Get ready to say goodbye to regular accounts – virtual accounts are here to stay!

A Virtual Account, as the name suggests, is a non-physical bank account that you can create for your customers. These ‘new kids on the block’ have been the talk of the town and for all the right reasons. Let me track this back a little for you – for a business figuring out ‘who paid for what’ is no stroll in the park. You’d typically get your team to manually track the payments with UTR numbers – a tedious process that we quite frankly dread. It’s time to put all of that behind you! You can now easily track payments via Open’s Virtual Account to stay on top of your collections. Further, businesses that expect thousands of payments coming in, can leverage the Virtual Account API, to reduce their operating costs. This is because managing multiple virtual accounts and reconciling payments is far easier than tracking them manually via a physical account.

Financial institutions, large and medium sized enterprises can expand their reach and speed of transactions, thereby boosting their efficiency (faster and less expensive) and also reconcile all transactions easily, once they integrate with Open’s Virtual Account API.

With this, they can have a complete view of their collections, thus simplifying bookkeeping. And by allowing customers to pay using their preferred payment method, it further enhances the customer experience.

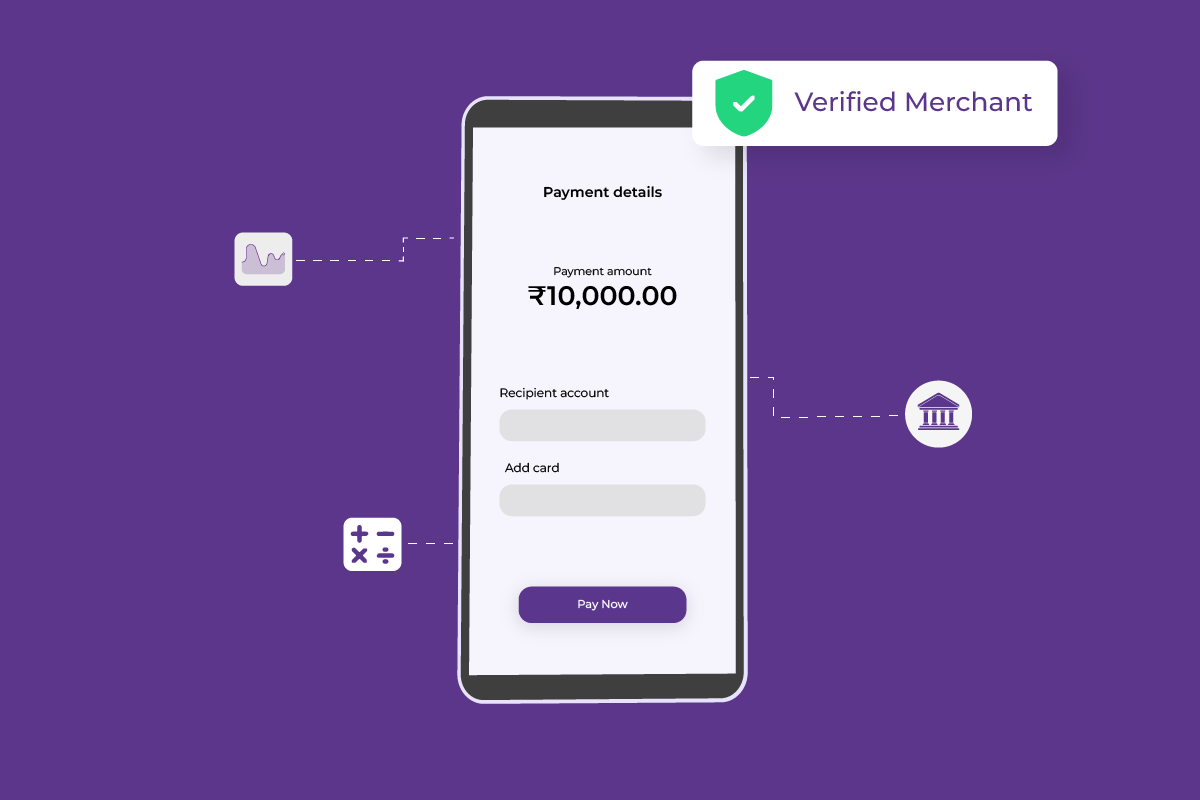

Open’s Virtual Account API allows you to create virtual accounts with a unique account number for each customer you collect from. Customers can make a bank transfer to these virtual account numbers, and as soon as the money hits your bank account, you get to know the payer’s details for each transaction.

Further, businesses that expect thousands of payments coming in, can leverage the Virtual Account API, to reduce their operating costs. This is because managing multiple virtual accounts and reconciling payments is far easier than tracking them manually via a physical account.

Financial institutions, large and medium sized enterprises can expand their reach and speed of transactions, thereby boosting their efficiency (faster and less expensive) and also reconcile all transactions easily, once they integrate with Open’s Virtual Account API.

With this, they can have a complete view of their collections, thus simplifying bookkeeping. And by allowing customers to pay using their preferred payment method, it further enhances the customer experience.

Open’s Virtual Account API allows you to create virtual accounts with a unique account number for each customer you collect from. Customers can make a bank transfer to these virtual account numbers, and as soon as the money hits your bank account, you get to know the payer’s details for each transaction.

Why integrate Virtual Account API?

Still, need convincing? No problem! ✌️ Let’s look at how transaction-heavy organizations such as educational institutions, fintechs, large corporations, and successful businesses can improve their payment systems.- Track Payments with ease: Virtual account API resolves your never-ending reconciliation issues. You are immediately notified when your customer pays using their virtual account number. Simply, we help you reconcile effortlessly.

- From Bank Transfers to UPI, you’ve got it all: collect payments the smart way using Virtual Bank Accounts API. With bank transfers such as NEFT/RTGS/IMPS to UPI, you can accept payments via several modes.