How does Open’s online bank account help my business?

If you are a small business, you’d second that while setting up your venture, an online bank account plus a business credit card is the need of the hour. Most of all, you need a bank account to start collecting payments. By signing up on Open, you’re entitled to all of this within two minutes. This account enables you to start collecting payments instantly & yes, there is no limit on how much you can collect. You could also start generating invoices & send payment links to your customers. Post sign up, share a few KYC details and you can unlock powerful features like activating your business credit card, settlements, payouts & more. In fact, Open’s online bank account is the ONLY account that combines banking, payments & accounting – all in one place, as a result, saving you time to focus on growing your business. You will no longer need to switch between multiple tools to manage your business finances. In other words, as you collect payments & make payouts, your accounting is fully automated, saving you tons of precious hours.How is Founder One card different from other business credit cards?

The Founder One is a VISA business card that comes integrated with your Open online bank account. This card is the smartest for a few reasons. They are:- Best debit card alternative

- Integrates your expense management

- Works in both debit & credit mode, allowing you to use it where only credit cards are accepted

- Reward points for services that your business uses

How is expense management integrated with banking & accounting on Open?

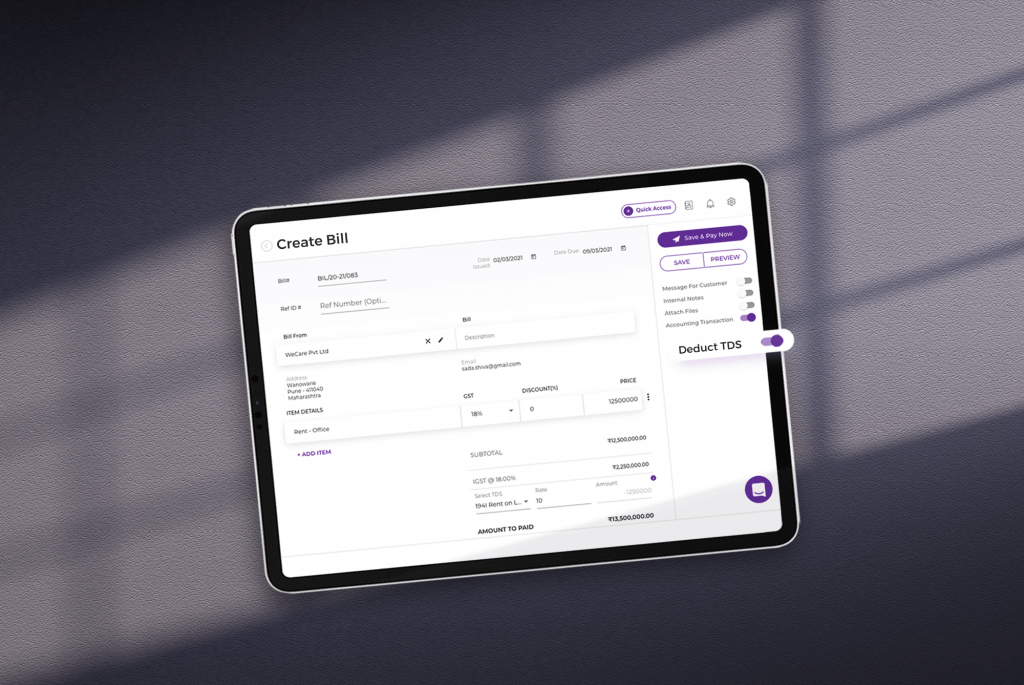

Managing expenses requires a credit card, but getting one for your business is no easy task. You are required to make an upfront deposit & secure a credit card against it. AND, you still end up losing out on almost 10% of the deposit amount. That leaves you wondering what your options are. 🤔 Well, what if there is a game-changer? With Open’s Founder One card, you can separate your business AND personal expenses with ease. You can get this card with minimum documentation & no upfront deposit. Even better – The card has a credit limit up to Rs. 200,000 at interest-free credit for the first 30 days. You can even manage your team’s expenses with virtual or expense cards or both. Use virtual cards for online subscriptions like Google ads or Facebook ads or AWS bills. Just set limits & load them directly from your online bank account. Expense cards can be assigned to teammates who step out of the office & have to make card swipes. When the card is swiped, your teammate will receive a Whatsapp message where he/she can upload the receipt & the expense is filed, just like that. Cash payments can also be recorded by uploading an image of the payment receipt. Open lets you manage the approval flow & reimbursements too. The best part? All these expenses are automatically recorded in your accounting since your banking & accounting are integrated. This is expense management, simplified.How exactly does Open automate accounting?

