Of late there has been a massive buzz around business automation.

So we thought of digging a little deeper to understand the why of it all!

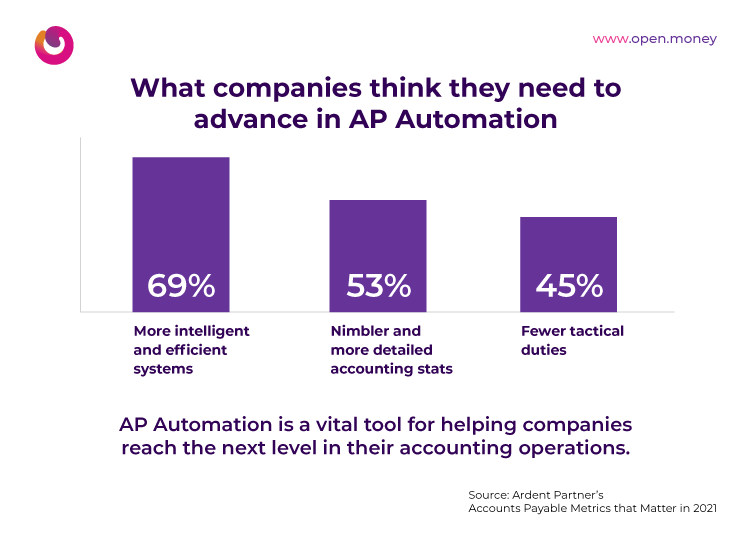

While we talk about automating various segments of a business, automating business finances holds primary importance. Financial service automation has become a business tailwind with a forecasted CAGR of 23.17%. To stay on top, businesses need to ensure that there are no liabilities on their books of accounts and also maintain healthy business relationships with their vendors and suppliers.

In this blog, we are going to talk about managing a business’ accounts payable to-the-dot. Based on the results derived from the IOFM (Institute of Finance and Management) survey, 84% of the typical accountant’s time is wasted on manual activities. To unfold the actual problem, first let’s look at what is accounts payable:

Accounts payable is the spectrum of payments that you owe to any service provider/ vendor for your business.

Therefore, streamlining and automating accounts payable favours your business relations fluently.

Now Let’s Talk About the Real Hold Up!

We have studied some common challenges that businesses face while managing accounts payable:

- It begins with maintaining the purchase orders. You need to ensure precision on what products/services you have procured, check on unauthorised purchases and avoid duplicate data.

- Once your service/product is acquired, you need to check and generate records of vendor invoices, so as to not miss out on any pending payments. At this point, adding manual data entries may take away all your time and effort, which could otherwise be put to better use.

- Not to forget, deduct TDS and make timely payment to close the vendor’s ledger account in your book of accounts.

- Lastly, pay the deducted TDS amount to the government before its due date.

Even if you somehow manage to do all of it, what if you need to cross-check an old invoice from your long-term vendor? If you are unable to find one, it will in turn, cost you additional time and effort in requesting a copy from them.

Businesses can curb these issues by automating accounts payable. You can opt for solid and reliable automated paycycle solutions with Open such as instant vendor payment and Payout APIs, that help sort your accounts payable process effortlessly!

Curious? Let us help you!

Want to learn more about Business Finance Automation & how are CFOs evolving?

Visit – https://register.open.money/business-financial-automation-ebook/

Make Instant Vendor Payments With Open

Never face the chaos of finding an old invoice for making due payments, when you have Open’s instant payment solution. Take a look at how you can make and track all your vendor payments in the most simple manner possible with Open. Moreover, simplifying your accounts payable process gets even easier when you can –

- Add the vendor only once for all your future transactions

- Add any number of vendors & start transacting immediately – no cooling period involved

- Track & view all aged payables vendor-wise & invoice-wise

- Make timely payments & send auto-reminders

- Schedule for post-dated payouts

- Download detailed reports of vendor payments on the same dashboard

There’s More! Choose a Solution That Suits Your Business

Open’s payout APIs help you make bulk vendor payouts in a single click, anytime and anywhere. And, it’s way easier than you think!

- Explore hassle-free integration – Open offers you the simplest integration recipe that not only helps integrating APIs, but also lets you test the same before you take it live.

- Add payees in a blink of an eye – Just update the payee details via APIs and choose the mode of payment you want and you’re good to go!

- Automate bulk payouts – Send bulk payouts to your vendors with a single click from your Open business account. That’s not it! In just another click, you can download the transaction report on the spot.

We already see you smiling whilst moving away from your payout and reconciliation hassles. 😎

We understand what it means to build, maintain and grow business relationships. Therefore, we are here to help you win over all your business banking struggles. Sign up now to get started on Open and transform your business banking game.

Give yourself the best shot with the most seamless accounts payable solution through Open.