Running a successful business is no easy feat, and managing finances can often be one of the most daunting tasks. Picture this: multiple current accounts scattered across different banks, navigating various Internet banking portals, juggling screens for payments and collections, and the never-ending manual reconciliation. It’s enough to give any entrepreneur a headache! But fear not, there is a solution – Connected Banking!

Are you tired of the financial chaos and yearning for a seamless way to manage your cash flow? Look no further! Connected banking offers a game-changing approach to financial management. In this blog, we will delve into the reasons why you need connected banking, how to get it for your business, and why OPEN is the best-connected banking platform for your needs.

Why Do You Need Connected Banking?

In the fast-paced world of business, every minute counts, and financial management can be a make-or-break factor for success. Managing multiple current accounts can quickly become overwhelming, leading to a lack of control and insight into your cash flow. Let’s take a closer look at the challenges you may encounter without connected banking:

- Lack of Overall View: As your funds are spread across various accounts, getting a comprehensive view of your financial standing becomes a Herculean task. Without a centralized system, you may struggle to gain real-time insights into your cash flow, making it difficult to make informed financial decisions.

- Juggling Between Screens: Picture this – you’re toggling between multiple Internet banking portals to execute payments, track collections, manually record payment and receipt entries, and painstakingly reconcile your accounts. This tiresome process consumes valuable time and increases the likelihood of errors, potentially harming your business.

Connected banking is the beacon of light that can dispel these financial management woes. By embracing this innovative approach, you unleash a plethora of benefits that can transform the way you handle your finances:

- AR & AP Automation (Accounts Receivable & Accounts Payable Automation: Connected banking introduces the power of automation, bidding farewell to the days of manually generating bills, invoices, payments, and collections. The platform takes care of these tasks for you, freeing up your time and resources for more strategic aspects of your business.

- Auto-Reconciliation: Gone are the days of going through transaction records and manually reconciling your accounts. With connected banking, your financial records are automatically reconciled, ensuring accuracy and giving you peace of mind.

- Auto- JV Creation ( Automatic Journal Voucher Creation): Keeping track of payment, receipt, and unaccounted entries during reconciliation can be a daunting task. Connected banking streamlines this process by generating automatic Journal Vouchers in your accounting tool, eliminating the need for manual intervention and minimizing the risk of discrepancies.

Incorporating connected banking into your business ecosystem is a game-changer. It simplifies your financial processes, empowers you with real-time insights, and ensures smoother, error-free operations.

How to Get Connected Banking for Your Business?

Are you ready to simplify your finances and embrace the convenience of connected banking? Follow these steps:

- First, Ensure Online Banking is Active: Make sure Internet banking or online banking is active for all your current accounts. If you don’t have a dedicated current account exclusively for payouts or collections, consider opening one. Only a select few connected banking platforms allow you to open a current account through their platform.

- Pick the Right Connected Banking Platform: When choosing a connected banking platform, look beyond the benefits we mentioned earlier. Ensure the platform can connect multiple current accounts from different banks, not just one. Moreover, it should seamlessly integrate with your accounting tools such as Tally.

- Connect the Platforms: Once you have selected your connected banking platform, follow their instructions to link your current accounts and accounting tools. The good news is that you don’t have to approach each bank and accounting platform individually – your chosen connected banking platform will provide you with all the guidance you need.

Discover the Best Connected Banking Platform for Your Business – OPEN

In the vast ocean of connected banking providers, one platform shines brighter than the rest – OPEN. Let’s explore why OPEN is the ultimate choice for your business’s financial needs:

- Connect Multiple Current Accounts: OPEN takes the hassle out of managing accounts with different banks. With OPEN, you can seamlessly link multiple current accounts from over 15 different banks like SBI, ICICI Bank, AXIS Bank, Yes Bank and more. Bid farewell to the tedious task of logging into various banking portals to view balances and execute transactions. By centralizing all your accounts on the OPEN platform, you gain complete control over your cash flow from a single, easy-to-use dashboard.