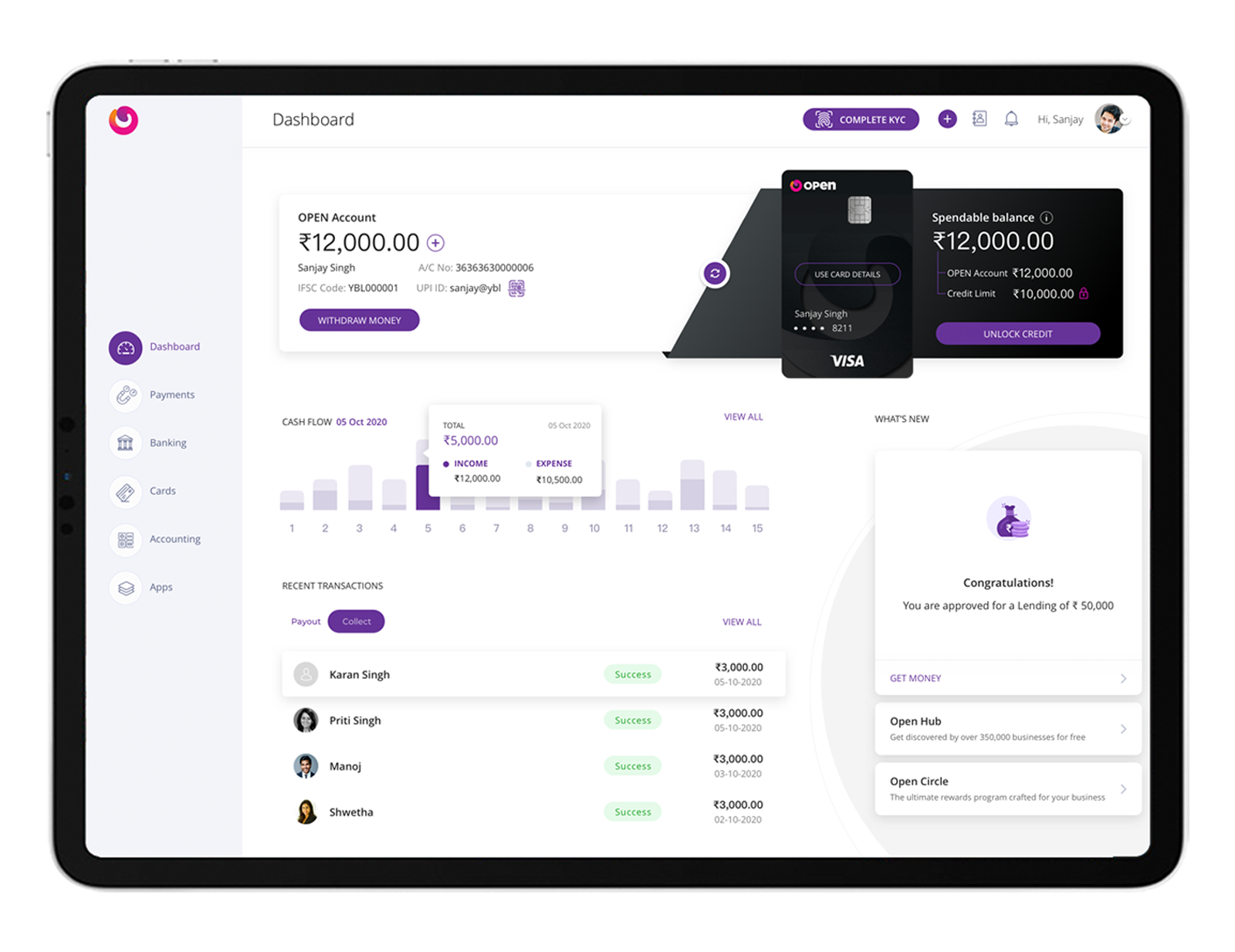

Consider this – you run a dance academy & your course starts from Rs. 3000. You have 7 students who joined your classes by the 5th of the month. You also paid your rent of Rs. 9000 & an electricity bill of Rs. 1500 for the previous month. Now you want to find the details of all your incomes & expenses. Simply log in to your Open dashboard & this is what it will look like. Now you know that 4 out of 7 of your students have already paid & all your expenses are being tracked.

Your entries are automatically categorized as income & expense without any manual intervention.

Yep! This is a true time-saver! 😌

You can even tag your incomes & expenses, which will give you a better understanding of payments that are due or made already.

What’s more?

If you’re already using third-party accounting software like Tally, you can use our plugins to integrate your Tally account with Open too. This way you can initiate all your payables and request payments against invoices directly from your Open dashboard. And just like that, it will automatically reflect on your Tally account too. One thing less to worry about when growing your business.

Now you know that 4 out of 7 of your students have already paid & all your expenses are being tracked.

Your entries are automatically categorized as income & expense without any manual intervention.

Yep! This is a true time-saver! 😌

You can even tag your incomes & expenses, which will give you a better understanding of payments that are due or made already.

What’s more?

If you’re already using third-party accounting software like Tally, you can use our plugins to integrate your Tally account with Open too. This way you can initiate all your payables and request payments against invoices directly from your Open dashboard. And just like that, it will automatically reflect on your Tally account too. One thing less to worry about when growing your business.