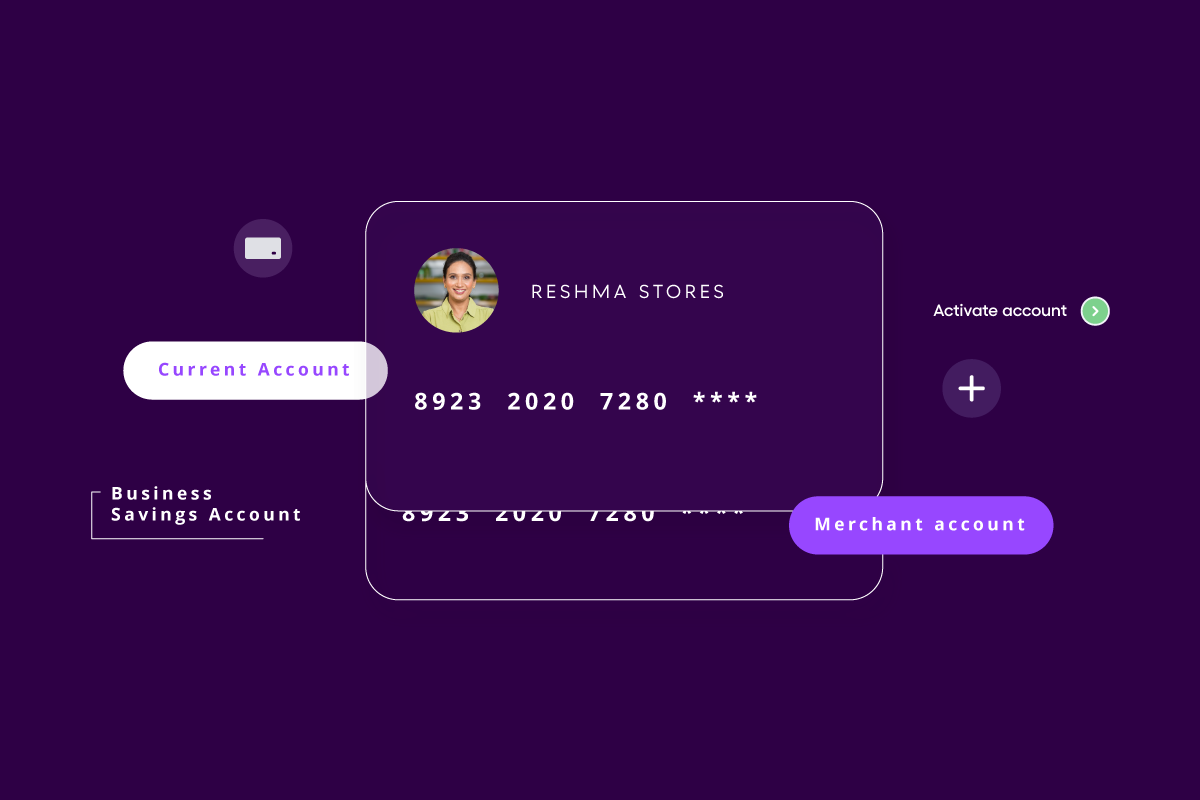

Businesses need a current account to carry out their day-to-day transactions with ease. One of the biggest advantages of an online current account is that it usually does not put a cap on the number of transactions processed per day. Also, it is an absolute necessity for businesses to keep their business and personal expenses separate because financial record keeping is important for audit purposes, and a current account makes it happen. A clean audit saves businesses from hefty penalties.

Why do businesses need a current account?

There are some advantages associated with current accounts that help businesses in terms of simplifying their business banking. Know them below:

A high frequency of transactions is never a problem

A huge number of daily transactions is a common requirement for businesses. Unlike savings accounts, current accounts online avail multiple transactions without charging extra. This way, even small and medium businesses can make their day-to-day transactions function hassle-free.

Makes businesses legitimate, which helps to get credits smoothly

A current account holds great value when businesses think of raising funds. It is necessary for auditing a business’s financial spending. A clean and successful audit leads to better business legitimacy, as financial institutes prioritize it as a top parameter before sanctioning loans.

Unlimited cheques available for business growth

Businesses are familiar with checkbooks that come along with savings accounts. When a business runs out of cheques, the bank generally charges them to get another one. The story is different in the case of current accounts. It is because most of the banks offer a huge number of cheques that businesses can write for business needs like making inventory payments. Moreover, banks provide plenty of cheques with current accounts as compared to savings accounts. This way, they can make a lot of payments with cheques in a hassle-free manner.

