India houses more than 63 million Small and Medium Enterprises (SMEs) and is the largest employment provider in India. They contribute to 50 percent of the country’s exports. SMEs in India also employ 40% of India’s workforce. Therefore, SMEs are crucial cogs in the wheel that will contribute to making India a $5 trillion economy by 2025. Besides their contribution, SMEs need help to avert financial and regulatory challenges. This challenge starts from getting hands on the best current account for the business to foraging for financial aid and complying with multiple multi-tiered regulations at every stage of the growing business.

Here are a few daily challenges businesses face:

- Increased Capital Crunch

- High Transaction charges

- Perceived as high-risk entities

- Lack of understanding of the changing regulations

- Low Employee retention

- Low Client retention

- Lack of tailor-made solutions

“If accounting is the brain, the current account can be considered the business’ heart.”

Looking closely at the SMEs’ challenges, one can see that it starts with a need for more funding. Most SMEs need help securing loans from banks as they do most of their business transactions with cash and need help managing an accounting system—this issue of lack of appropriate systems snowballs into the abovementioned more significant problems. If accounting is the brain, the current account can be considered the business’ heart. All transactions have to go through the business current account. The brain and the body cannot function optimally without a healthy heart.

Before starting a business, choosing the best current account is imperative. With this blog, we will decipher how you can decide on the best current account for your business needs.

What is a Current Account?

A current account is a type of bank account primarily designed for businesses to facilitate their high volume of daily transactions, which are limited by a savings account. It serves various purposes, such as salary payments and large supplier payments. By opening a current account, businesses can establish their credibility, streamline their financial management, and increase their prospects of securing funding in the future.

Here are the key differences between a current account and a savings account, as follows:

| Current Account | Savings Account |

|---|---|

| For daily transaction needs | It comes with limited transactions |

| No-interest bearing deposit | Earn interest rate on savings |

| Overdraft facility | No overdraft facility |

| High minimum balance requirement | Low minimum balance requirement |

| Best suited for business purposes | Suited for individuals |

Types of Current Accounts in the Market

Let’s dive deep into various types of current accounts in the offering.

Basic Current Account

A simple current account lets you deposit and withdraw funds, settle bills, and conduct online transactions. Generally, it does not come with supplementary benefits such as an overdraft facility or interest earnings.

Business Current Account

A business current account is a dedicated account for entrepreneurs. Its primary purpose is to handle cash flow, settle payments to suppliers and vendors, and monitor expenditures.

Premium Current Account

A premium current account is specialized with extra advantages, such as better interest rates, insurance coverage, exclusive discounts, and more. They typically require a higher fee than regular accounts and a minimum monthly deposit. Premium current accounts cater to customers who desire more features from their accounts, including exclusive offers, priority services, and other perks.

Joint Current Account

A joint current account is an account that two or more individuals jointly own. It is an effective means of managing finances together and settling bills collaboratively.

Offshore Current Account

An offshore current account is a bank account in a foreign jurisdiction. While offshore accounts may provide tax benefits, they can also carry added risks and compliance requirements.

8 things to look for while choosing the best current account

Each business has its own financial needs, and as we saw before that various current accounts will fulfill the requirements of diverse industries. Below is the list of what to look for in a current account while choosing one for yourself:

- Balance Limit

- Rate of Interest

- Overdraft Facility

- Digital Banking

- IMPS/RTGS/NEFT Fund Transfer

- Debit Cards

- Charges

- Additional Features

- Balance Limit

Current account does not come with upper deposit limits; however, businesses must manage a minimum monthly/quarterly average account balance to avoid being penalized. The minimum balance depends on the choice of a current account. Many banks provide industry-specific current accounts with minimum balance requirements fitting industries in the sector.

- Rate of Interest

Current accounts come with zero-rate of interest.

- Overdraft Facility

All current accounts provide an overdraft facility. The overdraft limit and interest charged depend on the transaction velocity and amount.

- Digital Banking

Like savings, all current accounts have 24/7 access to digital banking services; however, accessing these services comes with charges based on the transaction amount. These charges form a tiny fraction of the total transaction amount.

- IMPS/RTGS/NEFT Fund Transfer

A best current account provides unlimited Fund transfers, unlike a savings account. Fund transfers can be free based on the type of account the business chooses; however, they can also be a fraction of the transaction to a specific amount for a range of transactions.

- Debit Cards

Banks offer debit cards to businesses as per their requirements. To apply for a debit card, account holders must usually submit a completed application form with an indemnity letter. Depending on the bank, they impose a yearly fee on the card.

- Charges

Current accounts include multiple charges; businesses are advised to confirm each charge separately with the bank. Standard charges in the current account are:

- Non-maintenance of minimum monthly/quarterly average balance.

- Annual debit card charges.

- Cheque Bounce charges.

- Mobile alert charges (Most banks offer this service free of cost).

- Demand draft issuance charges.

- Chequebook issuance charges (per the bank’s policy).

- Cash deposit/withdrawal at the base and non-base location charge.

