The hyperlocal delivery businesses in India have been thriving on the customers’ demand to get things delivered at the doorstep within a click of a button!

Now that the pandemic is clouding the economic outlook, the hyperlocal delivery model — hands down — creates new opportunities for more such small businesses. As they can reach consumers across the locality and source local products and services faster.

And by streamlining business banking and finance processes together instead of using multiple accounts, perhaps such hyperlocal delivery businesses can function better.

Before we get into how you can efficiently manage your entire business operations with Open, let’s take a closer look at the hyperlocal delivery business model. And how it benefits both small businesses and consumers alike.

What is Hyperlocal Delivery Business Model?

The hyperlocal e-commerce business model refers to getting products delivered from the source directly to the customer within a small geographical area. Wherein, the pick-up store or outlet is situated in the same locality as the buyer.

And if given the remote possibility that consumers weren’t aware of a few startups that are simplifying the way people shop or subscribe for everyday essentials, we’re sure that customers residing in tier 1 and tier 2 cities know all about it now!

Remember the old days when you ventured out to buy milk directly from the dairy or pick up vegetables from a street vendor? The hyperlocal delivery model offers the same kind of convenience but through enabling GPS locations on mobile apps.

How do Hyperlocal Delivery Businesses work?

Brands like Big Basket, Dunzo & Swiggy Go, to name a few startups, are leading the hyperlocal delivery chain in India. They offer a marketplace-like platform or medium to connect local businesses with residents in the nearby localities. And to achieve this, hyperlocal delivery services build a rapport with local partners, delivery agents and merchants.

This kind of e-commerce delivery model works great as it caters to the requirement of procuring groceries, medicines, food and everyday household items online at a remarkable speed!

Let’s look at grocery delivery as an everyday hyperlocal delivery offering here. When the customer places an order for the requested fruits, vegetables etc., through the mobile application, the aggregator receives and shares the order details with the delivery partner.

The delivery partner then assigns a delivery person closest to the store in question, who picks up the task and completes the delivery. So the aggregator here acts like a medium that enables and runs the entire process on a commission basis.

And what with having to build local partnerships, getting delivery personnel onboard, deciding on the revenue model and more — optimising business workflow, operations, and the budget from end-to-end can be rather taxing.

Here’s when Open can swoop in and change the way hyperlocal delivery businesses run operations, making the entire system more seamless.

