What Is Neobank?

In Australia, Europe, and North America, neobank are digital banks that operate without physical branches. Earlier, these banks used to operate by partnering with traditional banks due to the lack of banking licenses. But now the respective regulatory authorities issue licenses for their banking operations. Hence, licensed banks, also called Challenger banks, are essentially real banks operating on an online working model. Since they operate entirely digitally, the operating costs for these banks are considerably low, and they can provide advanced services at affordable rates.

Neobanks in India are fintech entities partnering with traditional banks to offer advanced banking and financial solutions to their customers.

Neobanks in India are fintech entities partnering with traditional banks to offer advanced banking and financial solutions to their customers.

In India, neobanks are conceptually and practically different from western neobanks. Neobanks are mostly fintech players or entities, building new banking solutions to ease customers’ pain points. According to RBI, banking licenses are not issued to these online banking platforms or fintech players due to the compliance guidelines.

These banks can provide banking solutions such as virtual accounts and issue cards by partnering with traditional banks.

The neobanking space is growing at an astronomical rate around the world. The concepts and practices in the industry are changing rapidly and it has given rise to various operating models.

How does a neobank operate?

There are different ways in which neobank operate. Depending on the geographical location, terms such as neobanks and digital banks are interchangeably used around the world.

Neobank – Partnered digital banking solutions

In this model, fintech providers partner with existing traditional banks to provide financial solutions coupled with banking services. This model tries to give the customer the best of both worlds. While customers use conventional banking services, they can also enjoy the benefits of advancement in the fintech space.

These are fintech players who provide suites of solutions to ease banking services to their target customers. They essentially offer software or platforms that facilitate customers’ finance management journey.

Neobanks receive licenses for banking operation from the regulatory authorities, they become challenger banks.

These entities work with a proper banking license provided by the banking regulators of the respective country. They are essentially banks without physical branches, but they can provide all the services provided by a traditional bank.

Licensed digital banks operate on a unique (BaaS) based business model that encourages them to develop add-on features. The challenger banks are generally seen in western countries.

Additionally, there are small digital spins by traditional banks created to serve a tech-savvy target audience. These digital banks operate differently from their parent banks that hold legacy infrastructure and traditional systems.The digital spin versions are more adaptable to the dynamic technological landscape and focus on the new generation audience.

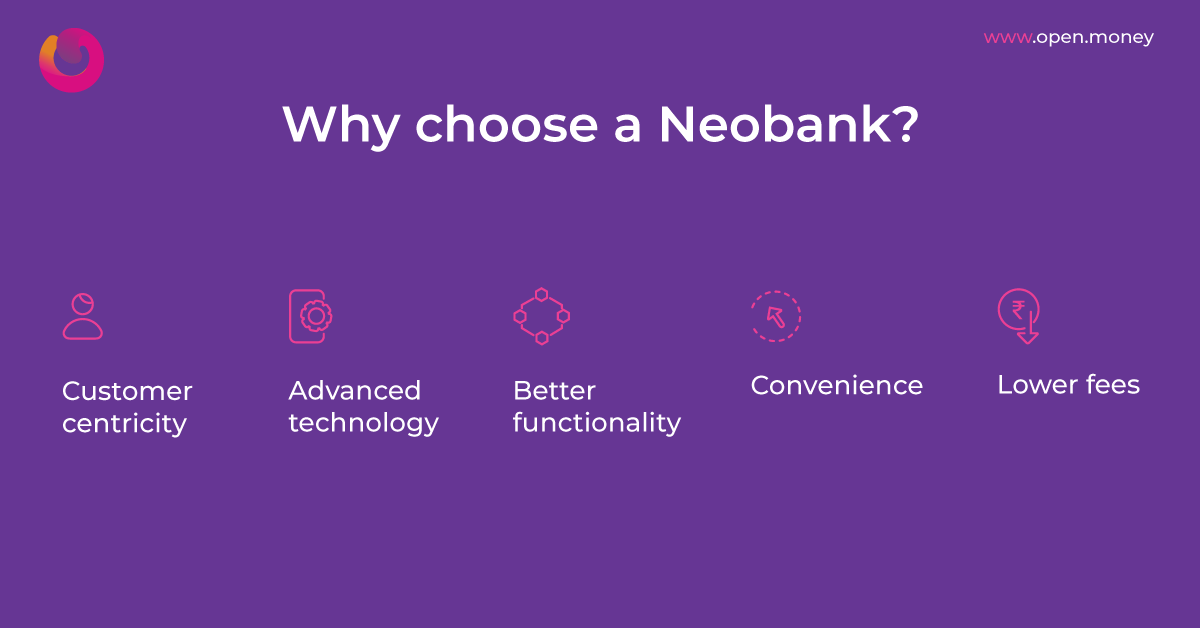

Why choose a neobank?

