Regardless of their size, businesses today show a clear preference for adopting SaaS (Software as a Service) options in favor of infrastructure ownership and its financial as well as logistical burdens. According to a Statista report, in the last seven years, i.e. since 2015, the global SaaS market has grown more than 5X, from just over £23 billion in 2015 to nearly £131 billion in 2022. In parallel, the global Virtual Cards market is expected to grow at a CAGR of 21.3% from 2022 to 2031.

Small businesses and startups especially find SaaS subscriptions to be a great option because they don’t require a huge initial investment of capital, offer automatic updates, and are more flexible than traditional alternatives such as physical servers. Moreover, with SaaS subscriptions, businesses don’t have to worry about housing expensive infrastructure and constantly upgrading it to compete with larger competitors. Managing the expenses of different SaaS subscriptions can pose various challenges for businesses, however, and Virtual Cards can prove to be of great help in overcoming these challenges. Before deep diving into it, let’s take a brief look at what we mean by SaaS, especially in day-to-day business operations.

What is SaaS?

Software as a Service, known popularly as SaaS, is a model in which cloud-based software and applications, developed by third-party providers, are offered to be used on a subscription or pay-as-you-use basis. For businesses, this means 24/7 access to essential services from any place that has an internet connection, a much better scenario in most cases than onsite machines and fixed business hours. Popular examples of such services for businesses include AWS, Hubspot, Jira, Salesforce, etc.

What are the challenges in SaaS spend management?

The major challenges faced by businesses in managing their SaaS spends are as follows:

-

Duplicate subscriptions

Due to different teams needing the same service and a lack of awareness and visibility regarding these subscriptions, businesses often find themselves using two or more different SaaS platforms that are alternatives to each other. For example, to back up important files on the cloud a team may be using DropBox when the business has already invested in getting extra storage with Google Drive.

-

Forgetting to cancel subscriptions

Canceling SaaS subscriptions that are not used by the business anymore due to replacement by alternatives (or for any other reason) is an essential but often overlooked task. Unused subscriptions can often put a strain on your budget, especially if the amount being deducted is too small to be noticed by the finance team but the leakage goes on long enough to make up a substantial amount.

-

Reconciliation of SaaS spends

Tracking and managing the expenses from various SaaS sources can be a tedious task, especially when it comes to reconciling them manually. The situation becomes even more complicated when the same services are being subscribed to by different teams in the organization.

-

Separation of expenses

Businesses that use a common credit card often face the challenge of attributing expenses to different SaaS platforms, especially if the subscriptions are for multiple teams or clients. For example, marketing agencies need to charge their clients based on the SaaS subscriptions being used for a particular period of time, for a specific client. You can imagine how difficult it would be to manually segment the expenses for different clients, along with each of their different SaaS platforms, from a common credit card statement.

-

Maxing out a personal credit card

If you are a business owner or a manager who subscribes to a bunch of different SaaS subscriptions with your personal credit card, you run the risk of maxing out the limit of your card. Apart from the difficulties you may face as an individual, your day-to-day business is also placed in a risky position if important subscriptions are not paid for on time.

Apart from these challenges, the subscription and pay-per-use models adopted by most SaaS platforms make it essential for businesses to track associated expenses on a regular basis and reconcile them accordingly.

What are Virtual Cards?

A virtual credit card is a unique & digitally generated 16-digit credit card number that lets you pay for all your subscriptions. You can use this number just as you would use a regular credit card, with many added advantages that make it optimal for SaaS expense management.

Here’s a detailed guide on everything you need to know about Virtual Cards

[su_button url=”https://app.open.money/register” target=”blank” background=”#663399″ size=”7″]SignUp Now[/su_button]

How can Virtual Cards help your business?

Virtual Cards, as we discussed above, function just like regular credit cards with the difference that you can generate them at will and avail other important advantages. Here are a few important ways Virtual Cards can help you in SaaS subscription management.

