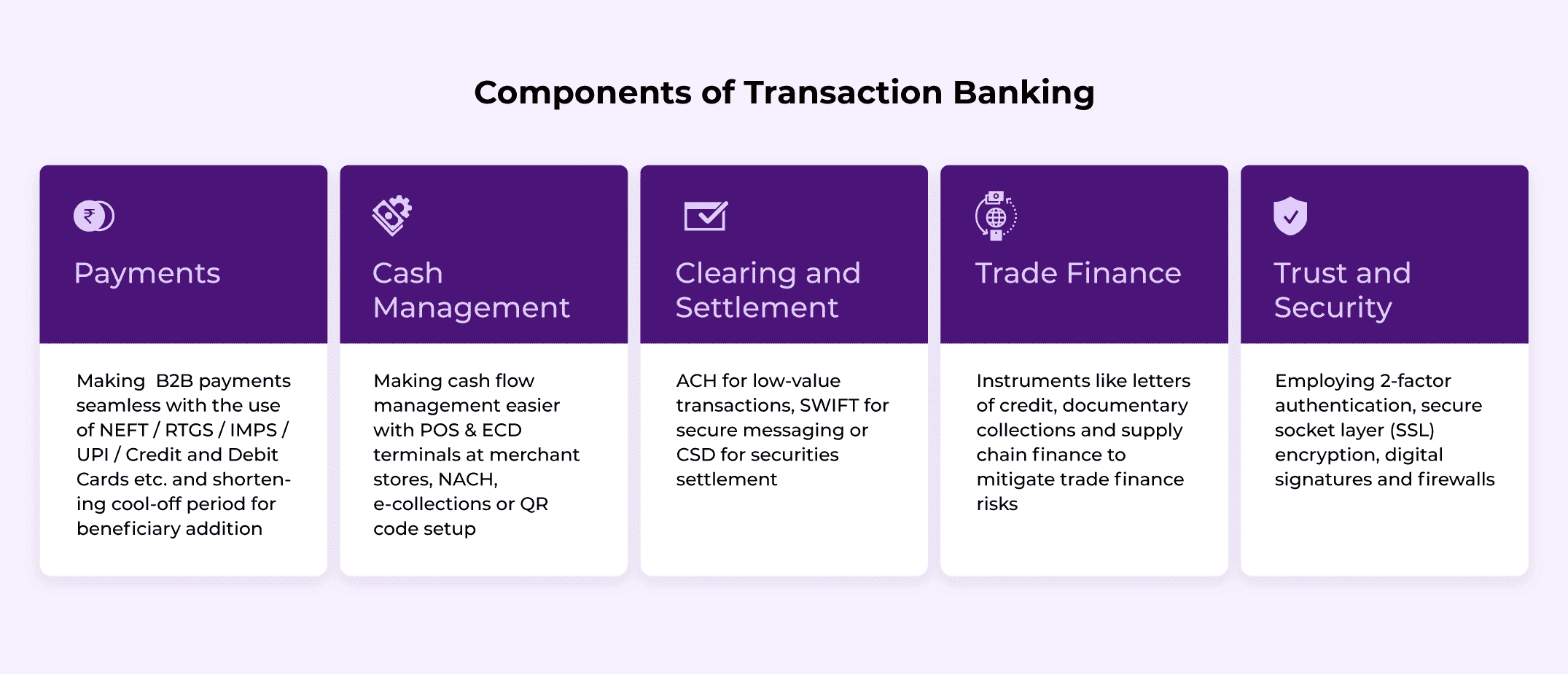

From the bank’s perspective, transaction banking is the reorganisation of several (sometimes fragmented) transaction-based activities into a single unit. For the end user, or small and mid-sized enterprises in this case, it means being able to conduct several transaction-based functions in one system.

Transaction banking is crucial for small and mid-sized businesses as it offers essential financial services to support their operations. It helps manage day-to-day financial activities like cash flow, payment processing, and liquidity optimisation.

By providing services such as cash pooling, electronic funds transfers, and trade finance solutions, transaction banking enables businesses to streamline their financial operations, enhance efficiency, and reduce costs. Additionally, it assists in mitigating risks associated with international trade through offerings like letters of credit and documentary collections.

Furthermore, transaction banking provides secure custody and administration of financial instruments like equities and bonds. Explore the components of transaction banking and their nature in this blog.

