What is a Business Bank Account?

As the name suggests, a business bank account is an account created exclusively in the name of the business to handle business banking and finance management needs. Running a business involves a huge number of transactions in the realms of income, expenses, employee pay, etc on a daily basis. Some businesses try to manage these transactions using personal bank accounts. This method brings along multiple challenges, mainly because distinguishing business expenses from personal expenses becomes difficult and time-consuming.

A dedicated business bank account, on the other hand, brings multiple benefits, like an accurate overview of spending, and aggregated data, to base important financial decisions on. Let’s look at the various types of business bank accounts and how they can help businesses, depending on their specific needs.

Types of Business Bank Accounts

The 5 different types of business bank accounts are as follows:

1. Current Account

This is one of the most versatile business bank accounts. It would not be wrong to call a current account an indispensable business banking account. All businesses deal in multiple transactions on a daily basis.

A current account facilitates this without putting any charges on the number of transactions. It does not provide any interest on the savings, but makes day-to-day business transactions easy, and therefore helps businesses carry out their operations smoothly.

2. Business Savings Account

When it comes to earning interest on operating profits (the remaining revenue after subtracting the cost of goods sold and all business expenses), this account can be an apt choice for businesses. However, a company should only use it for saving profits which it plans not to use in the nearest future. It is because it only allows limited withdrawals with strict terms and conditions.

This clearly means a company would not be able to use or withdraw funds easily in case of an emergency. Moreover, these accounts do not allow direct cash withdrawals from ATMs, nor do they allow cheques. Few banks even limit the number of deposits companies can make into this account.

3. Business Certificate of Deposit (CD) Account

This is another business bank account that business owners use to earn interest on their operating profits. The major attraction of this account is that it offers even more interest as compared to a business savings account. The only catch is that it does not allow any money withdrawals before a certain term, which may vary from a few months to years. If the money is withdrawn before the maturity of the term, it results in a hefty penalty.

4. Money Market Account

A business owner can opt for a money market account if he/she wants a middle ground between a savings account and a business certificate of deposit (CD) account. Depending on the banks, money market accounts provide a certain number of cheques monthly for withdrawals. They also provide higher annual percentage yield as compared to traditional business savings accounts along with ATM facilities. This account is best suited for businesses that keep higher balances as savings.

5. Merchant Account

This business bank account is essential for businesses as it deals with credit and debit card transactions and other kinds of electronic payments. When a consumer makes a card payment, the money first gets deposited into a merchant bank account and then automatically gets transferred into another existing business bank account. This account operates on a contractual basis. Terminating the account before the end of the contract incurs a penalty for the business.

6. Escrow Account

An escrow account is used when there is a large transaction between two parties, necessitating the presence of a third party, an escrow, to moderate the amount while the conditions laid down for the transaction are met. Common cases in which an escrow account is used are mergers and acquisitions, stock purchase or sales, and real estate transactions.

What are the features of Business Bank Account

A business bank account holder has access to a range of additional features that are unavailable to regular accounts holders. Here are some of the features:

