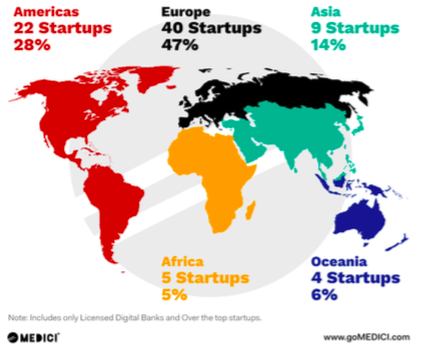

Mapping neobanks across the globe

When it comes to digital banking, the UK dominates the rest of the gang. The first few neobanks were fueled by the Dotcom boom in the late ‘90s. Another factor that gave them an edge in this space was the introduction of common banking guidelines for the whole of the European Union. This helped the neobanks in the UK to rapidly grow their customer base while being compliant with the regulations. The first set of neobanks that emerged from Europe include Revolut, N26, Starling Bank, Monzo, Atom Bank, and Tandem. According to Accenture’s digital banking tracker, over the past few years, neobanks have nearly tripled their customer base from 7.7 million customers in 2018 to more than 20 million in 2020. So much so that, at 150%, the growth rate of neobanks outpaces that of challenger banks (25%) and incumbents (1%).

According to Accenture’s digital banking tracker, over the past few years, neobanks have nearly tripled their customer base from 7.7 million customers in 2018 to more than 20 million in 2020. So much so that, at 150%, the growth rate of neobanks outpaces that of challenger banks (25%) and incumbents (1%).

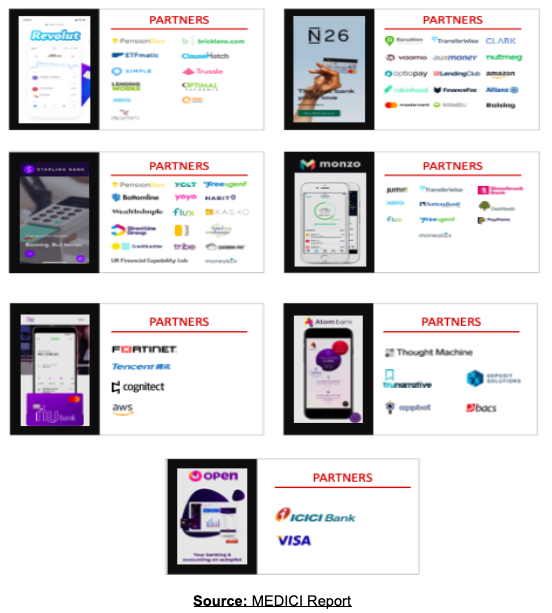

Digitization through collaboration

Around the world, there is a rising shift towards the digitization of banks. So much so that banks are now partnering with fintech companies to explore new possibilities. Let’s look at the three such ways:

(1) Direct investment:

It is amazing to see that a couple of big banks have made direct investments in various neobanks. And these investments are primarily aimed at facilitating the digital transformation of partnered banks.(2) Strategic partnerships:

In such collaborations, new technologies and services built by neobanks are integrated into the banks’ applications.(3) Mergers and acquisitions:

Over recent times, the growth strategy of banks has evolved from accelerator programs to acquisitions. As per the Medici’s report on neobanks, almost one in three banks and asset managers have plans to buy a fintech company in the next 12 months.Why do banks need such partnerships?

With these partnerships, customers and businesses will have access to more personalized financial products and services–right from transactions to payments, savings, credit, and insurance. Here are a couple of challenges that financial institutions across the world are trying to address by partnering with fintech:(1) Access to new segments:

Now, it isn’t feasible for banks to open up physical branches in every other remote area. With most people opting for low-value accounts, the returns would be very very minimal. For example, the partnership between the French multinational insurance firm AXA and another insurance provider MicroEnsure has helped the former in creating new insurance products for new segments at a much lower cost.(2) New solutions for customers:

Creating innovative solutions via partnerships is one brilliant way to bring in more regular and uniform revenue from existing customers. For example, Stanbic Bank had collaborated with an African fintech company DreamOval to offer a mobile payment platform for its customers called Slydepay.(3) Collect, use, and manage data:

Using data in banking has become a necessity to keep up with the competition. Banks are leveraging the expertise of fintech to collect and use customers’ data to create alternative risk modeling techniques. For example, Mexican fintech company BBVA Bancomer partnered with a Latin-American lending company Destacame to provide financing solutions for lending in Latin America.(4) Boost your customer engagement:

Through these partnerships, banks leverage digital tools to gain a better understanding of how customers engage across touchpoints.Partnerships for mutual growth

For a while now, neobanks have been partnering with other fintech /neobanks to extend their set of services to customers at a much lower cost. They have placed their bet on such partnerships with a vision to build a service marketplace that is centered around banking operations. Given that the UK’s Open Banking standards and the European Union’s PSD2 protocol are now in effect, it’s likely that more challenger banks would come forward actively seeking partnerships with fintech. Starling Bank, a challenger bank based in the UK, has already teamed up with 25 fintech startups to launch an API marketplace in 2019.