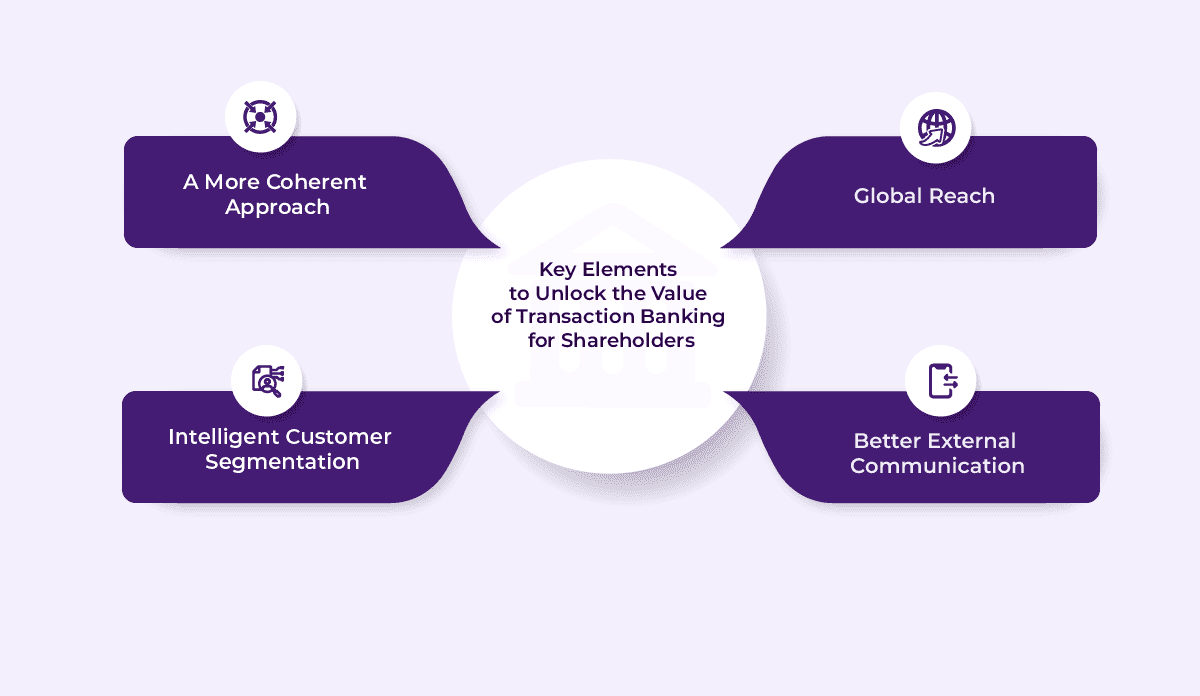

Overall, transaction banking empowers small and mid-sized businesses by providing them with the necessary tools and services to effectively manage their finances, optimise working capital, and navigate the complexities of the global market.

💡Did you know?

|

Cash Management System in Transaction Banking

Moving money is the most important function within a business. Maintaining and assessing this money movement information is key to growing any business. An important part of transaction banking, a cash management system is designed precisely for this reason.

Cash management systems help finance professionals record, track, forecast and report cash flows of a business. It enables them to monitor, collect, disburse and invest cash to ensure optimum liquidity and financial stability.

In summary, a cash management system provides SMEs with the tools and processes necessary to optimise their cash flows, enhance liquidity management, prevent fraud, reduce costs, and improve overall financial planning. By effectively managing their cash, SMEs can enhance their financial stability, growth potential, and operational efficiency.

Trade Finance in Transaction Banking

In the world of transaction banking, trade finance plays a pivotal role in facilitating international trade and enabling SMEs to navigate complex cross-border transactions. Its significance is highlighted by the common saying “Trade finance is the lubricant that keeps the gears of global trade turning”. Let’s delve into its key aspects and impact on transaction banking.

Understanding Trade Finance:

Trade finance encompasses a range of financial products and services that mitigate the risks associated with international trade, and intermediary services to facilitate the exchange of goods and services between buyers and sellers across different geographies.

Mitigating Risks and Enhancing Liquidity:

By leveraging instruments such as letters of credit, bank guarantees, and export credit insurance, trade finance enables businesses to protect against non-payment, political uncertainties, and supply chain disruptions. This risk mitigation factor enhances liquidity and fosters trust between trading parties.

Boosting Working Capital:

Trade finance plays a crucial role in optimising working capital for SMEs engaged in international trade. Through tools like factoring and forfaiting, companies can get immediate cash against accounts receivable, allowing them to meet operational expenses, invest in growth opportunities, and optimise their cash flow cycles.

Facilitating Global Trade:

With the increasing globalisation of businesses, trade finance acts as a facilitator, ensuring smooth and efficient cross-border transactions. By providing financing for pre-shipment and post-shipment activities, trade finance enables exporters and importers to manage the complexities of international trade, including logistics, customs requirements, and compliance regulations.

Embracing Technological Innovations:

The landscape of trade finance is undergoing a digital transformation. Fintech solutions, such as blockchain, are revolutionising the trade finance ecosystem by offering secure, transparent, and efficient processes. Embracing these technologies can lead to substantial cost savings and improved customer experiences within transaction banking.

Conclusion:

In summary, for small and mid-sized businesses, transaction banking offers two vital components: cash management and trade financing. Effective cash management helps optimise liquidity, streamline cash flows, and make informed financial decisions. Meanwhile, trade financing provides essential support for international trade, mitigating risks and boosting working capital. These interconnected services empower businesses to navigate global transactions efficiently.

As technology continues to advance, embracing innovative solutions in cash management and trade financing becomes crucial for small and mid-sized businesses to stay competitive and succeed in the ever-changing global marketplace. Transaction banking serves as a valuable partner, providing comprehensive tools tailored to the specific needs of smaller enterprises.

Take a look at our product walkthrough video & see how OPEN can help your business: https://register.open.money/product-demo/

Insightful and well structured blog! It clearly explains how transaction banking benefits enterprises by improving efficiency cash flow and control. A must read for modern business leaders.