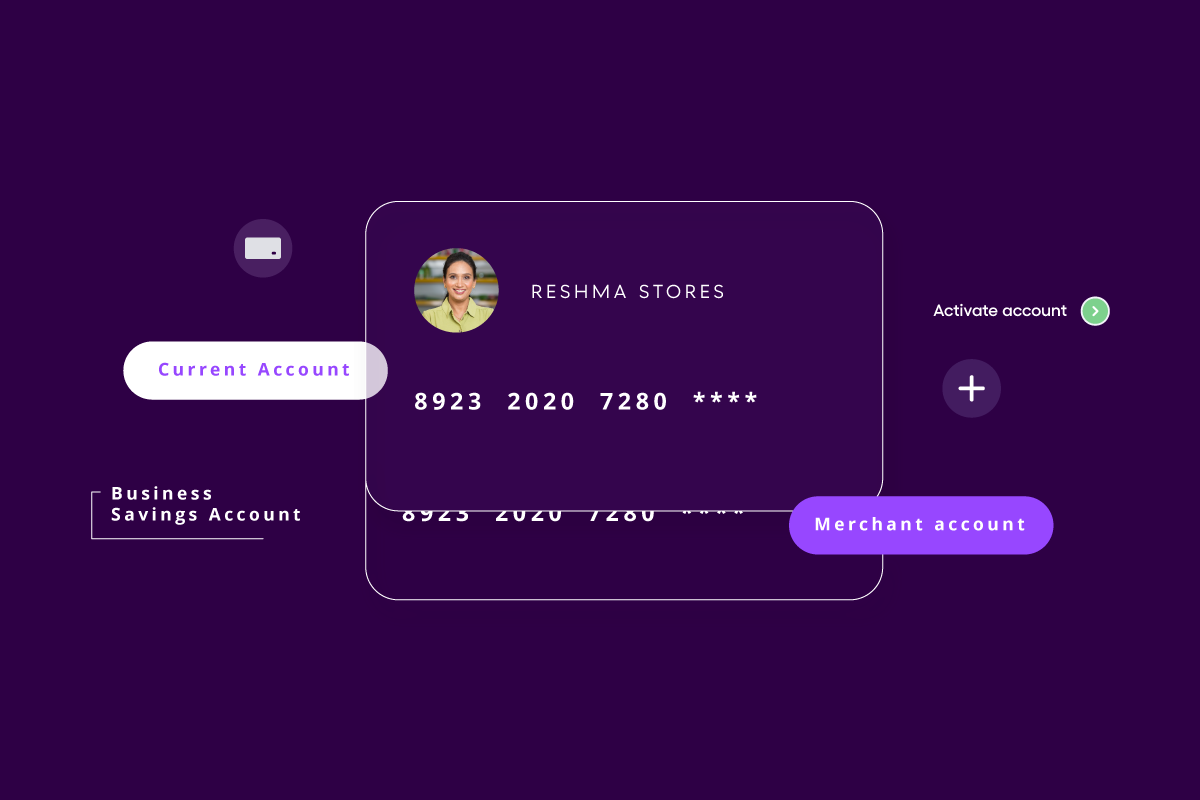

To cut right to the chase before we get into the nuances of our subject, a digital current account, also known as an online business account, is a type of current account that allows businesses to manage their finances digitally. This includes features such as online banking, mobile banking, and direct debits, among others. Nowadays, a few banks have taken the “digital” aspect even further by taking the application process, including KYC verification, completely online. Effectively, this means that a digital current account cuts back on almost all the banking challenges commonly faced by businesses.

Common challenges faced by businesses in getting a current account

Businesses may face hurdles at various stages of their journey, i.e. from applying for an account to transacting with it and maintaining it. The major ones among these are:

- Complex and time-consuming process for account opening

- Inflexible requirements of documentation such as PAN card and GST certificate

- Insufficient credit history or low credit score

- Inability to meet minimum balance requirements

- Restrictions on account usage, such as transaction limits or geographical restrictions

- High fees and charges for account maintenance and transactions

- Stringent know-your-customer (KYC) verification process

What are the advantages of a digital current account?

Businesses, especially when they are at an early growth stage, struggle first and foremost with the sheer amount of time they need to spend to get a current account. They need to gather all the documents, make multiple visits to the bank, follow up on the status of their application, worry about running the business with just a savings account while the application is in-process, and somehow still make the time to turn a profit and make their business a successful venture.

Sounds like an impossible situation, right? It kind of is, and improving this situation by leaps and bounds is where a digital current account truly shines.

