If you’re someone who follows the Indian fintech space at close heels, you must have definitely noticed the buzz around ‘Open banking’.

So, what’s this hype all about?

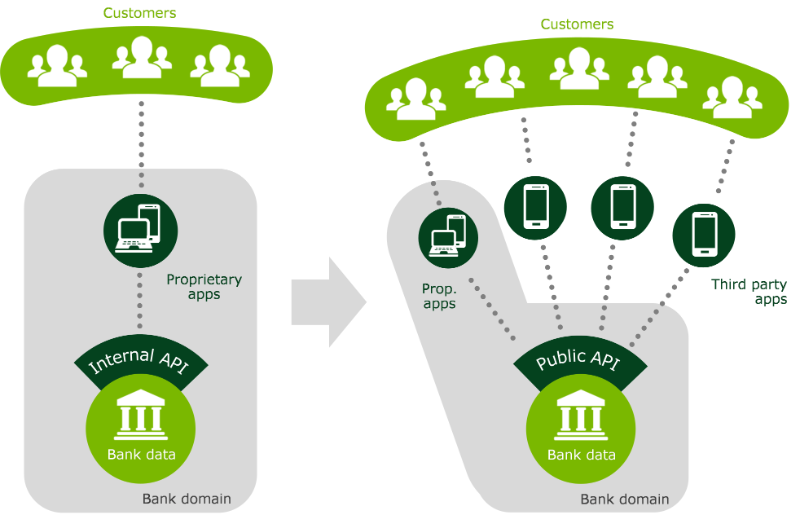

Open banking is a system where the banks share customer banking data (with their consent) in a secure manner with authorized third-party developers via Open APIs. This data enables them to build applications and services that make banking more fluid and accessible.

It’s a radical practice that has been slowly, yet steadily, transforming the relationship between banks and customers for the better.

Are PSD2 & Open Banking one and the same?

Quite often, the terms open banking & PSD2 are used interchangeably.

But are they really one and the same? Let’s dig in.

PSD2 (Payment Services Directive 2) is a decree administered by the European Commission in 2016. It seeks to regulate payment services and service providers and reduce the monopoly that banks have on customer banking data.

For example, with PSD2, it is now possible for a user who is shopping online to pay the merchant (like Amazon) directly without being redirected to another payment gateway service. Of course, this is only possible after the user has granted permission.

Thus, PSD2 explicitly empowers account holders with the authority to share data. In other words, it is a directive that requires banks to provide access to their customer data via open APIs. So, it would be right to say that PSD2 is the driving force behind open banking.

How did Open Banking take shape in India?

While Open banking has already been stirring waves on the global scale for long, India joined the booming bandwagon only a couple of years back.

It all started in 2013 when RBL Bank & Yes Bank exposed their APIs to other developers/partners to build innovative financial services. Back then this was limited to powering a few of the leading wallet providers who didn’t have a PPI (Pre-paid Payment Instruments) license.

Soon enough, many other banks like ICICI Bank, DCB Bank, and Kotak Bank followed suit.

How does Open Banking benefit Banks, Businesses, and Customers?

It goes without saying that everyone involved in the game stands to benefit from open banking. Some of the biggest benefits worth mentioning are:

Transparency of Data

Open banking has empowered fintech companies to do a lot more for their customers. For eg. Perfios, a leading product company in the fintech space leverages bank statement analysis (via APIs) to enable seamless onboarding at other Financial Institutions. Perfios makes this possible by enabling them to do real-time decision making, analysis and credit underwriting of their end customers.

Increased Digital Revenues for Banks

There’s no doubt that banks stand to benefit from open banking as well. By allowing authorized sharing of data with third-party developers, banks can widen their scope of earning income. Data sharing comes with a price, and as more players enter the market, banks can capitalize on this rush and enjoy a steep rise in their direct revenues.

Customers Reap the Benefit of Choice

Until recently, it was no piece of cake to file & get loans approved by the banks as they were the only players in the market. With open banking, fintech can now scrape into customer’s bank statements and come up with instant lending models. Today, instant credit is a real thing!

Newer Players in the Market

Open banking is revolutionizing the fintech world as banks no longer have a monopoly on customer data. With open APIs, an increasing number of businesses like Yes Bank & FreeCharge has got the green flag to venture into new territories.

Another example — open banking has empowered neobanks like Open to ease the life of SMEs by building a business banking platform that integrates everything right from instant bulk payouts to automated accounting & expense management — all in one place.

Increase in Customer Base

By opening up their APIs to fintech, banks can now reach out to a whole new customer segment. For eg. today there are fintech companies that are aimed at providing micro-credits to the micro-entrepreneur and student base. A segment that banks hadn’t tapped into earlier.

Adding on to that, open banking also opens up credit underwriting to SMEs. This way, it widens access to in-depth customer banking data than what was previously possible by looking at the data from just one bank.

What does the future hold?

The future of Open banking is exciting. It’s amazing to see how the big players in the global & Indian banking sector have already geared up to the idea of opening up their APIs to fintech.

In fact, the strong partnership between fintech & traditional banks plays a critical role in making open banking a success. Now that you know how open banking is changing the economy for the better, the question remains –how open are you to open banking?