The role of a Chief Financial Officer (CFO) has changed a lot in recent times. While they continue to oversee the financial health of an organization through traditional instruments like Profit and Loss statements and cash flow statements, CFOs are now required to use technology and data to make the best decisions.

CFOs must modify their strategies and adopt technological advancements to maintain a competitive edge and ensure long-term sustainability. This article will discuss their challenges and opportunities in the digital era and how they can leverage technology to achieve sustainable success.

The Digital Transformation of Financial Operations: Adapting to a Changing Landscape

Gone are the days of traditional hiring for finance leadership roles. Today’s focus is data utilization to understand the flow of funds in financial reporting and their cost-to-benefit ratio. This is being done using tools beyond finance to manage and benefit the whole organization. Today, finance offers analytical insights and is much more than just being a mere custodian of the funds.

Businesses have understood its importance as well. This is why a survey by Gartner reveals that more than 70% of CFOs consider digital transformation as a top priority in 2024.

Digital transformation cannot be implemented in a day or two. It implies integrating technology into all aspects of financial operations to maximize efficiency. However, once done successfully, it has several benefits to offer.

Reduce human error and increase visibility into finance processes: Tech involvement focuses on reducing manual intervention in the organization’s processes. The fewer humans are involved, the lesser the chance of errors. Automation and data analytics tools minimize manual data entry, improve accuracy, and provide real-time insights into financial performance.

Increase efficiency of the organization with workflow automation: Streamlining processes reduces bottlenecks, speeds up reporting, and frees up staff for other activities that can focus on the organization’s growth.

Improve communication with customers and stakeholders: Better data analysis and reporting techniques enable the finance department to provide timely and more accurate information for better decision-making across the organization.

Increase focus on business initiatives: By freeing up resources from manual tasks, the finance department can actively contribute to larger strategic goals that directly impact the organization’s business growth.

Challenges Faced by CFOs in the Digital Era: From Data Security to Compliance

When you decide to bring changes to a whole system that has been in place for decades, you sign up for some challenges, too. Financial data is a prominent target for hackers, so cybersecurity threats become a major challenge. According to a report by Dynamic Square, 73% of CFOs ranked privacy as their top concern. To ensure data security, CFOs must implement strong measures such as encryption techniques, firewalls, intrusion detection systems, etc.

Secondly, regulatory compliance is another hurdle that needs to be taken care of. The financial industry, in particular, has numerous regulations that it must adhere to, so it becomes the responsibility of the CFOs of these institutions to ensure they operate within the legal and regulatory frameworks set by these organizations.

While technology can help solve these problems to a large extent, a CFO must also ensure that their team adopts the changes as well. It is important to note that using technology requires some training as well. So, the team should be given proper guidance around the processes, and their benefits should also be communicated.

Want to know how CFOs can excel in accounts payable automation?

Check out our latest e-book here: https://register.open.money/automate-accounts-payable-ebook/

Leveraging Technology for Strategic Insights: How AI and Analytics Are Reshaping Financial Decision-Making

Artificial Intelligence and advanced analytics have been transforming the way in which CFOs make financial judgments. Modern AI-based tools can analyze massive amounts of data that reveal patterns, trends, or even exceptions that may be overlooked by a human being. Such information can be utilized to enhance accuracy in forecasting, resource optimization, and identifying possible threats as well as opportunities.

Additionally, by incorporating Robotic Process Automation (RPA) as well as AI algorithms into financial operations, huge progress can be made. The risk of human error is reduced while providing management with invaluable insights.

For instance, an AI tool can analyze historical data and market trends to prepare cash flow predictions for an organization. This then helps the finance team make budgeting decisions. Similarly, advanced tools can also perform very accurate investment analysis using historical and current market data.

This is why even market leaders such as JP Morgan and BlackRock use AI-driven models to make investment strategies.

Building Resilient Financial Systems: Implementing Robust Infrastructure for Long-Term Success

It cannot be stressed enough how important a solid financial system is for the sustainable success of a company. CFOs should see to it that resilience is integrated into their financial systems. Such resilience will help them withstand disruptions and adapt to changes in the digital age as well. This also includes the implementation of scalable cloud-based infrastructure, multiple data backups, and disaster recovery plans.

Resilience also means having the ability to quickly adapt to changing market conditions. Such flexibility is achieved through CFOs’ investing in adaptive financial systems. This might involve utilizing modular software components, adopting API-driven integrations, and incorporating DevOps methodology into financial system development.

The Role of CFOs as Technology Leaders: Driving Innovation and Change Management

At the very start of the article, we mentioned how the role of CFOs has changed over the years. Once mainly concentrated on financial reporting and compliance, CFOs are now expected to be strategic partners. Their job also is to inspire innovation and change across the business.

Moreover, digital transformation is now a priority for all firms, regardless of the sector. For this reason, CFOs are in pole position to lead this change because they exactly know how finance works and what it means for an organization in terms of technology investments.

In order to streamline operations, minimize costs and develop new business streams for their organizations, CFOs should embark on implementing new technologies and taking advantage of data analytics. Therefore they need to keep up with the latest technological developments and evaluate their potential impact on financial functions.

