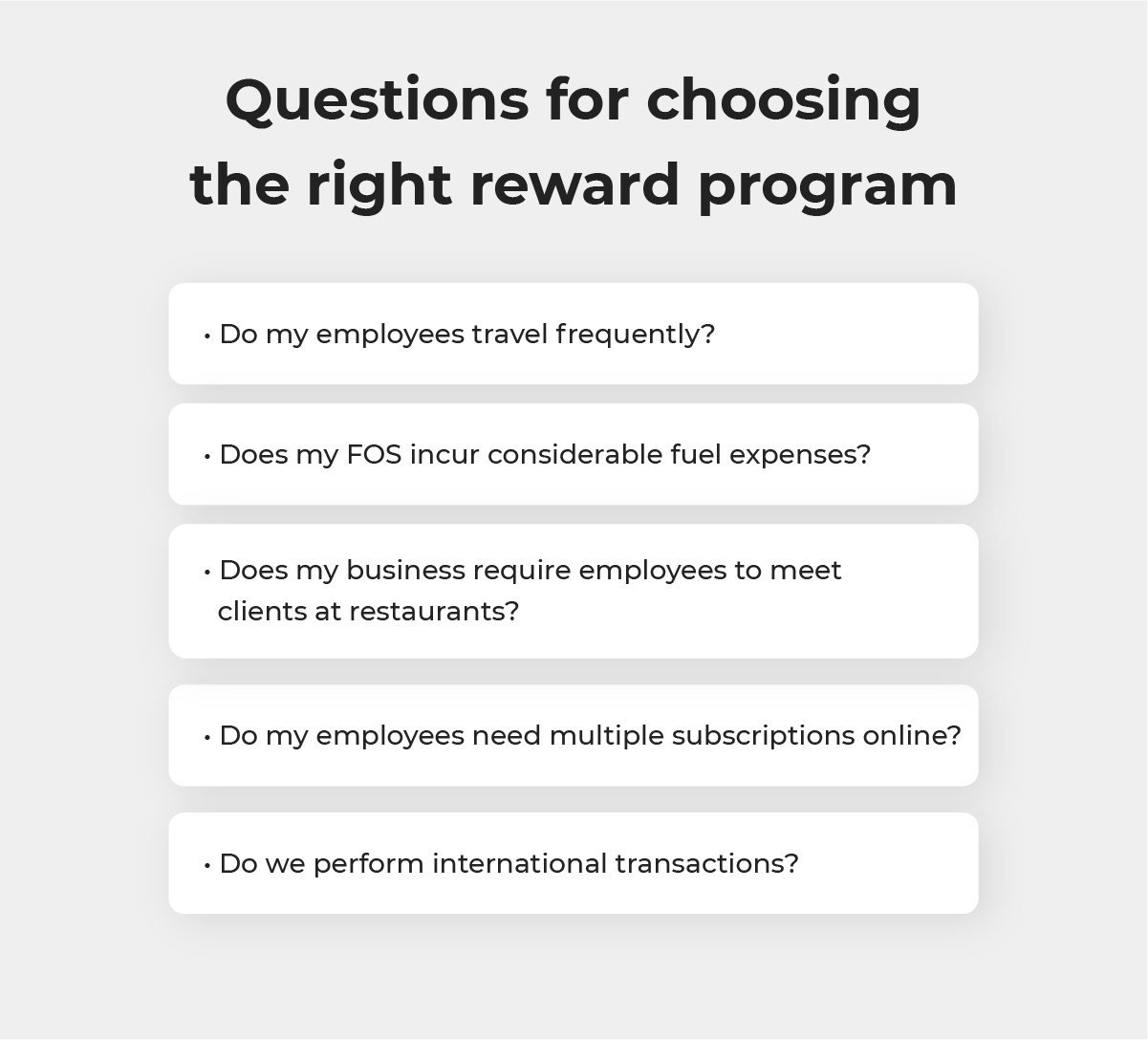

It is vital to know your cost centers and spending habits to make the best use of your corporate cards. Therefore, review your expenses and try to categorize them into travel, dining, fuel, advertising, etc. By organizing your expenses, you can subscribe to a card program that will provide maximum rewards for your money spent, and you can avail the best offers.

You can ask the following questions to make the most insightful decisions:

- Do my employees travel frequently?

- Does my FOS (Fleet on Street) incur considerable fuel expenses?

- Does my business require employees to meet clients at restaurants?

- Do my employees need multiple subscriptions online?

- Do we perform international transactions?

By asking these questions, finding answers, and categorizing business expenses accordingly, you can choose card programs that give maximum reward points for dine-outs, travels, cashback, redeemable vouchers, and offers.

It’s very common to fall into the trap of choosing a poor corporate card program with inadequate scalability, impoverished traceability, and an inferior expense management system focusing only on rewards. Instead, go for a well-conjugated program with an efficient expense management system, exceptional spend control, adequate visibility, esteemable transparency, and simultaneously coupled with maximum rewards.

7. Check the security plan used by the company

One of the most important things to consider before applying for a corporate card program is the security plan used by the company. You must ensure that you’re protected against frauds, hacks, and data breaches. To make sure that you’re safe, investigate how the company handles customer complaints and how they protect your personal information from third parties.

Conclusion

Not all corporate card programs provide a transparent or smooth experience, especially for a growing business. Hence, as a business owner, you have to choose the right cards for your business.

Open Corporate Business Cards

Open business cards are transparent, seamless and straightforward to use.

With Open, the corporate card program is as simple as it could ever get!

The Open Corporate Card program includes an Open Business Account, Open Cards, and Open Money Dashboard.

Open issues 3 types of cards to Open Money subscribers.

1. FounderOne Card

With every Open Money Account subscription, you will receive a FounderOne card. It is a premium debit card that can be used for all your business transactions, including international payments.

2. Virtual Cards

Open Virtual Cards are specifically designed for managing your subscriptions. You can use these virtual cards to subscribe to your Shutterstock, FB Ads, Google Ads, Softwares, Business Emails, and Clouds – Every subscription online!

If your company has multiple teams or departments, you can request numerous virtual cards with one Open Money account. You can hand over each card to different teams, such as marketing, accounting, digital, etc., for managing their payments and subscriptions in your organization. In addition, you can manage departmental subscriptions and expenses with Open Virtual Cards.

3. Expense Cards

Open Expense Cards help you to manage your daily expenses. If your team incurs day-to-day expenses such as food, travel, utility, fuel, toll, and parking but fails to report, track and monitor it properly, you need Open Expense Cards. You can even eliminate the tedious reimbursement process from your system with Open expense cards. With Open prepaid expense cards, you can allocate cards to team members with spend control. Each team member gets a card and they can swipe it on the go. Besides, they can file expenses via Whatsapp by just clicking a picture.

Now, you don’t have to use multiple apps and software anymore. Instead, open provides a complete solution to keep your cash flow under control. It is integrated with account management and expense modules as well. Open Cards can be used for business spending, including day-to-day operations, subscriptions, and team expenses.

An Open Business Account is a current account for businesses to facilitate banking transactions. It will help you perform and manage all your business transactions in one place.

With Open Dashboard, you can track, monitor, and manage all your expenses, accounts, cash flow, payroll, and more in one place without having to use multiple accounts and apps.

When you sign up for Open Corporate Business Cards, you get access to not just 1 but 3 solutions to manage your expenses comprehensively.

Told you, with Open, the corporate card program is as simple as it could ever get!