Advanced technology

Unlike neobank, traditional banks still operate on old IT infrastructure that is slow and narrow. Banks have limited budgets allocated for IT subsistence that they use for maintaining and retaining the old systems. When the situations get dire and inevitable, some banks occasionally allow additional budgets for enabling data analytics or customer relations. However, even those are not up to date with the current market practices such as cloud architecture.

On the other hand, neobanks are harnessing developments in the latest technology. As a result, Neobanks are swifter to adopt new technologies and reinvent banking solutions capitalizing on them. They have even incorporated AI, biometric log-ins, robotic advisors, and other similar relatively new capabilities to fintech. However, the industry is yet to see the impact these adoptions will bring into the market. Thus, neobank is far ahead of the tech adaptation curve, and they have advanced farther in developing fintech solutions for the future.

Convenience

Neobanks are customer-centric. They are up to date with the technical capabilities, and they solve the gaps of legacy infrastructure used in the traditional banking system. Whereas, traditional banks offer similar solutions to all the customer problems without accommodating changes in the business, technical and financial landscape. As a result, most companies move to neobanks due to the lack of comprehensive solutions to their problems stemming from additional service charges, outdated services, and uncompetitive pricing.

Customer centricity & better user experience

Most of the Neobanks cater to a young and tech-savvy audience who value convenience more than anything else. Hence, the user design of platforms and services provided by Neobanks are generally simple, funky, and relaxed. The flow of Neo banking platforms is relatively straightforward to understand. The additional features offered by Neobanks enhance user experience.

Better features and products

Compared to traditional banks, neobanks operate in a digital environment leveraging and experimenting with the elevations of the digital ecosystem. This equips them to fill the gaps inside the banking and finance industry caused by the legacy systems. Furthermore, due to the innovative and flexible nature of the digital ecosystems they are built on, neobanks are not controlled by the rigidity of traditional systems. Hence they can develop new features and innovative products to enhance the user experience and improve the customer service touchpoints faster.

Lower Fees

A neobank has fewer costs per service than a traditional bank due to the nature of operations. Neobanks are entirely digital, and they charge low or no fees for services. In most cases, they also provide a slightly higher rate of interest for deposits. Besides, neobanks offer better rates of exchange and sometimes enable free transactions abroad.

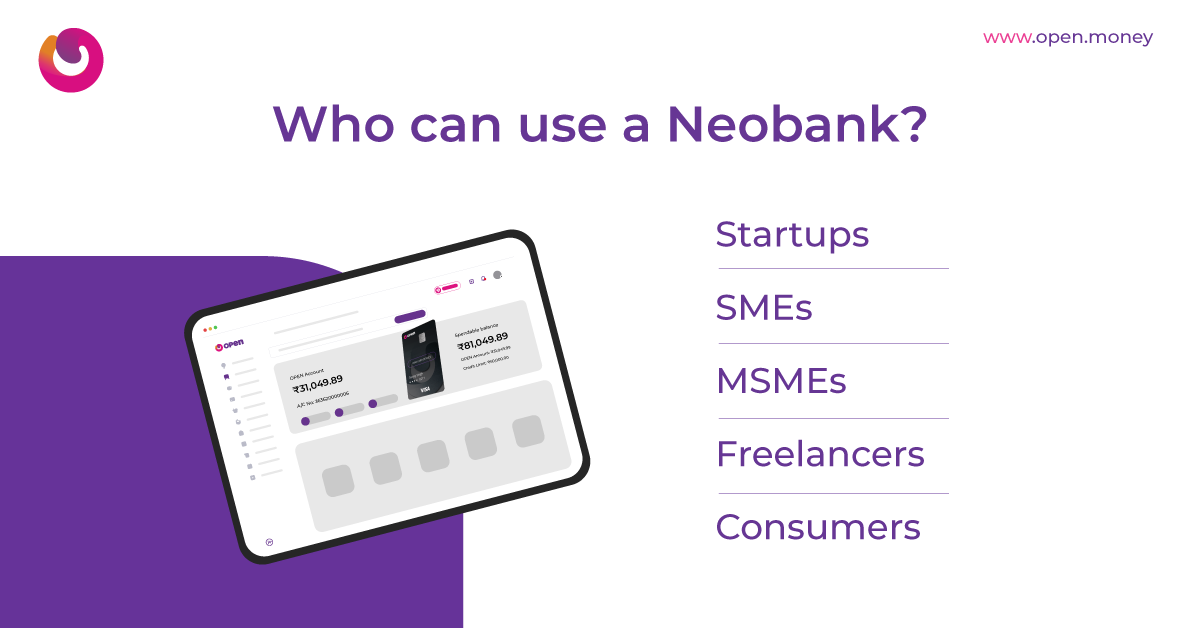

Who uses a neobank?

