Payment challenges faced by digital marketing agencies

If you run a digital marketing agency, you will second that managing the cash inflow & cash outflow of your business is taxing. But why are handling payments for agencies so complicated? Well, let’s find out.1. Invoicing multiple clients with varying billing cycles

Agencies onboard different clients at different timelines. And the duration of the contract varies from client to client. This will mostly depend on the nature of the client’s requirement. And the remuneration? Well, that fluctuates too. With so many factors that are subject to vary, an agency must still send out customer invoices — duly & diligently.2. Overseeing multiple ad manager accounts

Digital marketing agencies run ads for their clients on channels such as Google, Facebook, Linkedin, etc. They oversee & manage the ‘ad manager’ accounts of their clients. While running ads for multiple clients, the cost incurred for each client becomes difficult to track via net banking portals. For instance, let’s say you run Facebook ads for three different clients in the month of June. To validate the breakdown of your ad spends (client-wise), you must map each ad spend with the money debited from your bank account. This could be overwhelming because the entries in your net banking portal will not help you identify the clients. Thus, marketing spends for digital marketing agencies are no piece of cake. They are undoubtedly difficult to segregate.3. Managing online subscriptions

A marketing agency may offer multiple services such as SEO, SEM, web development, mobile marketing, email marketing, & way more. This means that agencies must subscribe to multiple online tools such as Mailchimp, SEMrush, Ubersuggest, Shutterstock, etc. Now setting budgets for each one of these tools & tracking the actual amount spent on them is no less than a nightmare.4. Reimbursing client servicing executives

A client servicing executive pursues new clients for the agency. They also maintain cordial relations with their existing clients. These executives are mostly out in the field & end up spending from their pocket for food & travel expenses. This amount gets reimbursed to the employee at a later point in time. But guess what? The executive must submit proofs in the form of physical receipts for every single expense. Now imagine the pile of receipts the finance team needs to keep a tab on to reimburse all their employees?5. Follow up for due & partial payments

While some clients make payments in full, some may prefer partial payments. Following up with clients for all the due payments can be time-consuming.6. Tracking client payments

Tracking all the payments received from multiple clients & mapping them to their relevant sources is certainly no cakewalk. The same goes with costs & expenses. Agencies don’t just spend on office rent & employee salaries. They also spend on their clients to drive the best outcomes. Achieving desired goals for clients is the core ethos of any marketing agency. But this comes with payment complications, especially the bit where you calculate the ad spends incurred. However, having this information (incomes & expenses) is crucial for agencies to prepare their Profit & Loss Statement.Open’s payment solutions for digital marketing agencies

The importance of getting an overview of your business’s financial health can never be overstated. Businesses can achieve this by keeping a close track of their cash flow (among other things). To track your cash flow regularly, a sound financial operating system is just what you need. And Open offers just that. Digital marketing agencies can now easily go about their payments (both collections & payables). Tracking marketing spends is now a whole lot easier than it used to be. Thanks to virtual cards. All in all, Open can ease business finances & payments for your agency. Read on to know how.1. Avail smart & timely client invoicing

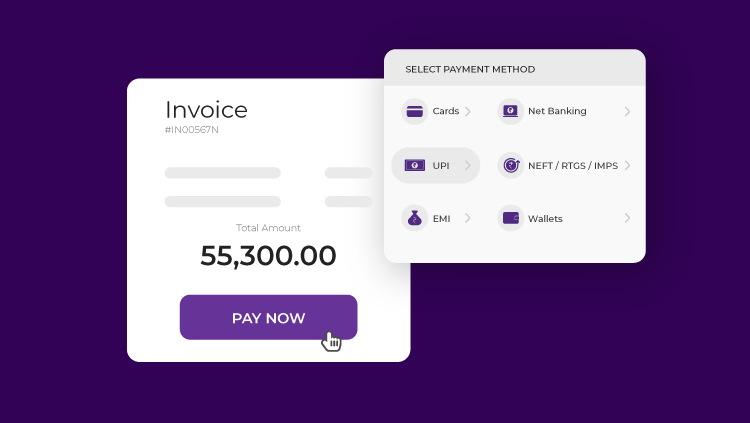

With Open’s GST invoicing module, you can send timely invoices to all your clients — in a breeze. Not just that, these invoices will help you collect payments faster. How exactly, you ask? Well, here’s how. Open’s invoices come with an in-built payment link. When you send out an invoice to a client, the client can simply click on the payment link, choose a payment mode & make the payment. Simple, right? The whole process is made so seamless for both you & your client.

Open’s invoices come with an in-built payment link. When you send out an invoice to a client, the client can simply click on the payment link, choose a payment mode & make the payment. Simple, right? The whole process is made so seamless for both you & your client.

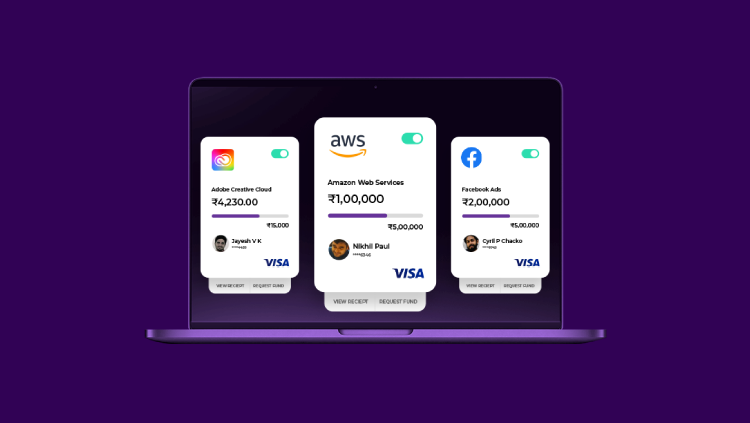

2. Assign virtual cards to manage multiple client accounts

As an ad agency, let’s say you have six different clients across the country. You run ads on multiple platforms for each client. But wait, how exactly do you go about tracking how much you spent on which platform & for which client? That’s precisely why we built virtual cards. To simplify marketing spends for digital marketing agencies. You can simply assign a unique virtual card to each client via Open. The cost you incur on ads for every client can be clearly tracked on Open’s dashboard. This way, you can save tons of time spent on bank reconciliation.3. Manage & control online SaaS subscription spends

As an agency that subscribes to numerous online tools, it’s likely to miss ‘unsubscribing’ from tools that you don’t use any longer. This ends up in renewal of the existing subscriptions, since monitoring active subscriptions is not your #1 priority. Not just that – if you don’t stay on top of your due dates, you end up paying the late fees on certain tools. But don’t worry. With Open’s virtual cards, you can avoid being overcharged on SaaS subscriptions. You can now manage, control & track the costs incurred on online tools. That’s right. Get virtual cards & save the day!

All you need to do is — assign one card to each tool you use & that’s it.

Now you can ensure that you don’t pay twice for the same tool. Also, easily track all your subscription payments with real-time visibility on every online purchase.

And just like that, you can simplify how you go about online spends.

That’s right. Get virtual cards & save the day!

All you need to do is — assign one card to each tool you use & that’s it.

Now you can ensure that you don’t pay twice for the same tool. Also, easily track all your subscription payments with real-time visibility on every online purchase.

And just like that, you can simplify how you go about online spends.