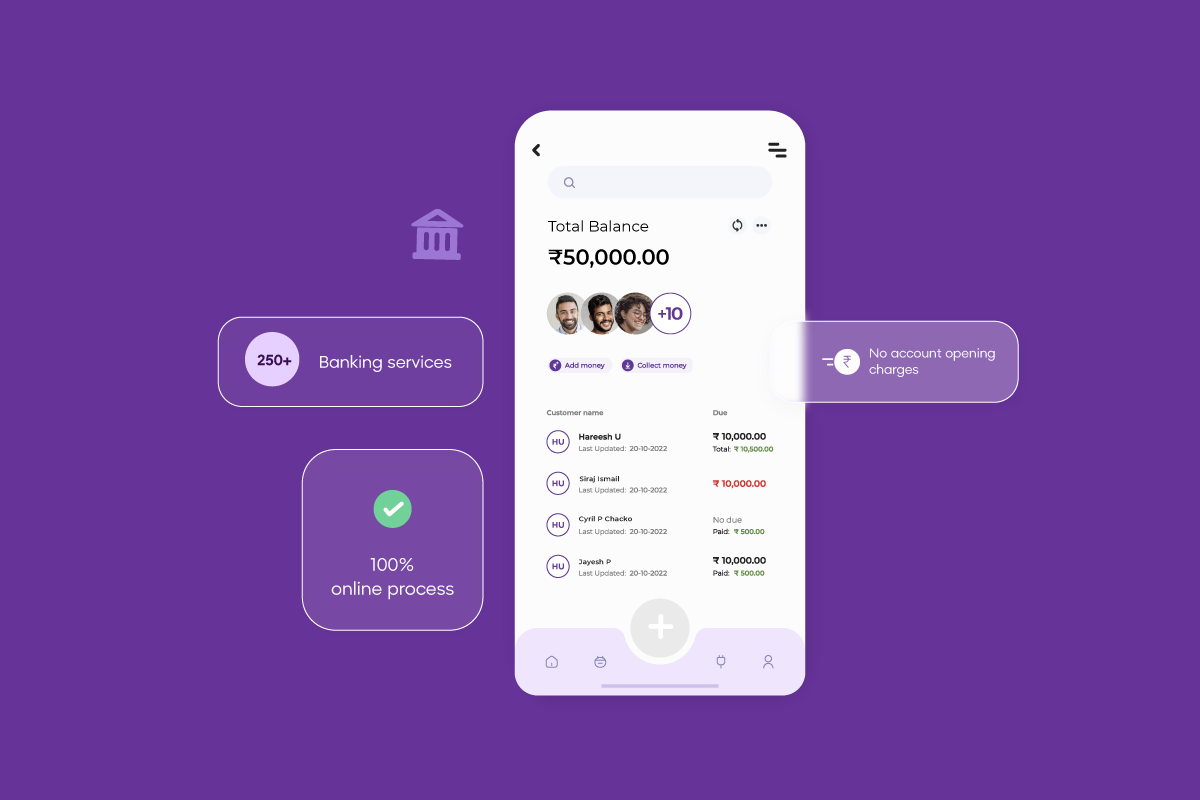

Benefits of linking your current account with OPEN

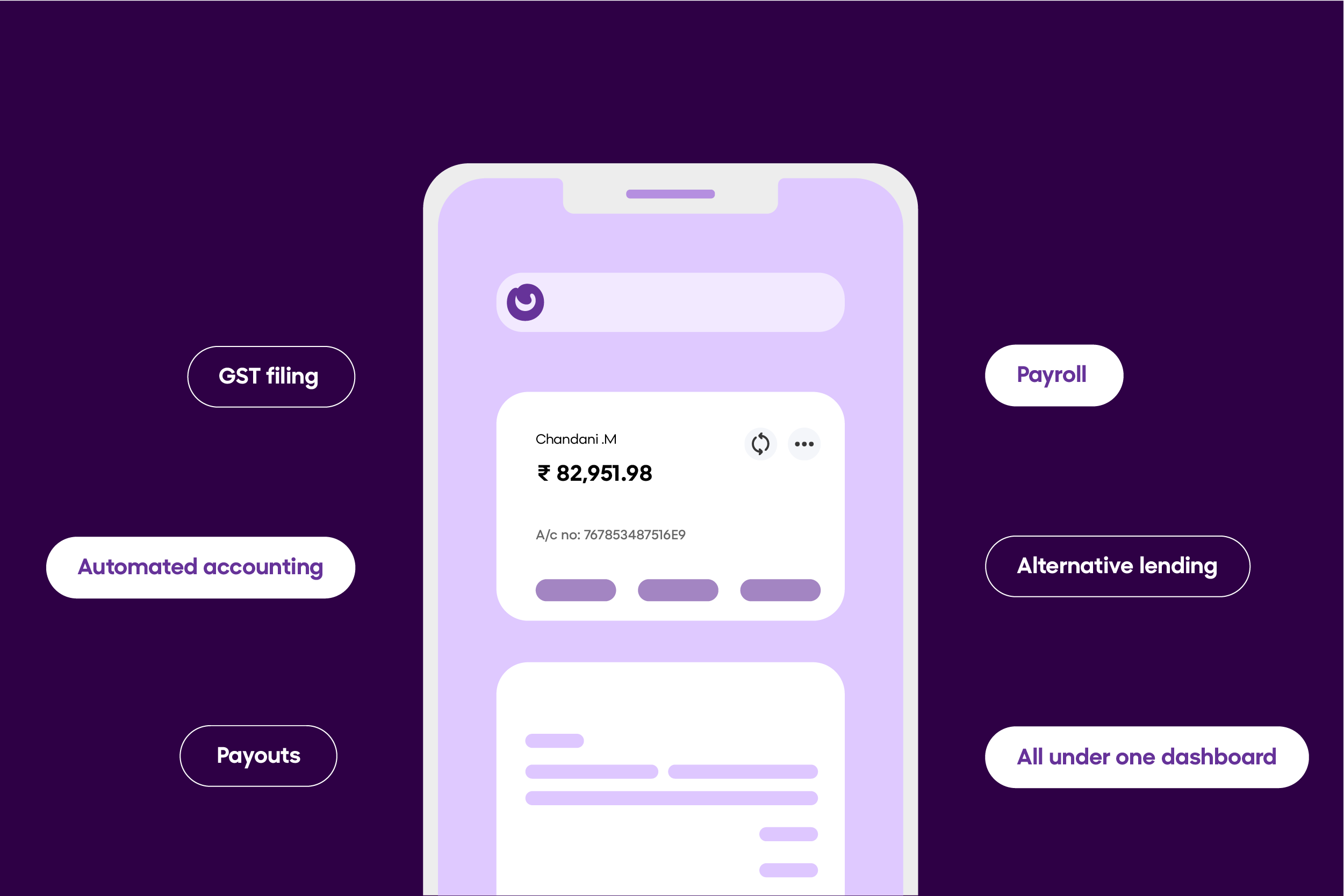

Linking your current account with OPEN brings a multitude of benefits, especially with OPEN’s Connected Banking feature. Connected Banking offers businesses a seamless platform where multiple current accounts can be linked with OPEN, unlocking a spectrum of advantages. From streamlined operations to enhanced business payments, businesses can leverage OPEN for payouts, collections, invoice management, and ensuring compliance, such as filing GST filings and much more.

OPEN enables businesses to centralize their financial activities, ensuring efficient cash flow management, simplified transactions, and a comprehensive approach to regulatory compliance. When linked, OPEN’s Connected Banking feature empowers businesses to combine all the current accounts they use and further simplifies business finances.

Connecting an existing current account with OPEN surely elevates both business banking process experience. Here are some of the key current account benefits with OPEN:

1) Automated accounting

OPEN’s current account helps automatically match invoices with payments received, thus eliminating the tedious and manual reconciliation process. Auto-reconciled transactions save tons of hours and costs and mitigate manual errors via automated data validation. Additionally, businesses get a complete overview of their payables & receivables and can pick out any transaction they want whenever needed.

2) Payouts

OPEN’s current account makes bulk payouts hassle-free with a single file upload, and this eliminates the strenuous process of adding beneficiaries for each payment. This saves a huge of time for employees, which they can otherwise devote to important business growth activities.

3) GST filing

A current account linked with OPEN enables businesses to send GST-compliant invoices to their customers with in-built payment collection links. Further, they can upload these invoices to the GST portal and file returns in less than 5 minutes!

4) Easy salary payments

With OPEN’s current account, businesses get access to OPEN’s payroll solution, which makes paying salaries to employees super easy. They can make bulk salary disbursements directly into their employees’ accounts without logging in to a separate account. Another time saver!

5) Everything under one dashboard

OPEN’s current account makes business banking easier and smarter. Businesses can connect multiple existing current accounts and get a complete overview of their business cash flow from a single dashboard. These provide ease of smooth tracking of transactional activities under a single dashboard while simultaneously managing multiple current accounts.

In conclusion, OPEN’s Connected Banking experience comes with a range of exciting benefits to businesses. It streamlines financial management for businesses and helps them manage their finances more effectively and efficiently. Thinking of how to go about a current account opening process or linking your existing one with OPEN? Click here and get all the details.