-

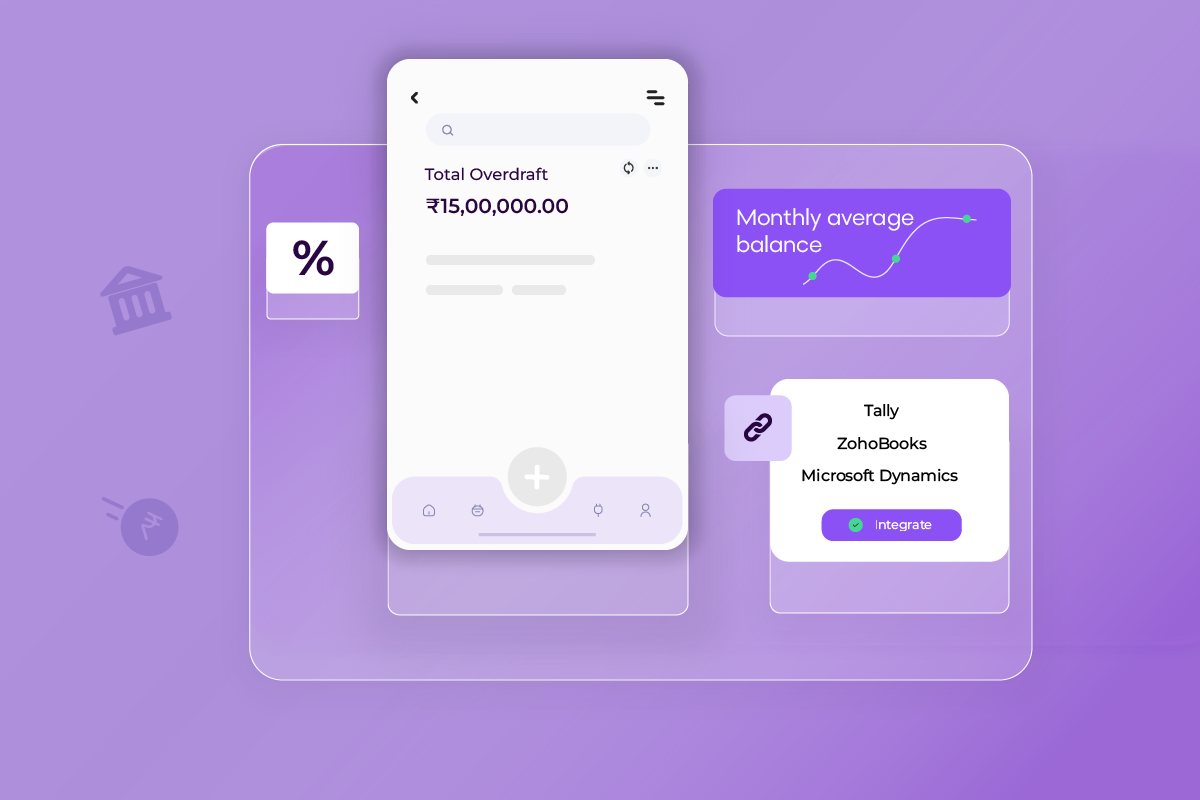

Loan and Overdraft facility: Certain business bank accounts come with an overdraft facility. It allows businesses to borrow money up to a certain limit based on their current account value, repayment history, credit score, etc.

-

Chequebooks and Debit Cards: Business bank accounts come with chequebooks to make payments to vendors or suppliers, or debit cards, which can be used to withdraw cash from ATMs.

-

Bill Payment Services: Some business bank accounts may offer bill payment services, which enable businesses to pay utility bills, taxes, and other bills directly from their account.

-

Merchant Services: Business bank accounts may offer merchant services, which allow businesses to accept payments from customers via credit cards, debit cards, and other payment modes.

-

Multiple Signatories: Business bank accounts allow for multiple signatories, which enable more than one person in the business to authorize transactions, for example the maker-checker format.