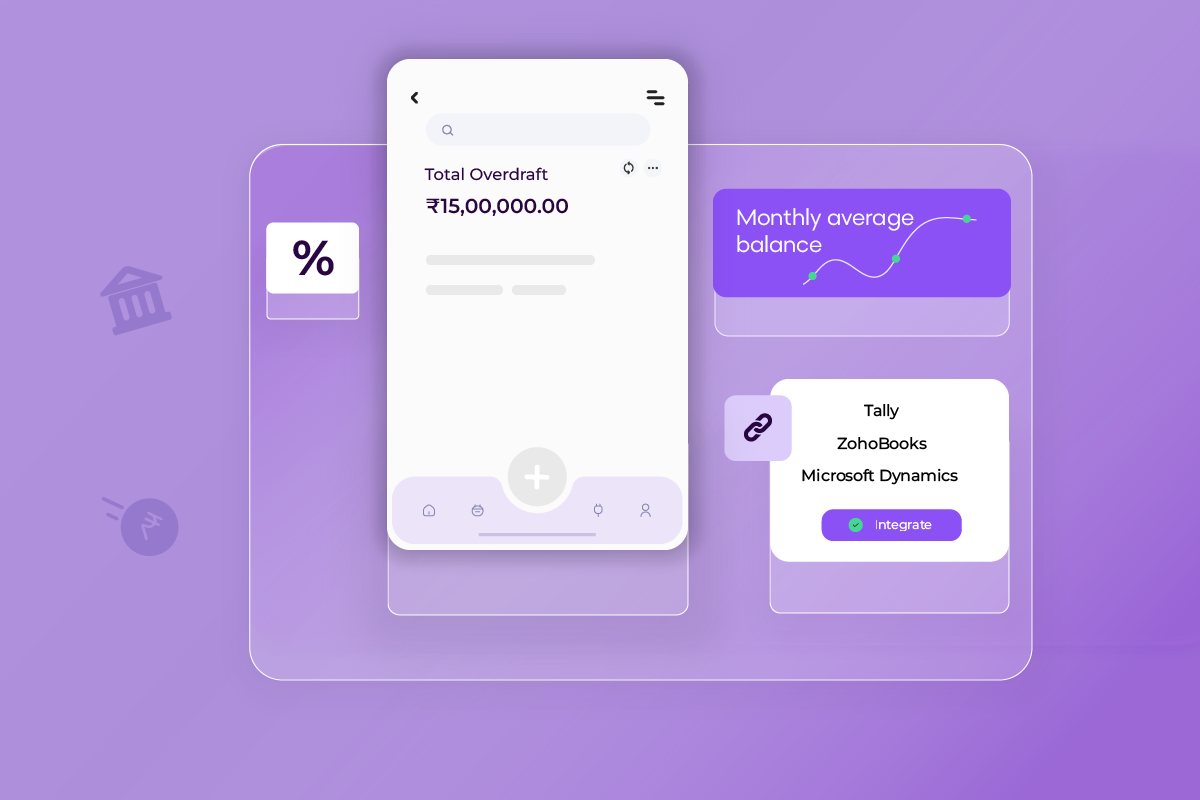

- Seamless Integration with Accounting Tools: Efficient financial management goes hand in hand with smooth integration between banking and accounting tools. OPEN understands this critical aspect of modern businesses. That’s why it integrates effortlessly with leading accounting software like Tally, Zoho Books, Microsoft Dynamics and Oracle Netsuite. Say goodbye to manual data entry and enjoy automated synchronization of financial transactions. With OPEN, your accounting records remain up-to-date, accurate, and hassle-free.

- 35 Lakh businesses use Open: OPEN has already empowered over 35 laks businesses to save 192 hours every year with its cutting-edge connected banking features. From small startups to established enterprises, businesses of all sizes have embraced OPEN’s transformative capabilities.

Don’t miss out on this transformative opportunity! Experience the power of connected banking with OPEN now.

With OPEN streamline cash flow, single and bulk payments, bills and invoices, GST and compliances and more.

The financial world is changing fast, and staying ahead is crucial for businesses. Don’t miss out on this chance to revamp your operations and enhance efficiency. Experience the power of connected banking with OPEN!

Discover how open works on our product walkthrough video: https://register.open.money/product-demo/