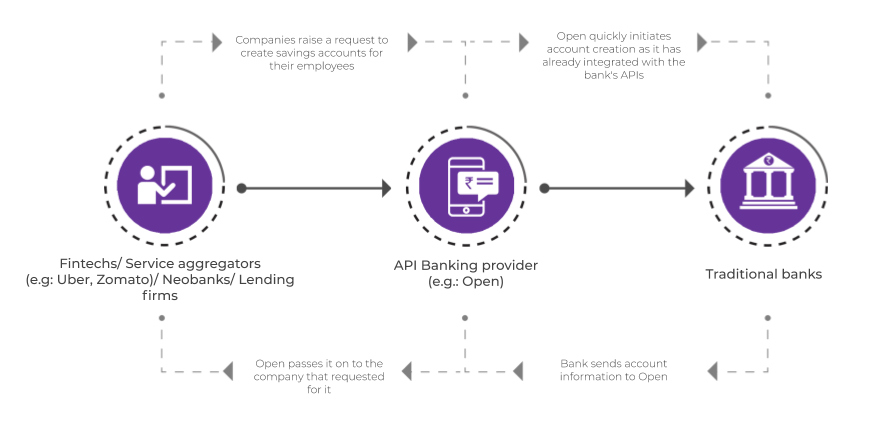

How does API Banking work?

API Banking is fairly simple and can be explained in a three-step process. Let’s pick an example. Say you recently started out Piggy, an online food ordering and delivery platform. And you are looking to create savings accounts for your employees. Now you want this done quick and hassle-free, so you approach an API Banking provider like Open. And having already integrated with the bank’s APIs, Open gets the job done in no time. Here’s a detailed run-through of what goes around: Step 1: Open integrates with the bank’s APIs and initiates a request to create savings accounts for Piggy’s employees. Step 2: Bank goes ahead and creates these accounts and sends the information back to Open Step 3: Open then passes on this account information back to Piggy. That way you can use it to transfer money to your employees.