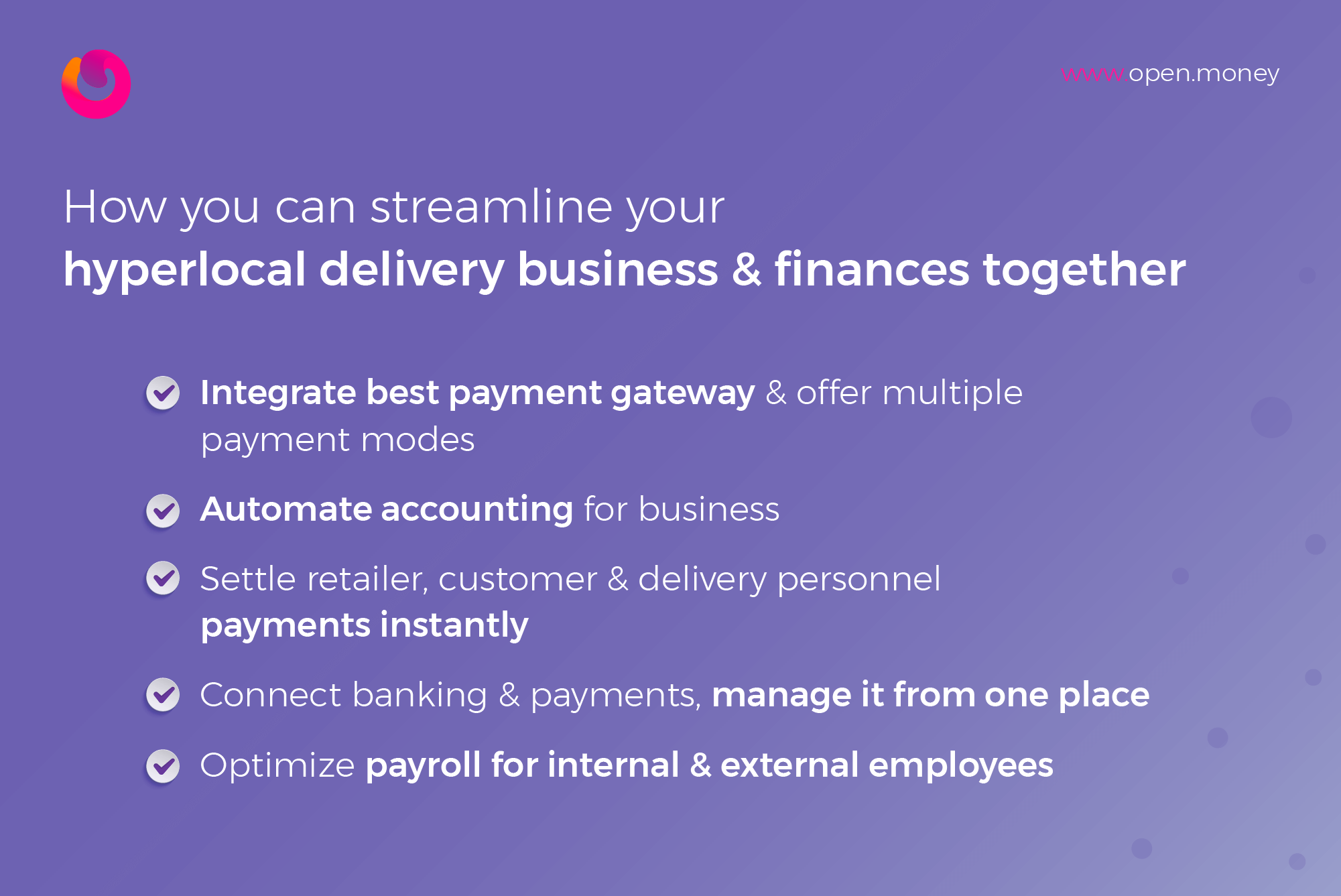

How Open can help streamline business & finances for your hyperlocal delivery business?

The hyperlocal delivery business model often requires external portals to manage the upkeep of products and services. Stay on track of retailer and buyer information, and partner with third-party payment gateways or providers to mark a good checkout process, among others.

With Open, you can manage your business and finance processes from one dashboard and oversee all your workflows together.

1. Integrate Open’s payment gateway & enable multiple online payment modes

By integrating Open’s payment gateway on your app or website, you can enable your customers to make payments without any inconvenience. The multiple payment gateway options help customers select the payment medium most relevant to them. This way, the consumers will keep using your website or application to place orders and make secure online payments.

It helps collect all payments smoothly while providing a seamless checkout experience each time and gives the customers a taste of procuring products from local service providers right around the corner without having to step out of the home.

Not to mention that with Open’s payment gateway, you also offer a wide range of payment options like card payments, internet banking, UPI AutoPay and others. In addition, you can directly share receipts with customers for the amount paid or refunds.

Are you weighing your options on how to go about integrating more than one payment gateway on your website? We have listed the pros and cons of having multiple payment gateways on your website to help you make an informed decision.

2. Automate accounting for business

We know that accounting plays a huge role in any business. And when you have multiple vendors, logistics and shipping details, it probably feels inevitable not to adopt third-party softwares to keep tabs on your hyperlocal delivery business reports.

It is also optimal for sellers or delivery personnel as they don’t have to backtrack every order to calculate their commission or earnings! The settlements can be auto-reconciled, and the payment will be transferred from your Open account directly to the retailer or merchant bank account.

You can automate your accounting with Open and view powerful bookkeeping reports, profit and loss statements and link your Tally account with Open’s Tally plug-in feature to always stay up-to-date on all your accounting.

3. Settle retailer, customer & deliver personnel payments instantly

You can create GST-compliant digital invoices, credit notes and more with customers. Share receipts with retailers, track payments received or due for logistics and shipping too. With Open, you can also schedule payments and share inbuilt payment links so that you never have to worry about payment settlements. And when it comes to your delivery personnel, you can also settle up payments for every delivery in real-time or auto-calculate earnings and pay later. This way, you don’t keep anyone waiting or rely on manual calculations.

4. Connect banking & payments for business with Open

Isn’t it cumbersome to switch between bank accounts to collect or send payments? With Open, you can connect all your existing bank accounts to Open. And process payments and payouts from one dashboard. The best part is that you get a 360-degree view of your cash flow from one business account, so you don’t miss out on anything.

5. Optimise payroll for internal & external employees

Managing a hyperlocal delivery business is not an easy task, what with keeping tabs on multiple delivery agents and deliveries made, different work shifts, revenue models etc. Adding to this, when it comes to sorting payroll for a large section of employees, the process can be rather tedious.

With Open Payroll, you don’t have to spend countless hours on salary calculations when you can auto-upload the payroll sheets on Open once and process salary payments like a pro.

You can also explore easy attendance and leave management for delivery agents and other employees, calculate and view payroll analysis in real-time, and generate payslips at one go. So you never have to think twice or worry about the payment cycle.

Don’t you think Open indeed gives you more flexibility while running your hyperlocal delivery business?

With hyperlocal delivery businesses delivering products and services to the local population in the region, one can only hope that the retailers, merchants and customers can keep thriving regardless of the restrictions due to the covid-19 crisis.

Open offers the same comfort and convenience to businesses so that you don’t have to depend on external softwares to outsource information — when you can do it all from one business account and keep your details secure.

And by using Open for streamlining business and finances, your business can adapt to a robust yet easy-to-use dashboard to run your business & finance processes effortlessly.

Related Articles –

How Open brings banking & finance together for your business

Why an online bank account is essential for SMEs & Startups

Simplify your startup expenses with the smartest credit card

How to collect & track payments like a pro with Virtual Account APIs

API Banking: The fast track to building fintech products

Everything you need to know about Open’s Corporate Cards

Subscribe via Email

Liked this article? Subscribe to our monthly newsletter. We don’t spam. Promise!