Payroll Management Solutions can solve the growing challenge of timely salary payments for employees in small businesses in India. The reasons for this statement are, firstly, the exponential growth of the Indian Economy(6.8% growth is the growth target for 2023-24, according to IMF). Secondly, India is also getting better at the ease of doing business rankings(62 in 2019 from 100 in 2017, a 37 position improvement, a position better even than China). Thirdly, the sudden influx of international businesses as India becomes the hub of a thriving business centre has forced the hands of regulators to meet the international standards of payroll compliance. These changes have affected small businesses the most, which need relatively more resources to tackle the changes.

Payroll Management challenges of small businesses

The changing regulatory landscape with complicated calculations has forced SME and startup business owners to take trips to concerned departments while complying and coordinating with the authorities instead of focusing on activities that business growth. Some aspects of the Indian payroll management system are digitised and have transformed thanks to the rise of process automation. Many processes still involve the manual submission of paper documents. It doesn’t even scratch the surface of many challenges SMEs face. According to the recent HR Trends Survey Report, small businesses’ top five payroll processing challenges are:

- Keeping up with national, state and local level recordkeeping compliance (59%)

- Manual data processing (55%)

- Payroll tax compliance (51%)

- Data security and payroll fraud prevention (35%)

- Paying independent contractors and gig workers (30%)

How can payroll management solutions from Open help small businesses?

The question is how small businesses can help themselves overcome payroll-related challenges and get back to running their company as usual. Here are some ways small businesses can leverage payroll management solutions to help them overcome the challenges mentioned earlier:

- Easily manage attendance, payslips, and expenses to disburse salaries on time

- Integrated tax modules to comply with all levels of tax compliance (TDS, PF, ESI, PT)

- Save time with end-to-end automation

- Intuitive analytics and reports

Easily manage attendance, payslips, and expenses to disburse salaries on time

Today, the kinds of employees that small businesses hire are not limited to full-time vs freelancers and onsite vs remote. Business needs to address the needs of all employees irrespective of where they are and who they are. Taking care of all their unique compliance needs is tiresome for a company and requires much workforce when done manually.