Moreover, CFOs should inspire a culture of innovation within their finance teams. This involves welcoming new voices, opinions, and, most importantly, change! They must also support the adoption of new technologies and provide training and resources to upskill finance professionals.

OPEN’s Role in Shaping the Future: Empowering CFOs with Cutting-Edge Solutions for Sustainable Growth

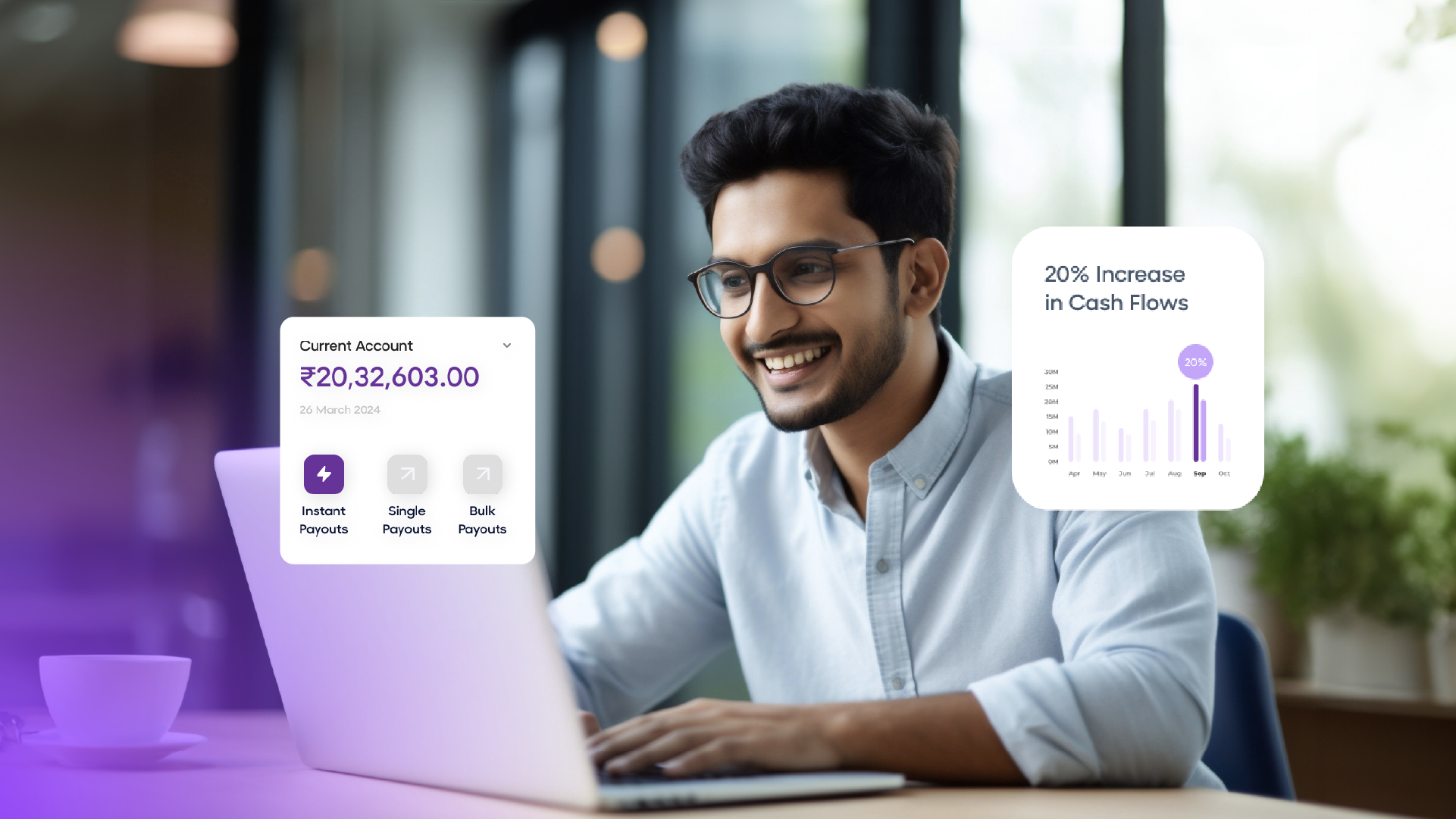

OPEN is a connected finance platform that simplifies and modernizes business finance. We offer various solutions specially designed to empower CFOs and their teams to navigate the challenges in the world of finance and achieve sustainable success.

How do we do that? Here’s how:

Our platform uses machine learning and advanced analytics to provide CFOs with the insights they need to make informed decisions, optimize financial performance, and drive growth. We also offer solid security features to protect financial data and ensure compliance with industry regulations.

Moreover, OPEN Business Account makes the lives of CFOs easy by bringing banking, accounting, expense management, payments, payroll, taxes, and everything together.

So, partnering with OPEN can help CFOs transform their financial operations, unlock new opportunities, and position their organizations for long-term success in the digital age.

Believe it or not, the future of financial operations is being shaped by technology. CFOs who are already starting to use the power of technology will be well-positioned to lead their organizations toward sustainable growth and success. So, in this article, we learned how CFOs can leverage technology to change the world of financial operations completely. We also talked about the challenges they can face and how they can navigate them using a trusted platform like OPEN. Visit Open.money for more information.