Unlike traditional banks, neobanks don’t have a one-approach-fit-all strategy. Instead, they are flexible in their approach and try to tailor-make solutions for different types of customers. Most of the neobanks in India target small businesses, while some develop solutions for retail customers.

Let’s have a look at the neobanking solutions and their audience:

Startups and SMEs

Neobanks primarily focus on supporting startups, small and medium-sized businesses as traditional banks do not have specific solutions for their business problems. As a result, there’s a vast gap between their needs and existing services.

Small and medium businesses have a significant role in India’s economy. MSMEs contribute 20-25 trillion – over 28% to India’s GDP with over 63.8 million organizations. However, this fact is often ignored while designing banking services and functionalities. Small and medium businesses require high lender coverage, access to more capital, and efficient platforms for operations. But traditional banks label SMEs risky due to their informal structure and servicing costs. To fill the gaps in this ecosystem, MSMEs require an efficient system of banking.

Research shows that every business function of an MSME is a business opportunity. From operations management, clientele management, supply chain management, and finance management, every task requires specific solutions different from corporate solutions.

With the third-largest ecosystem in the world, accounting for more than 55,000 startups, the Indian startup space needs neobanks that will cater to their needs.

Consumers

Consumer neobanks focus on individual customers such as gig economy workers, blue-collar workers, and teenagers. Together, they account for at least 800 million Indian population. However, the massive size of the segment, growing economic participation, astronomical growth in online media, work from home job models, and tech collaboration tools have made it unforgivable to ignore this segment anymore.

Freelancers

Gig economy workers or freelancers are contract employees hired by individuals or organizations for specific assigned tasks. Due to the growth in technology and workspace collaboration tools, freelancers now have more access to organizations. Besides, Covid demands flexible working models and companies are open to collaborations with gig workers. This has contributed to the rise in the gig economy, and they need customized banking solutions.

Consumers

Traditional banks ignore this segment due to their low transaction volume and velocity. As they account for 250 million Indian population, neobanks are offering tailor-made product offerings such as Zero balance saving accounts, sachet loans, and more.

Overall, consumer neobanking platforms exhibit several characteristics that allow them to carve out a niche space for themselves.

How does a neobank help businesses?

A neobank helps businesses in multiple ways. It simplifies banking functionality as well as supports other aspects of business such as accounting, budgeting, and taxation. It bridges the gap between traditional banking systems, functions, and technology by providing more intelligent solutions.

Seamless account opening

Neobanks enable a smoother and simplified account opening process. Customers can open accounts on the platform within a couple of minutes. After authenticating the KYC, the account activation and the onboarding takes only five minutes.

Cards

In India, neobanks partner with existing banks for providing accounts and cards to their customers. Neobanks partner with existing banks and card providers to provide card services to their customers.

Payment services

Neobanks facilitate payment services to their customers. Customers can use a payment gateway, payment links, IMPS/NEFT/RTGS, and API-based bank bulk payouts to conduct business transactions.

Loans

Certain neobanks offer loans to their customers. Since the operations are digital, the cost of operations for a neobank can be cheaper than traditional systems. Hence neobanks can provide loans at more affordable interest rates. Also, loan processing time can be shorter.

Value-added services

Most of the neobanks in India have virtual platforms that provide users with additional services and features. The supplementary services include cash management, tax filing, automated accounting, budgeting, eCommerce, other plugins, and similar services to enhance the user experience. Thus it helps in the consolidation of banking and other non-banking financial services.

Infrastructure and platforms

Neobanking platforms provide unique intuitive dashboards that ensure a 360-degree real-time view of financial transactions and decision-making analytics.

Overview of neobanking in India

The RBI, SEBI, and IRDA primarily regulate the Indian financial sector. When it comes to fintech, these regulatory bodies ensure a safe, consistent, and seamless financial sector growth and controlled accessibility to financial products in the digital mode. The regulatory framework also makes sure that the technological advancements in the financial services and banking sector are compliant with the existing norms.

In the growing digital banking ecosystem, the next step would be that regulators update the existing regulations, including the business correspondence guidelines, so that neobanks have more flexibility for innovations.

With the commendable growth of the Indian fintech sector, the regulators have now introduced the ‘regulatory sandbox initiative’ to test new products/services in a controlled environment. The Video KYC, the Reserve Bank Innovation Hub, and the introduction of the Account Aggregator framework are some of the other initiatives allowed by Indian regulatory bodies. If this dynamic approach of the regulators continues, we can expect astronomical growth of the fintech industry soon.

Related Articles

Neobanks 101: Everything you need to know about neobanks

How neobanks are defining the future of banking

Decoding neobanking: Why neobanks are winning over businesses

How neobanks are disrupting the banking space

Neo banking — What does it mean?

How Neo Banks are reshaping the Gig-Economy