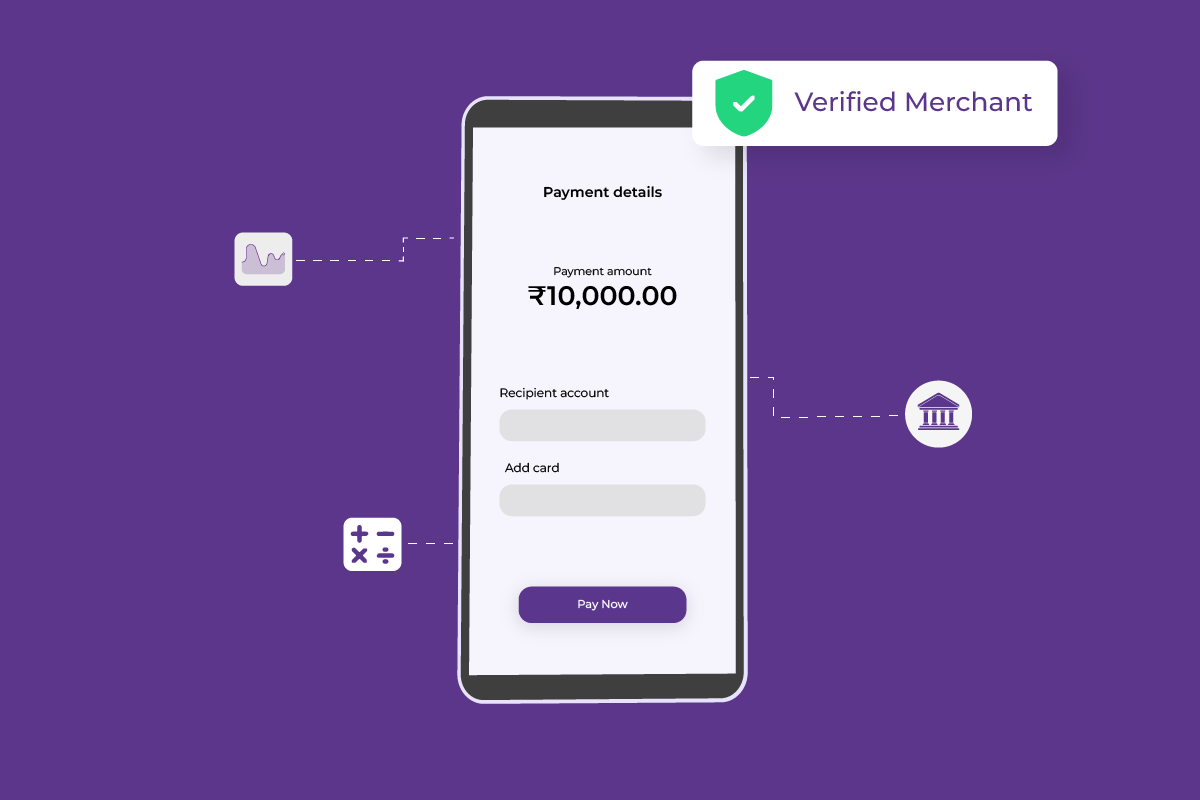

When your employees can take care of their attendance through the self-service portal, the payroll solution can auto-generate payslips (based on local rules and regulations), and employees can manage expenses in coordination with their managers. It makes the payroll process becomes reliable and streamlined. After simplifying the processes, the salary calculation becomes accurate and reliable. With the payroll management solution from OPEN, businesses can disburse salaries to employees from the dashboard directly without going to the banks’ website every time. It saves time, money and effort for companies to focus energy on tasks promoting business growth.

Integrated tax modules to comply with all levels of tax compliance(TDS, PF, ESI, PT)

Taxes and insurance rules vary from state to state. The payroll department must know which contributions to withhold and when. Employee State Insurance(ESI) and Professional Tax are not applicable across all the states but have compliance obligations where they do.

In the same way, the state government’s labour association manages the Labour Welfare Fund (LWF) and determines the contribution to be made by the employees and employers. For businesses to cope with and communicate the Provident Fund (PF) Know Your Customer (KYC) documentation to authorities is a challenge. There are many more complications, and the above examples are the tip of an iceberg that muddles tax management for payroll. Integrating automated tax management with payroll management solutions is a boon that keeps annoyances away from the payroll department and the business owner.

Save time with end-to-end automation

Employee onboarding to final settlement is the complete life cycle of an employee in the company. In this life cycle, various occasions like promotions, yearly increments, bonuses and many others need to be taken care of by payroll, and businesses must communicate it to the tax authorities and banks. Payroll management solutions can automate all of it.

During employee onboarding, the payroll solution can autofill all the necessary fields by scanning the digital document the employee submits. It can also cross-verify across various databases to manage compliances and show multiple discrepancies to rectify them in the records for hassle-free recordkeeping. During the employee’s tenure, the benefits, taxes and other remunerations can be calculated automatically based on previous employment history, terms agreed with the employer, attendance, and other factors. Similarly, during the employee’s exit, the payroll solution can calculate the desired settlement based on their performance and the agreement they have signed with the employer.

Intuitive analytics and reports

Payroll analytics and reports are essential in getting an overview of taxes the business must pay to the government, employee-specific payroll information, and timesheets. The Payroll Register includes detailed reporting of the entire company’s payroll details for the period. It entails the company’s complete tax information, such as how much the government taxes it and what it owes to the government(PF, PT, and ESIC). Then, there are Employee Payroll Reports, often called Employee Earnings Reports or Payslips. These reports are part of the payroll register and contain an employee-specific detailed calculator of wages, taxes, and deductions. Every employee is entitled to receive payslips every month.

The Timesheet Reports are helpful if the business pays its employees based on time tracking. A sound time-tracking payroll system will ensure you can analyse time attendance metrics. Time tracking reports help managers correlate time management and productivity to make improvements where required. Businesses can access all these reports through the payroll system Open offers.

Conclusion

Small businesses and Startups struggle the most when there are regulatory changes. How these small businesses function leaves little room running for the authorities of each department and understanding every regulatory amendment in the payroll. Intuitive payroll management solutions allow for complying with the changing rules automatically and seamlessly. When the same payroll solution easily integrates with your accounting, tax management, expense management, invoicing and other proprietary solutions, it gives the business owner an edge through comprehensive reports of their business finances. These in-depth reports, in turn, helps business owner develop a deep understanding of how their business is functioning and take the proper steps forward.