Accounting automation refers to the use of technology to streamline accounting processes and reduce the need for manual intervention. This can include the use of software to automate tasks such as data entry, bank reconciliations, and financial reporting. It can also involve the integration of different systems to create a more efficient and connected accounting process.

Accounting automation enables businesses to save time, reduce errors, and improve decision-making by providing real-time access to financial data.

Although technological innovation has always unlocked smarter ways to reach goals across accounting or other business functions, the word automation is met with both hope (“it will make people more efficient than ever”) and reluctance (“it will alter the industry for the worse”). As a finance professional or accountant, you should see it as a tool to scale up and do more meaningful work, not a threat.

Delegating tasks to software takes the slow, tedious, repetitive work out, giving you more time to perform creative, analytical, and strategic accounting tasks. With accurate, organised data, finance professionals and accountants can be reliable, impactful partners for their companies.

“Automation is an opportunity for humans to move up the value chain, to do more meaningful and rewarding work. It’s a chance for us to learn new skills and to take on new challenges.“ – Klaus Schwab, founder and executive chairman of the World Economic Forum.

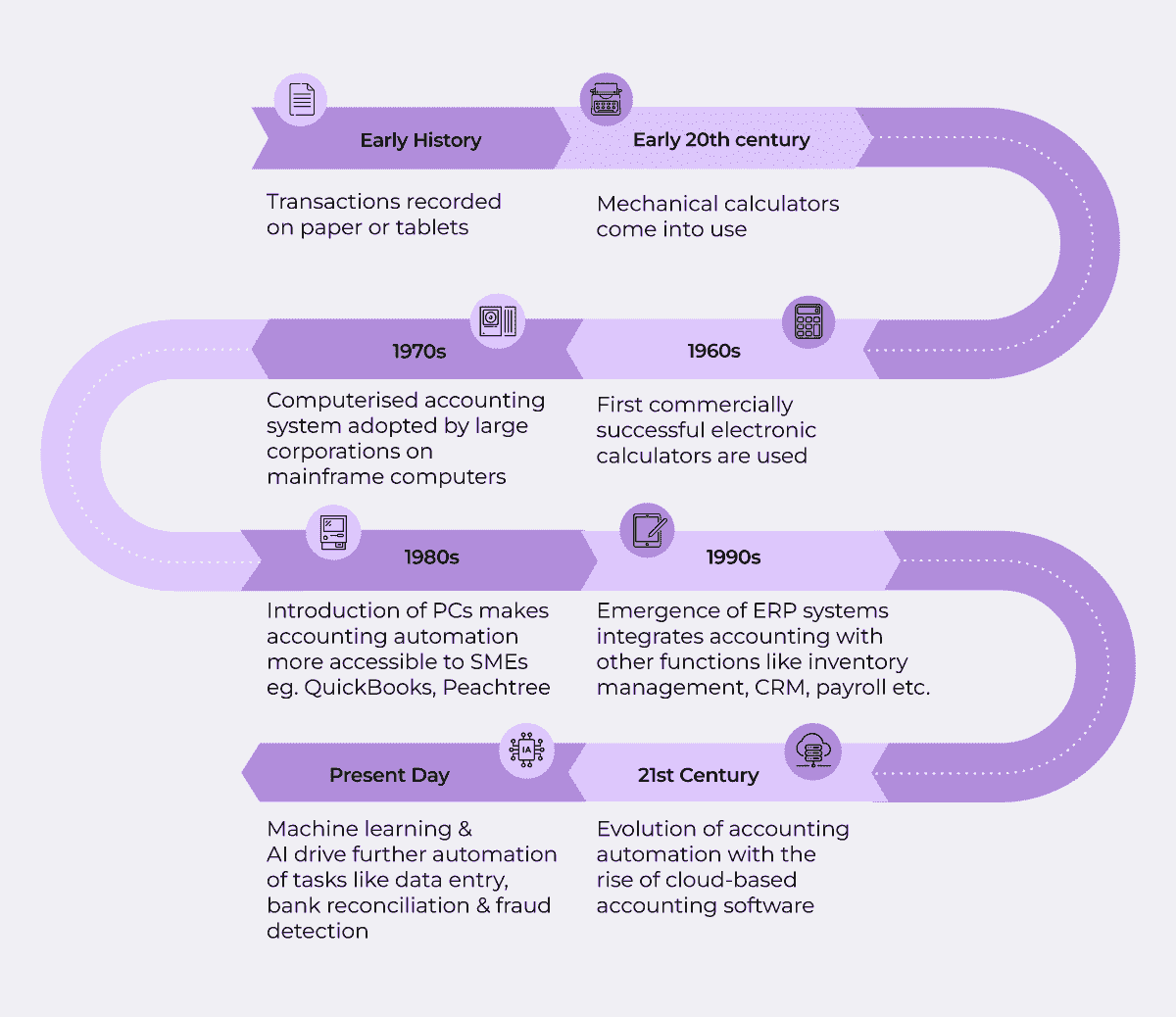

Moreover, technological advancement in accounting and finance is not exactly a recent phenomenon. It has historically helped accountants and finance professionals make their work more fruitful.

Recommended Read: Account Payable Automation: All you need to know!

The journey of accounting automation through time

Accounting automation solutions are popular among businesses for good reason:

- Copies data from one sheet to the next

- Identifies discrepancies and missing information

- Updates and collates data in real-time

- Minimises data entry work

- Follows instructions on autopilot

- Saves time in bookkeeping and creating reports

Wondering how to choose the right Accounts Payable Software? This guide is the one for you.

Accounting Automation: A Game Changer

1. Maximise Your Time. Minimise Your Worries

With automated accounting, you can streamline financial processes, reduce errors, and access real-time data, leading to improved productivity and better time management. An automated accounting solution saves you time by eliminating tedious, manual tasks and giving you accurate, up-to-date financial information, allowing you to make informed decisions and focus on growing your business.

2. A Safer Way to Do Business

Automated accounting offers advanced data security features such as encryption, multi-factor authentication, and access controls, reducing the risk of data breaches, fraud, and financial loss. With the right data security features, you can rest assured that your financial data is secure, reducing the risk of fraud, cyberattacks, and reputational damage.

Want to learn more about Business Finance Automation & how are CFOs evolving?

Visit – https://register.open.money/business-financial-automation-ebook/

3. Reduce Costs Strategically

Automating your accounting tasks can help you save costs in several ways, including reducing manual labour, avoiding errors, and identifying cost-saving opportunities through data analysis and reporting. It can lead to significant cost and time savings, allowing you to allocate resources to other strategic initiatives that drive business growth and innovation.

| 💡Did you know?

In a recent survey conducted by IMA (Institute of Management Accountants) and Deloitte, 75.7% of respondents stated that their business accounting processes are either fully manual or need considerable manual intervention.[1]. Slow adoption of available automated accounting software emerged as the central challenge. |

In Conclusion

Accounting automation solutions use technology to streamline accounting processes, reduce errors, and improve decision-making. They involve the use of software to automate tasks such as data entry, bank reconciliations, and financial reporting and can also involve integrating different systems to create a more efficient and connected accounting process.

The tool is best used in tandem with other vital business functions like payroll, expenses, and tax management. By helping businesses save time, reduce errors, and improve decision-making with real-time access to financial data, accounting automation presents an opportunity for finance professionals and accountants to move up the value chain and perform more meaningful and rewarding work.

Checkout our product demo & see how OPEN works: https://register.open.money/product-demo/