Managing multiple current accounts can be a cumbersome task in business payments operations, often leading to inefficiencies, manual errors, and a lack of real-time insights. However, with the advent of Connected Banking, businesses can now streamline their cash flow management and simplify their account and banking operations.

Let’s explore how Connected Banking transforms the way you handle multiple current accounts.

Challenges of handling multiple current accounts for business payments

Imagine a scenario where a business owner, let’s call him Mr. Sharma, is juggling multiple current accounts across different banks. Each account demands separate logins, manual initiation of each payment, and loads of reconciliation efforts.

Mr. Sharma and his accountant find themselves buried in a pile of OTPs, struggling to track and manage vendor payments, and often missing out on opportunities due to delayed collections.

This common challenge among businesses is what banks aimed to address with Connected Banking, by partnering with business payments platforms such as OPEN.

How can Connected Banking help Mr. Sharma manage multiple current accounts?

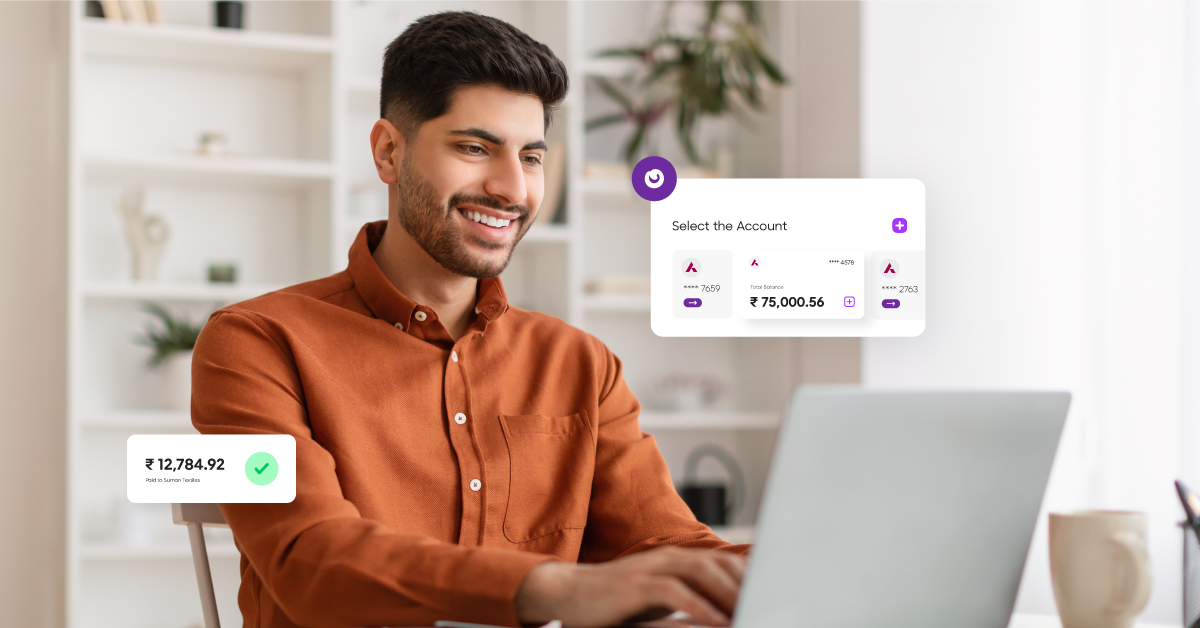

What is Connected Banking? A business payments automation that links multiple current accounts and accounting tools to a single platform, simplifying payments, collections, and reconciliation processes. It gives Sharma better control over his accounting and banking operations.

Get a better overview of business payments:

Connected Banking provides a consolidated view of all current accounts, allowing Mr. Sharma to check balances, e-statements, and transactions in one place. By connecting the current accounts with the business payments platform: he creates and shares invoices and makes payments and collections on the same platform.

This enables him to reconcile e-statements automatically, with negligible manual effort. Hence, he gets a better overview of business payments in one place.

Streamlined Vendor Payments with Connected Banking:

With Connected Banking, Mr. Sharma initiates multiple payments in one go through the Connected Banking platform as the current accounts are linked already. Payment entries are automatically created and pushed into his accounting tool

Accelerated Collections: receive payments online faster:

Mr. Sharma pulls invoices from his accounting tool or creates invoices directly within the Connected Banking platform. Here, the unique feature is the automatic addition of payment links to these invoices before sharing them with customers. Offering multiple payment options and sending auto-reminders speeds up the collection process significantly.

Automated reconciliation of e-statements:

No more manual efforts in reconciling multiple e-statements! Connected Banking automates the reconciliation process for Mr. Sharma. Transactions, payments, collections, and journal vouchers are automatically matched with e-statement entries. This ensures Mr. Sharma has a precise overview of every financial movement, leading to accurate books of accounts.

Two-way sync between accounting tools:

Banks made a smart move by partnering with leading business payments platforms like OPEN, where these platforms are seamlessly integrated with accounting tools such as Tally, Zoho Books & Microsoft Dynamics.

These days Sharma extracts bills and invoices from the accounting tool automatically. Then, makes payments and collections against them at ease. Also, for all the payments and collections on the business payments platforms, a journal entry is created in the accounting tool.

How does an ideal Connected banking platform like Mr. Sharma’s perform?

In an ideal world, a business owner should be able to link their current accounts (SBI, ICICI, HDFC, Axis Bank, and 11 other banks) to the connected banking platform effortlessly. Enabling them to:

- Pay multiple vendors and employees at one go

- Collect payments 30% faster with payment link-embedded invoices

- Reconcile in less than 5 mins

- File GSTR 1 on the go

And, automatically sync entries in connected banking platforms with accounting software. Well, those are the benefits OPEN brings to the table.

How OPEN simplifies business payments?

OPEN’s offerings go beyond just that…

Connected Banking isn’t just about streamlining current accounts. The partnership between OPEN and leading banks brings a multitude of value-added services to the table, catering to diverse business needs:

– Spend Management: Simplify expense tracking and approvals for both businesses and employees.

– Payroll: Monitor reimbursements, leaves, and payroll directly from the OPEN platform.

– E-invoicing: Generate invoices with ease and let OPEN handle e-invoices and IRN generation.

– GST Filing: Effortlessly calculate GST for inward and outward supplies, file GSTR1, and verify GSTR 2A.

Are you ready to revolutionize the way you manage multiple current accounts? Join hands with OPEN, a trusted partner of 35 lakh+ businesses and India’s top national banks (including SBI, ICICI, Axis Bank, Yes Bank, and 11 others).

Want to know how OPEN can help? Checkout our product demo video here: https://register.open.money/product-demo/

Discover the power of Connected Banking today! Get Started