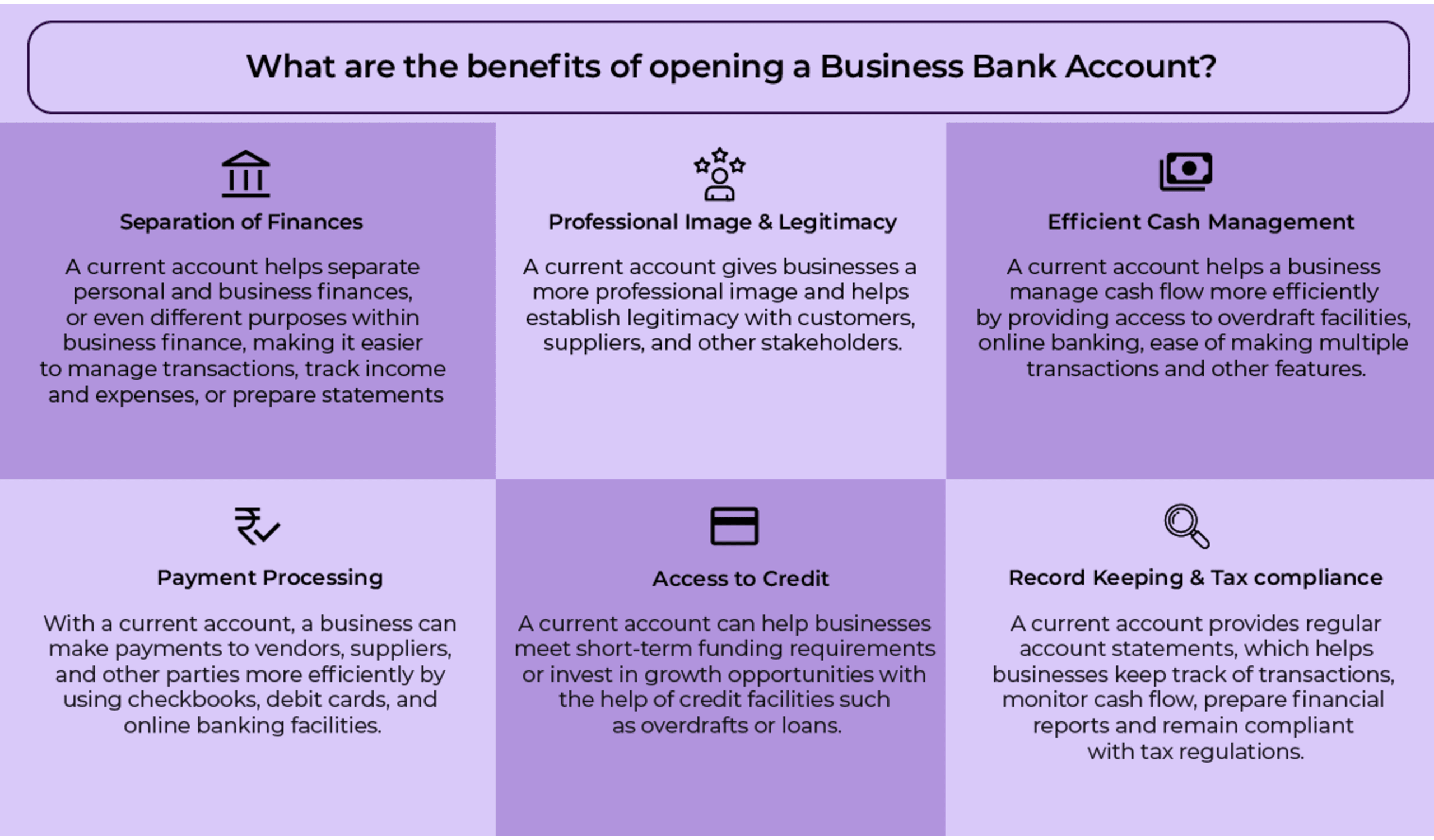

Benefits of opening a Business Bank Account

How to open a Business Bank Account?

Opening a business bank account online is simple and these are the steps typically involved:

1) Select the preferred bank for opening a business bank account

2) Here’s a checklist of documents you should keep handy before starting the application:

- Employer identification number

- Business owner identity

- Business details

- Important agreements and more

3) The business bank account opening process can be carried out using the bank’s online portal or by visiting the physical branch of the bank. The online process differs depending on the preferred bank. In any case, filling out the application form for opening a business bank account is a must.

4) Submit the required documents along with the application form. After the verification process from the bank’s side, the business bank account will be successfully set up.

Important points to consider before opening a Business Bank Account

Monthly Maintenance Fees: Many banks in India charge monthly maintenance fees for accounts. Business owners may want to inform themselves about the additional expenses and whether they can afford them, especially if the business is small or new.

Minimum Balance Requirements: Some banks require a minimum balance to be maintained in an account. Business owners may worry about meeting these requirements, especially during slow growth periods, and the potential penalties or charges for not maintaining the minimum balance.

Overdraft Fees: Business bank accounts typically come with an overdraft facility, which allows businesses to borrow money up to a certain limit. However, banks may charge high interest rates and fees for using this facility, and business owners should be mindful of any potential debt.

| 💡Did you know? You can get a powerful, fully digital bank account with which you can set up single or bulk payouts by filling minimal fields. Collect payments through popular means and manage your accounting and tax filing, all in one place: The OPEN Dashboard. Ask us how! |

Transaction Charges: Many banks in India charge transaction fees for various activities such as cash deposits, cheque clearing, online transfers, and more.

Bank Reputation and Services: Business owners may also be concerned about the reputation and services of the bank offering the current account. They may worry about issues such as poor customer service, lack of digital tools, and limited branch accessibility.

Compliance with Regulatory Requirements: Business owners must study the regulatory compliance requirements for operating a business bank account. This may include the maintenance of proper accounting records, filing of taxes and other regulatory requirements, and KYC (Know Your Customer) compliance.

Got a current account already? You can make it even more powerful.

Current accounts are one of the most desired and versalite business banking accounts. Depending on your bank of choice, you are probably already using, or considering using a business credit card. With your current account, you can receive payments and send bulk payouts easily. While these are account basics, a growing business needs to step up with tools like:

Automated accounting | Payouts | Expense management | GST filing and tax management

Easy salary payments | Alternative lending | Control and visibility of transactions and reconciliations

We have put together this e-Webinar for you to explore how you can do this better and more efficiently with OPEN. Do sign up for it and watch it at your convenience!

Alternatively, business owners can also get a business bank account through OPEN. Partnered with RBI-regulated banks, OPEN facilitates opening a current account with these banks.