-

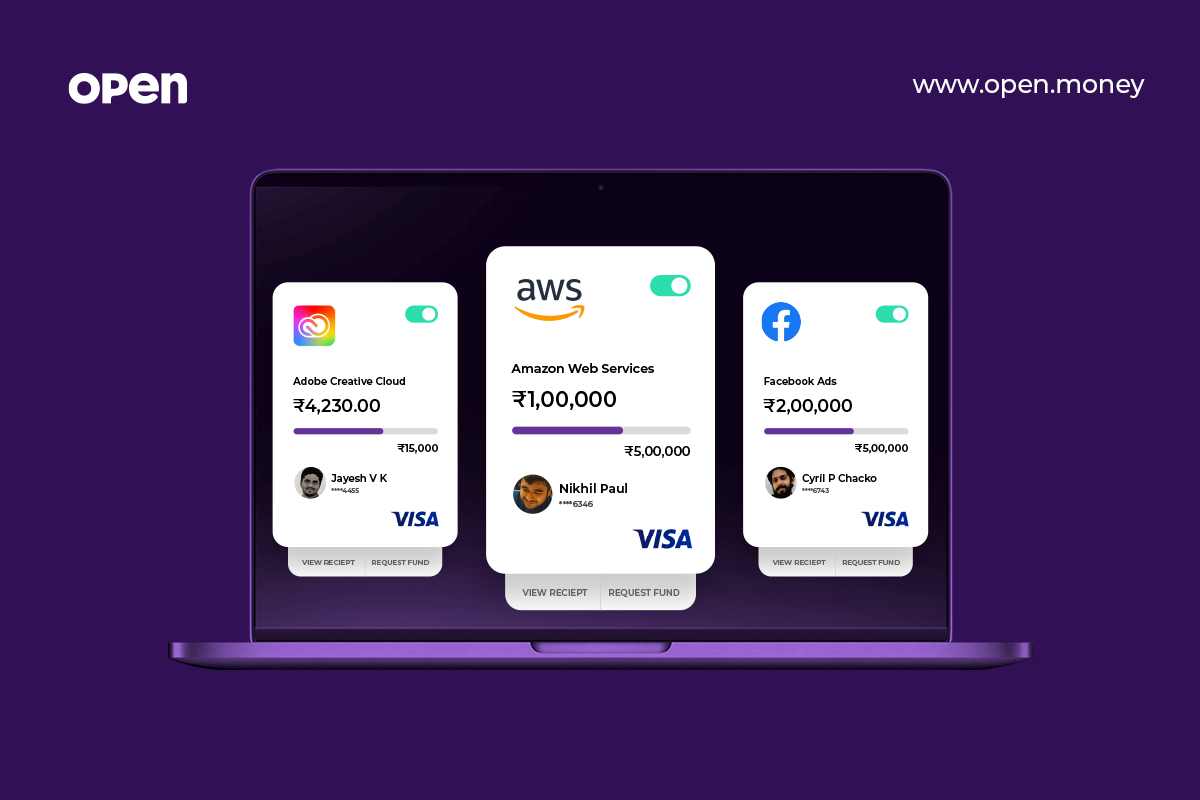

Manage ads and other SaaS expenses seamlessly

By assigning different virtual cards to different ad platforms or cloud-infrastructure platforms, you can simplify your digital expenses and do better budgeting.

-

Stick to the budget of your digital spending

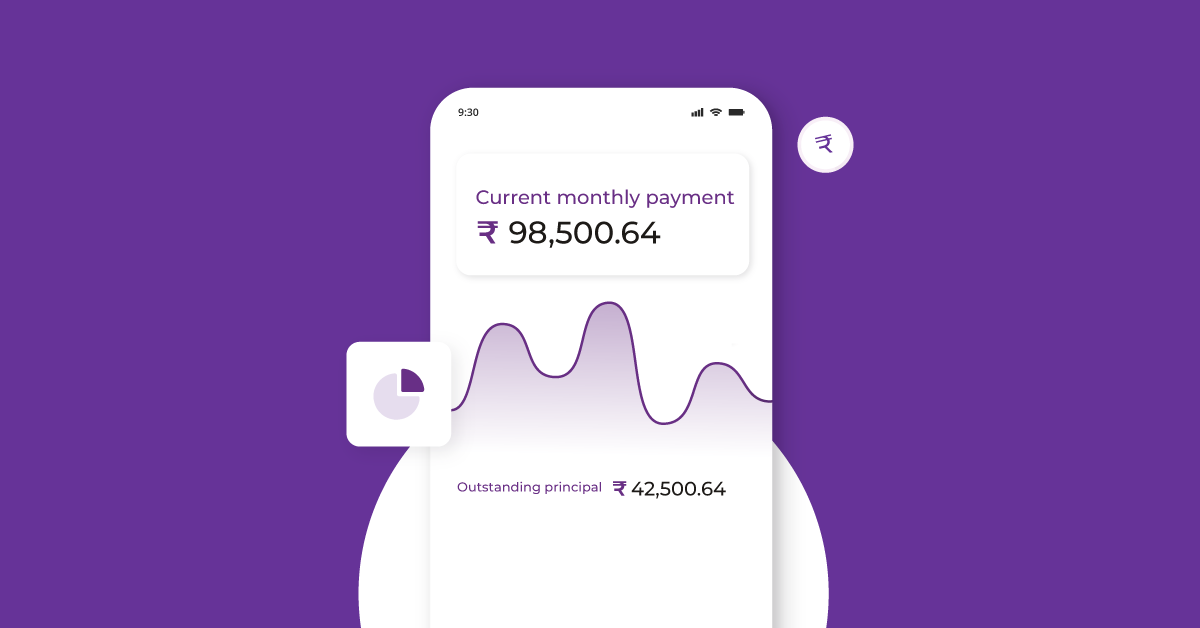

You can track and control each expense made via virtual cards in real time, and you can also set spending limits on the cards to make sure you stay within your budget.

-

Automate payments and never miss a deadline

Using Virtual Cards for business expenses lets you schedule regular payments on various platforms to make sure that everything keeps running smoothly.

-

Stop worrying about security issues

The great thing about virtual cards is that you can track each transaction in real time. Moreover, you know exactly to whom a particular card has been assigned and for what purpose. Most platforms that offer Virtual Cards also offer a one-click activation/deactivation feature to ensure that you always remain in complete control of your SaaS spend.

-

Say goodbye to tedious reconciliation

Digital banking platforms such as Open offer you the benefit of having all your transactions made via Virtual Cards reconciled automatically, saving you hours of manual reconciling and making sure you focus your time on business growth.

These benefits offered by Virtual Cards can be a game-changer for the way you manage your business’s digital spends, whether they are subscriptions to cloud infrastructure or digital ad platforms. Consider, for example, how a marketing agency can assign different Virtual Cards for different clients to make sure their expenses are separated from each other and easily trackable for quick review. From easy budget management to a better chance at optimizing the campaigns for your clients, running a marketing agency can be much simpler with Virtual Cards

To manage other business spends such as petty cash, employee expenses, procurement expenses, etc. you can use prepaid cards. Read about them in more detail here.

As a cherry on the top, with Open’s Virtual Cards you also get the advantage of a powerful business banking account that comes integrated with a Current Account, and solutions for Tax, Payroll, Reconciliation, and a lot more. Give your business the boost it needs and sign up today!

[su_button url=”https://app.open.money/register” target=”blank” background=”#663399″ size=”7″]SignUp Now[/su_button]