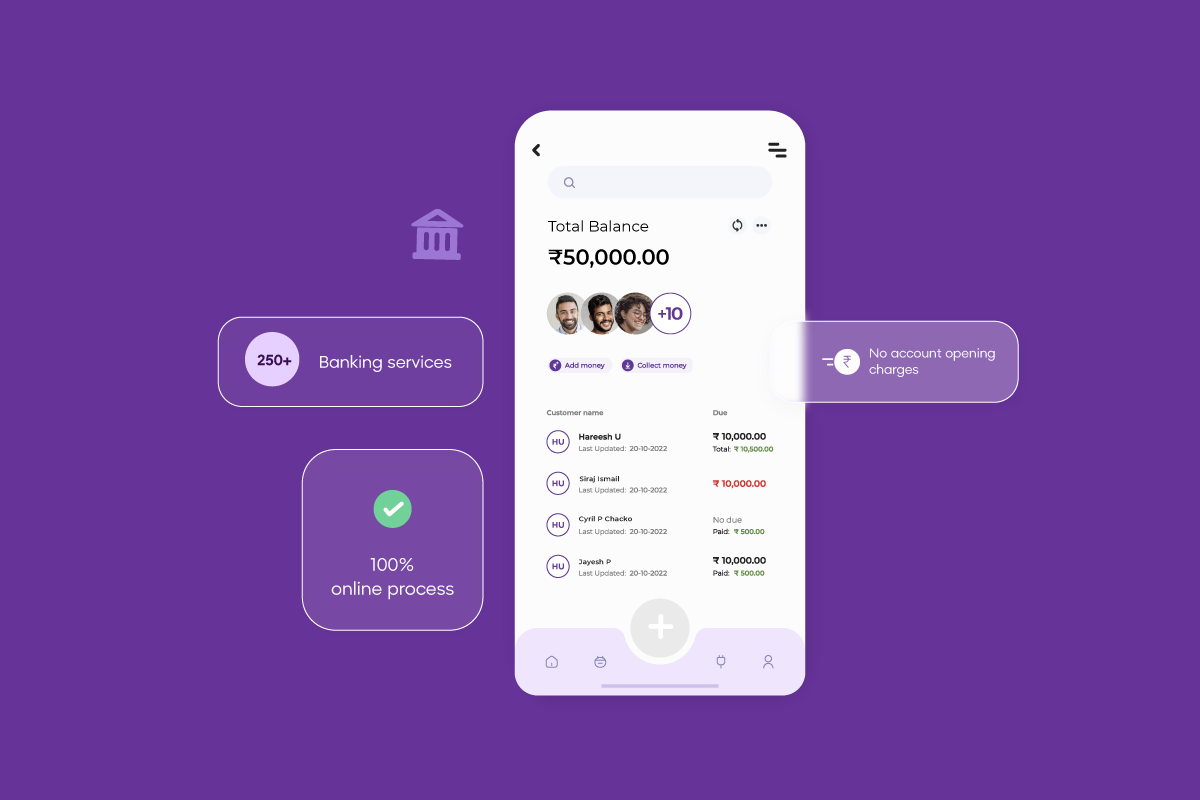

Ease of application and operation

Banks and new-age fintechs (Axis and OPEN, for example) now offer digital current accounts with an end-to-end digital process, right from application to activation. By leveraging video KYC verification, such a digital current account simplifies the application process, allowing business owners to get a current account at their convenience. The only documents an individual needs while applying for this account are the PAN card and the Aadhaar card. Moreover, netbanking and mobile banking supported by such a digital current account gives businesses the flexibility to manage their finances from anywhere, at any time. This can be especially beneficial for small and medium-sized businesses that may not have the resources to maintain a physical presence at a bank branch.

Digital current accounts also provide businesses with greater flexibility in day-to-day operations. With a digital account, businesses can make payments and transfers instantly, with no need to wait for cheques to clear or for funds to be transferred between accounts. This can be especially useful for businesses that need to make payments on a regular basis, such as paying suppliers or employees. Additionally, many digital accounts offer the ability to integrate with accounting software or come with built-in features to facilitate accounting and invoicing, making it easy to track and record transactions.

Added features for banking and financial services

A major advantage of a digital current account is that it can help businesses streamline their financial management processes. For example, businesses can set up direct debits to automatically pay bills and manage their cash flow more effectively. Additionally, businesses can also access detailed financial reports and transaction history online, making it easier to track expenses and manage their finances.

Such additional features can make an individual’s life very easy when it comes to managing business banking and finances. For example, some of the amazing features offered by the OPEN current account are as follows:

- Powerful expense management suite with VISA-powered Expense and Virtual Cards

- Automated reconciliation of all business transactions and integration with your existing accounting systems, Unified tax solution for direct and quick GST and TDS tax payments, along with challan history and management, and Payroll solution with salary disbursement, leave management, & 100% statuary compliance

- Exciting rewards and benefits

The best current account for you is the one that goes over and beyond to delight you as a customer, right? Keeping this in mind, many banks and fintech now offer rewards and cashbacks to make the benefit of a current account clearly stand out for businesses. These benefits could be anything from discounts at specific merchants and marketplaces to per-transaction cashbacks or deals on lifestyle services such as entertainment and dining. The OPEN current account powered by Axis, for instance, provides individuals 1% cashback on all online spends using E-Debit Card, 1 BOGO every month on Bookmyshow on Visa E-Debit Card, and cashback upto 50% on Grab Deals, along with many other benefits.

The major thing to keep in mind about additional benefits while choosing a digital current account for yourself is what will be of best use for you and your business in the long run. Generally speaking, the best current account for individuals and businesses is considered to be the one that puts together the most lucrative offers with reliable service and an easy application process.

Cost savings and better security

Another major benefit of a digital current account is cost savings. With a digital account, businesses can often avoid costly fees and charges associated with traditional current accounts. For example, many digital accounts require a lower minimum balance than traditional accounts, which can save businesses money in the long run. Additionally, many digital accounts have lower fees for transactions and account maintenance, which can help businesses to save money on banking costs.

Digital current accounts also provide businesses with greater security and protection against fraud. With a digital account, businesses can set up multiple layers of security, such as fingerprint or facial recognition, to protect their account information. Additionally, many digital accounts have built-in fraud detection systems that can alert businesses to suspicious activity on their account. This can help to prevent fraudulent transactions and protect businesses from financial loss.

In conclusion, a digital current account can provide significant benefits for businesses in India. The convenience and flexibility of a digital account, coupled with cost savings, security, and the ability to access financial services make it an attractive option for businesses of all sizes. With the increasing adoption of digital banking, it’s important for businesses to consider a digital current account as a viable option for their financial management needs. With the right digital account, businesses can streamline their financial management, reduce costs and access the financial services they need to grow and thrive.

To better understand the finer nuances of a current account, you can refer to this detailed compilation of the most frequently asked questions about current accounts.