- NACH/ECS return charges

Note: Charges vary according to banks’ policies.

- Additional Features

A current account should not be limited to just doing business transactions. The best current account is the center of all the financial transactions businesses perform. These transactions provide insight into the business’ health. If we are to analyze and associate it with various tools, such as:

- Accounting to understand transactions,

- Payroll management to pay salaries,

- Payouts to make bulk payouts to the vendors,

- Expense management to segregate expenses,

- Tax management to pay taxes,

- Business loans for urgent fund requirements,

And various other tools.

Businesses must also look for tools associated with the best current account that enable them to do business transactions efficiently and manage them from anywhere, anytime. The tool associated with the best current account allows the business to have a single place from where he can work on it and have a holistic view of the business.

Why is OPEN the best current account any business can have in its arsenal for growth?

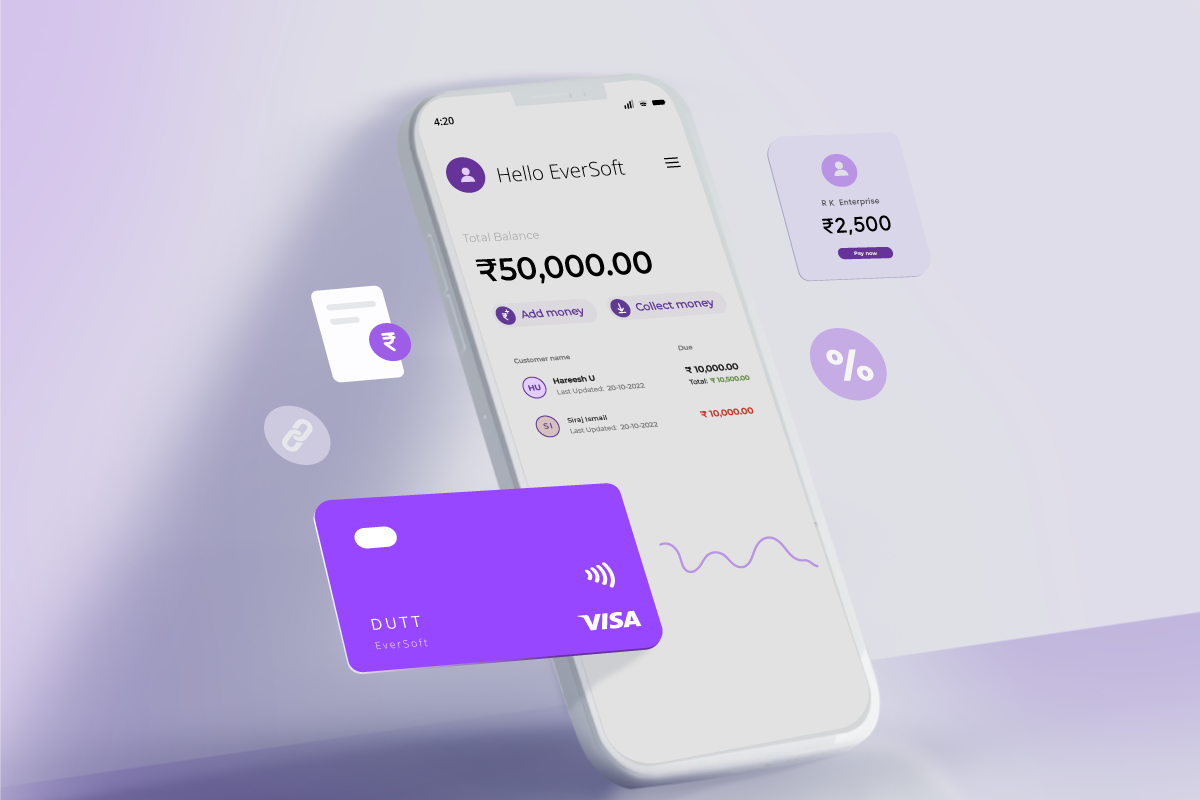

OPEN is a current account explicitly created to tackle business problems. The current account with OPEN is accompanied by a range of features curated for customers, such as sole proprietors, corporates, and small and medium-scale enterprises. Open businesses can get a ZERO-balance account under limited terms and conditions. If all the business-related documents are at hand, one can complete the formalities to create a current account in minutes in the comfort of their home instead of queuing up in front of bank counters. Post verification, the business can access all the tools, such as:

- Payroll management for salaries,

- Payouts to make bulk payouts to vendors,

- Payments and Payment Gateway to make and receive payments,

- Expense management to manage cash flows and expenses,

- Invoicing and Billing to create GST-friendly bills and invoices,

- Tax Management (GST and TDS) to file and pay taxes, and

- Get Business Loans based on your transaction history.

The current account from OPEN can help businesses manage and streamline their business and aid in steady growth. They can use all the above tools to a specific limit for free by accessing a current account. They need to pay a small premium to access all the features of the tools. You can go to the pricing page now to check the prices of individual tools or the complete suite.