Technology is disrupting businesses across industries, and Startups today are taking a liking and adding on to this massive digital transformation in all aspects of their businesses, including making bulk payments!

A success story: How Scogo Networks is disrupting the IT services industry

Scogo Networks, a SaaS startup offering an IT service management platform, brings about a positive change in the Indian IT services industry. As the current delivery models weren’t making a mark and the distribution seemed highly inefficient, this startup came up with a model that helps digitize the same. Scogo Networks is automating the processes and further delivers services at a lesser price to customers, thus improving customer experience and making it both faster and better.

Challenges faced

Emerging as a new business, Scogo Networks has grown rapidly by hiring active service delivery partners and connecting with new end-users. But reaching out to service partners working out of remote locations, building the trust factor, and assuring timely salary payments — all-in-all, establishing themselves as a relevant and trust-worthy company was a complex task.

Scogo Networks going the Open way

For a business at this scale, it’s a necessity to have a quick turn-around-time and thorough transparency. You know how the saying goes, “money saved is money earned.” So businesses at an early stage tend to avoid using payment gateways and API because of their high charges so they can reduce costs.

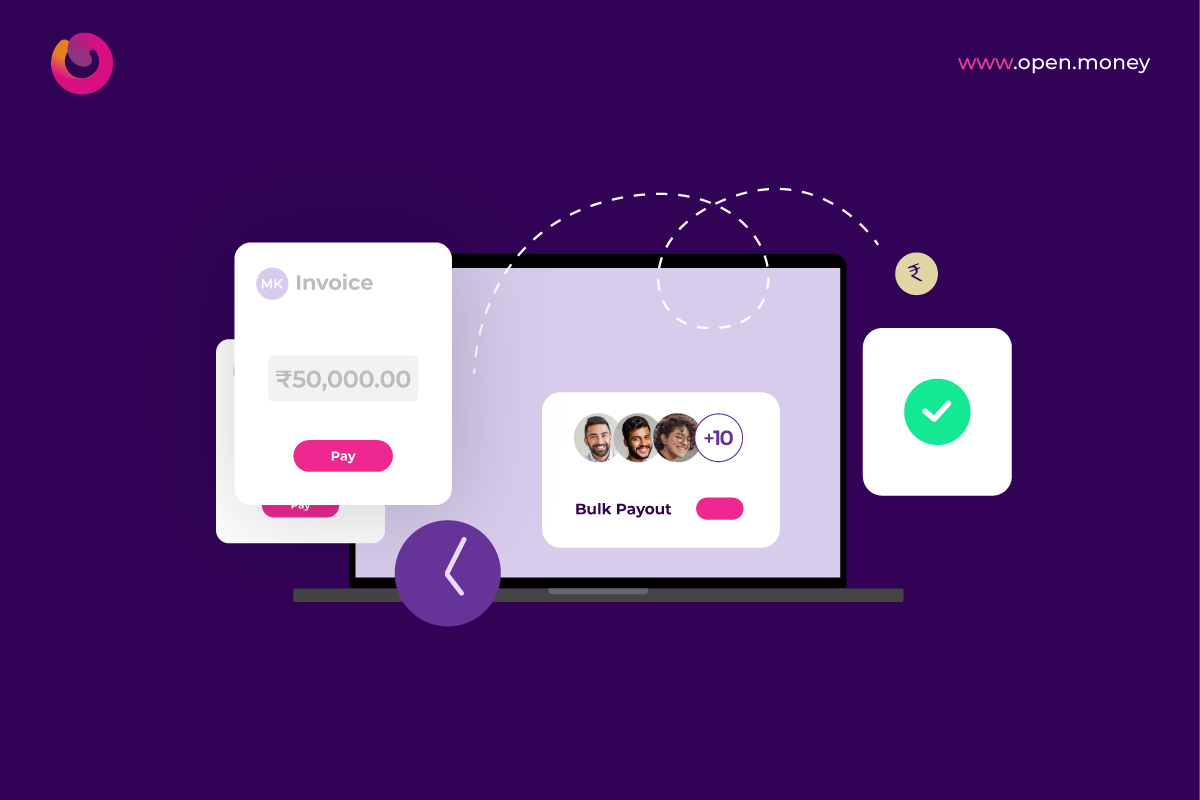

Instead of switching between multiple dashboards for making payouts, accounting, and expense management, among others — Scogo Networks could achieve it all from ONE Open dashboard.

How Open’s Payout API optimized operations

A special shoutout goes to Open’s Payout APIs! They were the game-changers for Scogo Networks. Making payouts the traditional way can be exhausting for organizations that need to send payouts in bulk to service partners. These payout APIs help businesses make instant payments to service partners with any hassle.

With Open’s Payout APIs, Scogo Networks was able to –

- Seamlessly process bank transfers to beneficiaries

- Save big on time spent every month on sending payouts to cater to a large number of service partners or vendors

- Automate the entire process leaving less to no scope of errors

Managing business finance with Open

Open has changed the way Startups & SMEs manage their finance & do business banking in India!

By simply creating an Open online bank account within minutes, companies can track, manage & control their business expenses from one place.

So why manage your business banking & manage your business finances the old way? Sign up and explore Open today!

Related Articles –

Top 10 recurring payment challenges faced by businesses

Open to revolutionize recurring payments for small businesses with UPI AutoPay

All you need to know about Open – banking that gets your business

How to collect & track payments like a pro with Virtual Account APIs